Mar 14, 2023

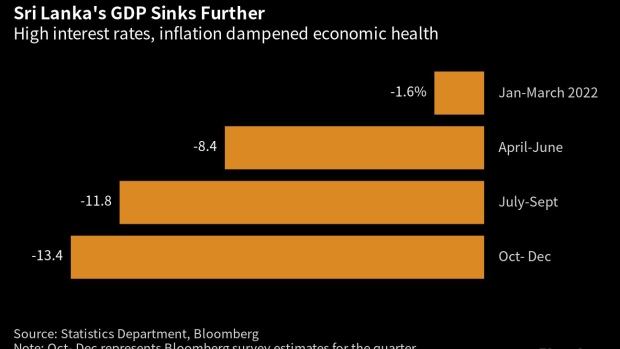

Sri Lanka’s GDP Slump Likely Deepened as It Chased IMF Bailout

, Bloomberg News

(Bloomberg) -- Sri Lanka fell into a deeper recession last quarter as borrowing costs at a two-decade high to rein in inflation took their toll on the $89 billion economy.

Gross domestic product fell 12.4% in the three months to December from a year ago, according to data released by the statistics department Wednesday. That’s the biggest drop in two years and compares with a median estimate for a 13.4% decline. GDP slumped 11.8% in July-October.

The island nation’s economy has contracted for four straight quarters, with the funds it needed to pull out of its worst crisis in seven decades remaining elusive through last year. Some respite may be in sight.

An International Monetary Fund approval of Sri Lanka’s $2.9 billion bailout at a meeting next week is counted on to help unlock more funding that will steady the nation’s finances.

The bankrupt nation grappled with soaring costs, depleted funds and severe supply shortages for much of 2022 as it pursued a loan program with the IMF after a debt default in May. While waiting for relief, Sri Lanka repurposed funds, tightened its belt and raised interest rates to the most since 2001.

Demand will stabilize by the second half of 2023 as IMF funds trickle in, said Sanjeewa Fernando, senior vice president of research at Asia Securities Pvt Ltd in Colombo. Dollar inflows, a stable currency and an end to power cuts will help manufacturing activity going forward, he said.

Managing Director Kristalina Georgieva said last week that “decisive policy actions” by local authorities and financing assurances from major creditors would bolster the nation’s efforts to emerge from the crisis and set it on a “trajectory of strong and inclusive growth.”

What Bloomberg Economics Says

“We expect sequential growth to pick up in the current quarter amid easing supply-side issues and a recovery in tourism, and forecast the economy to grow by 2% this year.”

Ankur Shukla, South Asia economist

— For the full note, click here

To secure IMF’s approval, Sri Lanka had increased taxes, cut energy subsidies, returned to a more flexible exchange rate regime and further boosted its benchmark interest rate to keep a lid on inflation.

--With assistance from Asantha Sirimanne, Tomoko Sato and Karthikeyan Sundaram.

(Updates with chart and economist quote in the sixth paragraph)

©2023 Bloomberg L.P.