Jun 7, 2022

Stagflation danger sees World Bank cut global growth outlook

, Bloomberg News

Stagflation is here now: SIA Wealth's Colin Cieszynski

The World Bank cut its forecast for global economic expansion in 2022 further, warning that several years of above-average inflation and below-average growth lie ahead with potentially destabilizing consequences for low- and middle-income economies.

“The world economy is again in danger,” President David Malpass said in the foreword of the latest edition of the lender’s Global Economic Prospects report released Tuesday. “It is facing high inflation and slow growth at the same time. Even if a global recession is averted, the pain of stagflation could persist for several years -- unless major supply increases are set in motion.”

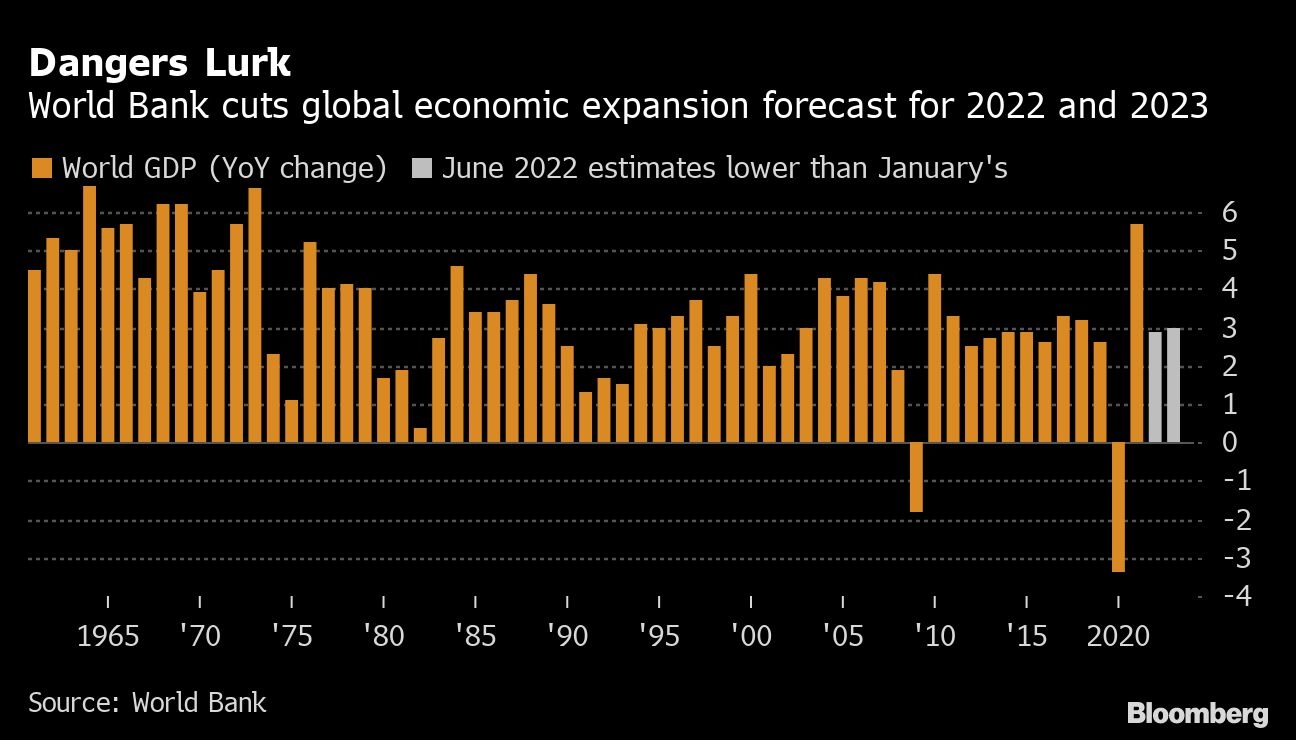

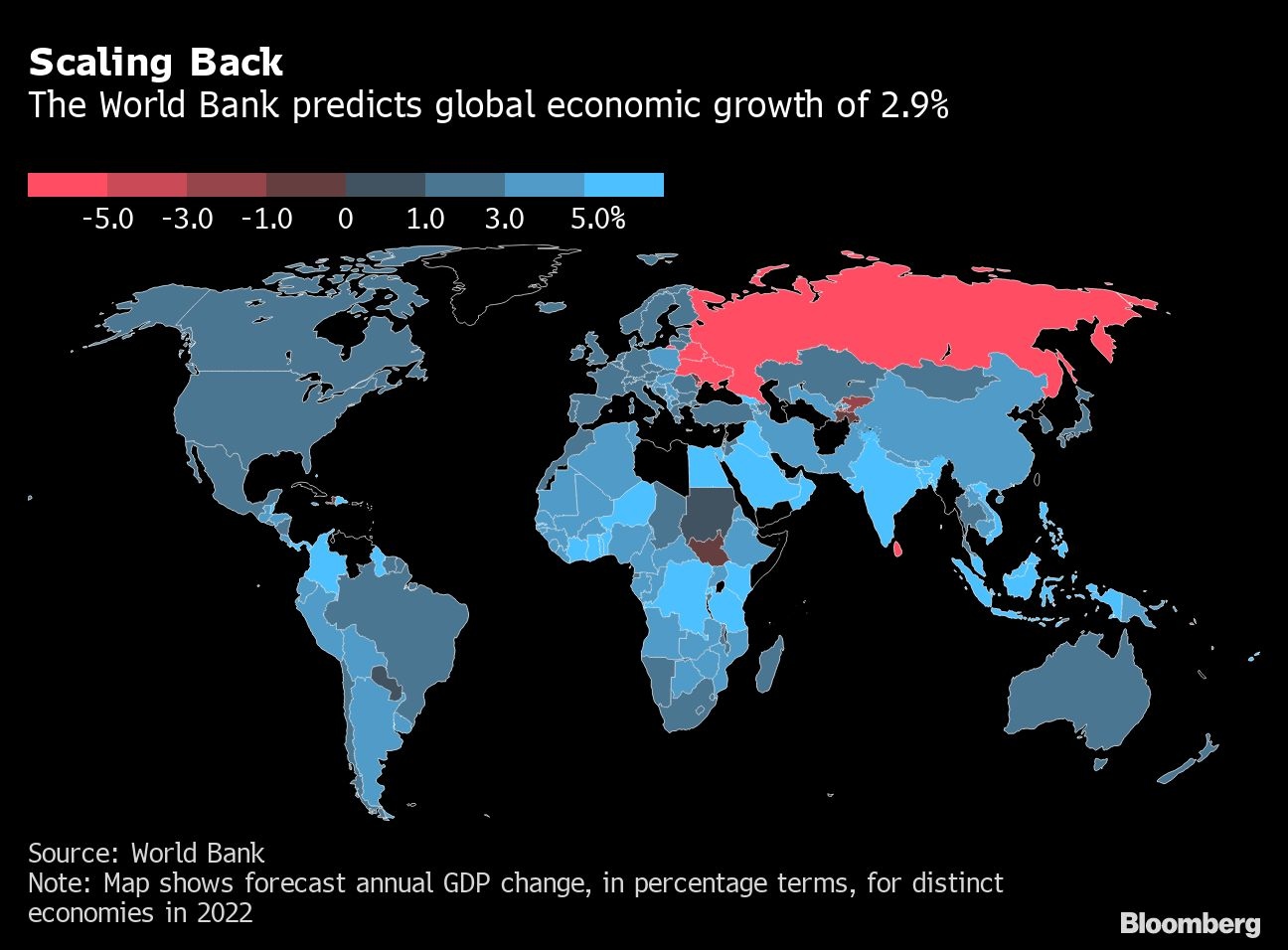

The Washington-based lender reduced its estimate for global growth this year to 2.9 per cent from a January prediction of 4.1 per cent and April’s 3.2 per cent estimate due to a surge in energy and food prices, supply disruptions triggered by Russia’s invasion of Ukraine and a drive by central banks globally to increase interest rates from rock-bottom levels.

The world economy expanded 5.7 per cent in 2021 after the COVID-19 pandemic triggered the deepest global recession since World War II.

“For many countries, recession will be hard to avoid,” Malpass said, adding that the adverse shocks of the past two years mean real income per capita will remain below pre-COVID-19 levels in about 40 per cent of developing economies in 2023.

Central banks are battling a worse-than-anticipated inflation surge spurred by disruptions in the supply of goods, energy and food amid lockdowns in key production hubs in China and the war in Ukraine. More than 60 monetary authorities -- including the Bank of England and the Federal Reserve -- have raised interest rates this year, and the European Central Bank may start within months.

