US GDP Report Set to Highlight Immigration-Driven Economic Boom

Initial data on US gross domestic product for the first quarter of 2024 is set to confirm an ongoing economic boom amid a tailwind from surging immigration.

Latest Videos

The information you requested is not available at this time, please check back again soon.

Initial data on US gross domestic product for the first quarter of 2024 is set to confirm an ongoing economic boom amid a tailwind from surging immigration.

A South Florida office skyscraper from Related Cos. landed new finance tenants, including a John Paulson business and a private equity firm that counts Mark Bezos as a founding partner.

Oracle Corp. is moving its headquarters out of the city. Tesla Inc. is pulling back after a rapid expansion. Almost a quarter of commercial office space is vacant, and nowhere in the country have residential real estate prices fallen further from their pandemic peak.

Mortgage rates in the US increased for a fourth straight week.

It’s independents, a growing voting bloc, who drive election victories in the swing state, where the GOP is rushing to defuse abortion as an issue.

May 25, 2019

, Bloomberg News

(Bloomberg) -- The hunt for a new president of the European Central Bank will gather pace this week as euro-area leaders congregate in Brussels.

Who gets the job will ultimately come down to politics and nationality as the ECB presidency is just one of a few in the mix alongside the leaderships of the EU Council and European Commission.

The decision-making is important for investors who will be keen to discover who will succeed Mario Draghi and whether they will maintain his approach to monetary policy. Still, it could take months for governments to make up their minds.

Check out our state of play story and try your hand at our game.

Here’s our weekly rundown of key economic events:

The U.S. and Canada

The throwing of blows in the trade war between the U.S. and China will dominate again. Reports out this week will give more color on consumer spending and the Federal Reserve’s preferred inflation gauge in April, along with trade and pending home sales. The update of gross domestic product data will also provide a look at economy-wide corporate profits.

Corporate Profits Poised to Cool on Tax Reform Base-Effects

“The data will warrant heightened attention, given the backdrop of weak corporate earnings in the last couple of quarters,” said Bloomberg Economics’ senior U.S. economist Yelena Shulyatyeva. “There is little reason to believe profits will improve until the second half of this year, resulting in limited business-investment growth in the near term.”

As for Canada, its central bank is set to leave interest rates unchanged on Wednesday before GDP data on Friday.

For more, read Bloomberg Economics’ full Week Ahead for the U.S.

Asia

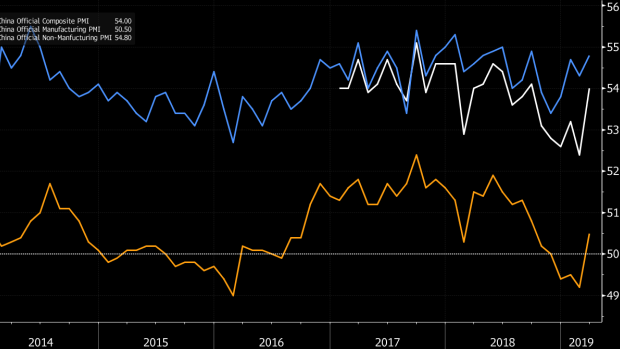

U.S. President Donald Trump meets Japan’s Prime Minister Shinzo Abe early in the week, with Abe set to argue the case against tariffs on his nation’s auto exports. Then at the end of the week, extra tariffs of up to 25% on $200 billion of Chinese exports to the U.S. and on $60 billion of U.S. exports to China come into force, deepening the trade war between the world’s two biggest economies. Investors get their first look at how China’s economy fared in May with Bloomberg’s wrap of early indicators followed by Friday’s Purchasing Managers Index.

China Official PMIs

Sri Lanka may cut interest rates on Friday after the recent terrorist attack, but South Korea is seen keeping its benchmark unchanged on the same day.

For more, read Bloomberg Economics’ full Week Ahead for Asia

Europe, Middle East and Africa

Aside from the political to and fro over the ECB’s presidency, the central bank also releases its latest financial stability report and some inflation data from around the euro region is set to indicate continued weakness. Turkish first-quarter economic growth data on Friday will probably show the nation exiting its first recession in about a decade, but economists are pointing to the possibility of another contraction later this year.

In South Africa, Finance Minister Tito Mboweni is likely to retain his post at a Cabinet shakeup that could be announced on Sunday, as the nation looks to deal with its formidable debt burden and slowing growth, according to two people familiar with the process. Elsewhere in Africa during the week, central bankers in Ghana and Kenya are expected to keep interest rates unchanged at their respective meetings.

For more, read Bloomberg Economics’ full Week Ahead for the EMEA

Latin America

Data due on Thursday will likely confirm that Brazil, Latin America’s largest economy, contracted in the first quarter for the first time since emerging from recession in 2017. A negative revision to the fourth-quarter figure would mean Brazil is already in recession.

Brazilian GDP Still Far From Pre-Recession Levels

In Mexico, the central bank is expected to reiterate concerns about above-target price increases when releasing its quarterly inflation report on Thursday. In Argentina, wages are expected to keep lagging inflation in March, according to data due on Wednesday that may further challenge President Mauricio Macri’s re-election bid.

For more, read Bloomberg Economics’ full Week Ahead for Latin America

To contact the reporter on this story: Simon Kennedy in London at skennedy4@bloomberg.net

To contact the editors responsible for this story: Stephanie Flanders at flanders@bloomberg.net, Zoe Schneeweiss

©2019 Bloomberg L.P.