Aug 17, 2022

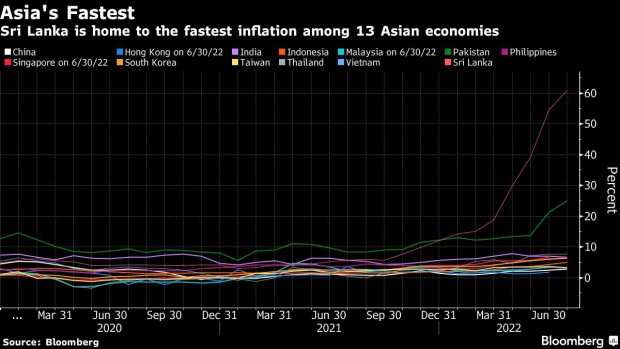

Sri Lanka Keeps Rate Steady as It Lets Past Hikes Tame Inflation

, Bloomberg News

(Bloomberg) -- Sri Lanka kept its benchmark interest rate unchanged, as policy makers weigh the impact of past hikes on Asia’s fastest inflation.

Governor Nandalal Weerasinghe held the standing lending facility rate at 15.5%, the Central Bank of Sri Lanka said in a statement in Colombo on Thursday. Seven out of nine economists surveyed by Bloomberg predicted the decision, while one saw a full percentage point increase and the other a 150 basis-point move.

The decision shows policy makers are assessing the effect of 950 basis points of hikes this year on cooling price growth, amid an unprecedented economic crisis that has seen the country run out of funds for food and fuel supplies. Headline inflation accelerated to 61% in July.

“Effective market interest rates are notably high,” the central bank said in the statement. “Policy measures that have already been implemented by the Central Bank would continue to be further transmitted to the overall economy.”

While the central bank expects inflation to remain elevated in the near term, it said the pace of price gains was slower in July compared to recent months. It expects consumer price-growth to moderate going forward, thanks to subdued demand pressures from tighter monetary and fiscal policies.

The central bank also see the supply disruptions contributing to a larger than expected contraction in real economic activity this year.

(Updates with central bank’s comments on inflation and growth from the fourth paragraph.)

©2022 Bloomberg L.P.