Accelerating inflation and slowing growth have raised World Bank officials’ concerns that the global economy is entering a period of stagflation reminiscent of the 1970s. As a result, a steeper-than-anticipated policy tightening may now again be required to return inflation to target -- and this might trigger a hard landing.

With emerging and developing economies’ debt at multi-decade highs, “the associated rise in global borrowing costs and exchange-rate depreciations may trigger financial crises, as it did in the early 1980s,” the World Bank said.

About 60 per cent of the world’s 75 poorest countries are in or at risk of debt distress, and this is spreading to middle-income countries, Malpass said in an interview on Bloomberg Television.

China is the biggest creditor, and the contracts are written with collateral and non-disclosure clauses, which makes it “hard to engage the conversation,” he said, adding that the bank is working to “find ways to restructure the debt and have it be more transparent.”

Here are some highlights from the report:

- The US economy will likely expand 2.5 per cent in 2022, 1.2 percentage points below the prior projection due to higher energy prices, tighter financial conditions, and additional supply disruptions caused by the invasion of Ukraine.

- The bank cut the outlook for China’s economic expansion to 4.3 per cent this year due to larger-than-expected damage from COVID-19 and related lockdowns.

- Euro-area growth is projected to slow to 2.5 per cent, 1.7 percentage points less than seen in January.

- Ukraine’s economy is set to shrink 45.1 per cent this year, while Russia’s may drop 8.9 per cent. The lender had forecast expansion for both previously.