Sep 23, 2019

Stage Set for Swiss Franc Rally as SNB Saves Policy Ammunition

, Bloomberg News

(Bloomberg) -- Currency traders may have a green light to push the franc higher after the Swiss National Bank refrained from joining global central banks in easing policy and as Europe’s economy worsens.

The franc has rallied since Swiss policy makers last week projected lower inflation and growth yet did not follow the European Central Bank and Federal Reserve in cutting interest rates. The SNB may be keeping its powder dry to deal with further currency gains, given rates are already at record lows.

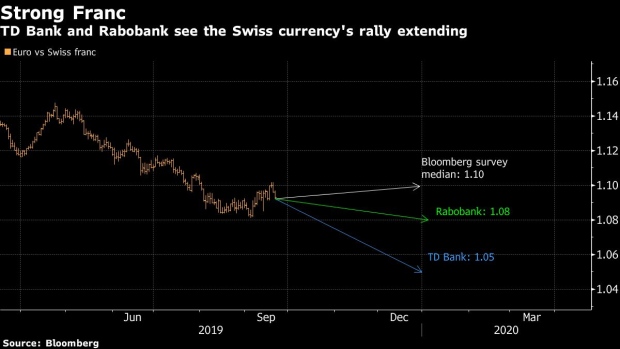

The Swiss currency is among the world’s winners this year, touching a two-year high versus the euro this month, as a bleak European outlook, trade disputes and Brexit drive demand for havens. That’s bad news for the SNB as a strong franc hurts Switzerland’s exports. Further appreciation seems inevitable and curbing it might be beyond the central bank’s powers, analysts said.

“The SNB have had their fingers burnt before,” said Jane Foley, the head of currency research at Rabobank. “The biggest thing that would allow the Swiss franc to weaken would be an increase in the growth rate and risk appetite in the euro zone. Policy at the SNB, it’s like pushing on a string to some extent given this demand for safe havens.”

The franc has gained 3.6% this year versus the euro. It strengthened for a third day Monday to 1.0866 per euro, after data showed Germany’s private sector is suffering its worst downturn in almost seven years. That took the franc close to the 1.08115 level touched earlier this month that was the strongest since mid-2017. The rally has spurred talk of what level could draw market intervention by the SNB, which says that the currency is highly valued.

Line in Sand

In June the currency finally smashed through 1.12, previously seen by analysts as a potential line in the sand for the SNB, after bouncing off that level several times in the previous year. Now market attention is turning to 1.08, with a recent increase in the bank’s so-called sight deposits suggesting it may have been active in defending that level, according to Toronto-Dominion Bank. The SNB did not immediately respond to Bloomberg queries on its policy.

“The SNB continue to flag their intervention capacity,” said Ned Rumpeltin, the European head of currency research at Toronto-Dominion. “They have revealed a preference to use that channel to defend against undue appreciation rather than policy rates.”

The SNB may not be able to take rates much more negative given growing political pressure, and may also avoiding stepping into the currency market for now, according to Barclays Plc.

“FX intervention risks remain low given less clear franc overvaluation, a bulging balance sheet, and increased scrutiny by the U.S. Treasury, all of which point towards further euro-franc downside,” Barclays strategists including Nikolaos Sgouropoulos said in a note.

The SNB wasn’t alone in avoiding looser policy last week. Norges Bank hiked interest rates, while minutes from its Swedish counterpart’s policy meeting showed the Riksbank is keen to end negative interest rates -- and the krona’s slide this year is giving it the flexibility to do so. That followed counterparts in Canada and Australia backing away from adding more stimulus.

“The policy community is being cautious here, which seems appropriate under the circumstances, as monetary ammunition is rapidly depleting,” Toronto-Dominion’s Rumpeltin said. “You either shoot first and try to get ahead of the curve or save it and wait until you see the whites of a recession’s eyes.”

Rabobank expects the franc to return to 1.08 per euro by the end of the year, while Toronto-Dominion forecasts a rally to 1.05 -- a level last seen in 2015 following the SNB’s lifting of a cap on franc gains.

The Swiss central bank scrapped a ceiling of 1.20 per euro in January 2015 as it got too expensive, with hefty balance sheets, to limit the franc’s rally against a euro that was weakened by the ECB’s ultra-loose monetary policy. The surprise decision saw the franc surge 30%, sent shock waves through markets and left the SNB’s credibility in doubt.

“Maybe given the difficulties that they had before they are being quite realistic that they probably cannot turn the Swiss franc around when risk appetite is low,” Rabobank’s Foley said. “That was a warning to them. They don’t want to get into that position again.”

(Updates prices throughout.)

To contact the reporter on this story: Anooja Debnath in London at adebnath@bloomberg.net

To contact the editors responsible for this story: Paul Dobson at pdobson2@bloomberg.net, Neil Chatterjee, Michael Hunter

©2019 Bloomberg L.P.