Jan 10, 2020

Stock Bulls Keep Calm in Canada, Shaking Off Iranian Tensions

, Bloomberg News

(Bloomberg) -- If you’ve only just come back from your holiday break and looked at equity markets, you’d think nothing bad happened this week.

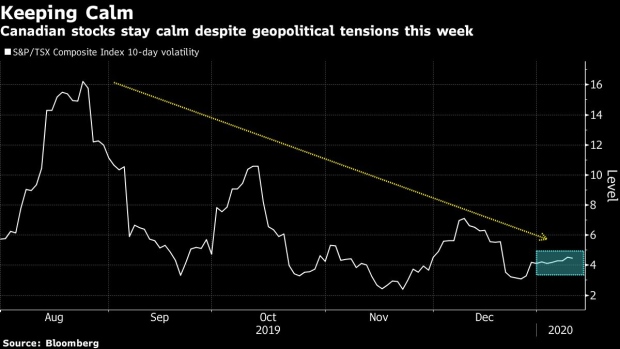

Canada’s stock benchmark posted its biggest weekly climb since November after reaching a fresh record Thursday, while the S&P 500 rose almost 1%. Geopolitical tensions over Iran may have roiled Asian and European markets, but volatility soon faded during U.S. hours and failed to stir Canada’s S&P/TSX Composite Index much, where gold and energy stocks make up about 20% of the benchmark.

“It was fascinating to me,” said Rose Devli, a portfolio manager at 1832 Asset Management. “The market was telling you: no this is nothing, this is going to pass and everything is going to pass with a little bit of volatility,” she said at a panel discussion on the 2020 outlook at Bloomberg’s Toronto office Wednesday.

Relations between Iran and the West deteriorated after the U.S. killed a top Iranian general, Iran struck back with attacks on U.S. bases in Iraq, and a plane crashed near Tehran killing 176 people, including 63 Canadians. Canada, the U.K., U.S. and Australia all said they have intelligence showing the plane was shot down.

Weaker-than-expected jobs data from the U.S. did little to alter investor views that the economy remains fundamentally sound, while Canada’s rebound in employment backed the central bank’s view that the labor force continues to be resilient.

That left equity bulls still in charge as they continue to look past the flare-up in tensions with Iran and focus on the potential for a pickup in global economic growth. And Canada is still listed as one of the four markets at the top of Bloomberg Intelligence’s global equity scorecard for 2020.

Markets -- Just The Numbers

Chart of The Week

Economy

Canadian jobs data released Friday showed employment rebounded in December after two straight months of declines. Employment grew by 320,300 this year, the second-most since 2007.

“The small December rebound keeps the 3-month moving average in negative territory at -13K, which implies a slowdown in hiring after a year of strong gains,” said Brett House, deputy chief economist at Bank of Nova Scotia. This is consistent with the slowing in the fourth quarter and leaves the door open to rate cuts by the Bank of Canada in the first half of this year, he said.

Politics

Prime Minister Justin Trudeau was front and center after the crash of Ukraine International Airlines Flight 752. He said evidence indicates the plane was hit by an Iranian surface-to-air missile, that may or may not have been an accident.

#TrendingInCanada

Tim Hortons is offering Prince Harry and his American actress wife, Meghan Markle, free coffee for life if they move to Canada after they said they’d “step back” from their roles as senior members of the royal family and “work to become financially independent.”

To contact the reporter on this story: Divya Balji in Toronto at dbalji1@bloomberg.net

To contact the editors responsible for this story: Kyung Bok Cho at kcho7@bloomberg.net, Jacqueline Thorpe, Steven Frank

©2020 Bloomberg L.P.