Mar 1, 2021

Stock Bulls Have Stopped Pretending to Care About Balance Sheets

, Bloomberg News

(Bloomberg) -- Another nondescript month for stock-market benchmarks is obscuring an ever-strengthening embrace of the economy by investors.

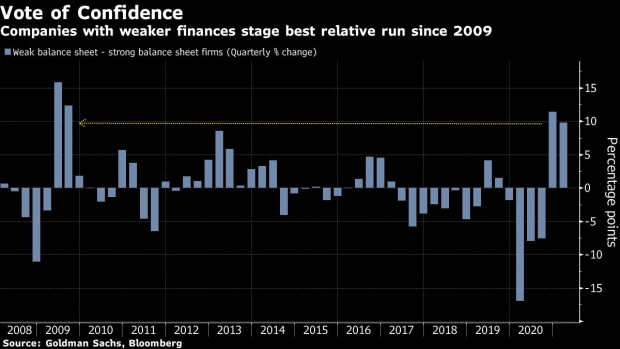

Even as Treasury yields rise, companies with weaker balance-sheets and loaded up on debt are in the midst of a comeback not seen since 2009 -- when the world was emerging from the global financial crisis. The strength in credit-impaired firms in the equity market has proved a prescient signal in past recoveries, and is a vote of confidence in the economic rebound that lies ahead.

Rising tastes for shakier companies at a time when bonds are showing stress illustrate a central paradox of markets right now. In each case, the biggest threat to investors is that the economy is getting too hot, fattening risk tolerances and conceivably forcing the Federal Reserve to move up its schedule for interest-rate hikes.

A surge in bond yields has rattled the stock market, with both the Nasdaq 100 and the S&P 500 falling for a second straight week. Still, investors and economists remain relatively upbeat amid expectations for further fiscal stimulus and a progression in the Covid-19 vaccine rollout.

“At this part of the cycle, people aren’t concerned they have to withstand a downturn right now. They’re looking for the rebound, so lower-quality companies tend to do pretty well in this environment,” said Wayne Wicker, chief investment officer at Vantagepoint Investment Advisers. “People only start to care about the quality of the balance sheet when all of a sudden markets start to tank.”

Fed officials have said repeatedly they will keep monetary policy accommodative and hold interest rates low to ensure the economic recovery continues. Chairman Jerome Powell recently told the Senate Banking Committee that the increase in bond yields reflected “a statement of confidence” in the outlook for growth.

The stock market seems to agree. Rather than cave under the prospect of higher interest rates, a basket of companies with shaky finances fell 0.9%, while a similar group of stocks with sturdier balance sheets dropped 3.4% and the S&P 500 ended the week 2.5% lower, data compiled by Goldman Sachs Group Inc. and Bloomberg show.

In February, companies with weaker finances outperformed more solid ones by more than five percentage points. That was the third-best performance since May 2009 (the strongest month was last November after the election and positive vaccine news, while the second was in 2010). On a quarterly basis, the start of 2021 coupled with the last three months of 2020 is shaping up to be the best period for firms with weaker balance sheets in more than a decade.

Back then, companies with more fragile finances led the first big chapter of the stock upswing. The group’s bottom versus their relatively stronger counterparts came in March 2009 -- coinciding with an end of the bear market in equities and arriving three months before the onset of an economic expansion that eventually lasted almost 11 years.

For Lauren Goodwin, economist and multi-asset portfolio strategist at New York Life Investments, there are some factors driving the strength in these companies. She says they stand to benefit more in a thriving economy, which could favor a bigger rotation into value stocks. In addition, if economic growth leads to higher inflation, it will make it easier for those firms to “reflate” out of their debt, according to her.

The outperformance of cyclical sectors, value, small caps is “a strong signal on economic reflation as is the increase in interest rates and the steepness of the curve over the past couple weeks,” said Goodwin. “It’s the same message.”

Two months into the year, energy producers have surged 26% -- with the group posting its best month on record relative to the S&P 500 in February. Banks have jumped 16% in 2021. Meanwhile, value stocks enjoyed their best performance relative to growth shares since 2000.

John Hancock Investment Management has added to more rate-sensitive cyclical parts of the market, but that doesn’t mean it’s dumping high-quality companies.

“When you think about cyclical areas of the market that have started to do well, you think about things like energy. The balance sheets aren’t as attractive there,” said Emily Roland, the firm’s co-chief investment strategist. “We still want some of those names with good balance sheets, good return on equity. It’s really about finding a balance between the two as we look forward throughout the rest of the year.”

©2021 Bloomberg L.P.