Dec 4, 2019

Stock Bulls Added Most in Two Years to ETFs Before 2% Slide

, Bloomberg News

(Bloomberg) -- A 2% slump in the U.S. stock market couldn’t have come at a worse time for investors in exchange-traded funds.

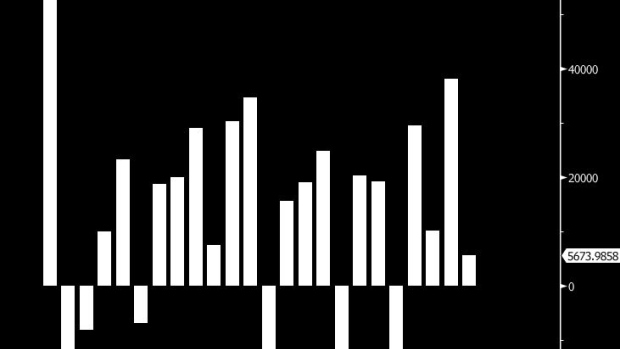

More than $38 billion flowed into equity-focused ETFs in November, the biggest monthly influx in almost two years, data compiled by Bloomberg show. The inflows accounted for about 77% of cash absorbed by U.S. ETFs in the period through Nov. 30, the highest proportion since April.

Those investors were hurting after the worst three-day slide for the S&P 500 Index in two months. While stocks rebounded on Wednesday, sentiment has soured amid uncertainty over whether the U.S. and China can agree the first part of a trade accord by Dec. 15, when American tariffs ramp up. Further whiplash may be ahead, but stocks could ultimately push higher, according to Jason Browne, president and founder of Alexis Investment Partners.

“Investors are just nervous as we’ve reached all-time highs,” said Browne, who oversees about $45 million in assets in Bethlehem, Pennsylvania. “The trade news was a good excuse for consolidation.”

The largest stock ETF -- the $288 billion SPDR S&P 500 ETF Trust -- lost $1.3 billion on Tuesday, the most in more than two weeks, data compiled by Bloomberg show. The fund took in $6.6 billion across November.

To contact the reporters on this story: Rachel Evans in New York at revans43@bloomberg.net;Ritika Gupta in London at rgupta219@bloomberg.net

To contact the editors responsible for this story: Jeremy Herron at jherron8@bloomberg.net, Dave Liedtka, Randall Jensen

©2019 Bloomberg L.P.