Mar 9, 2023

Stock ETFs Blamed for Liquidity Shocks in Short-Term Treasuries

, Bloomberg News

(Bloomberg) -- The stock ETF boom has been blamed for seemingly every Wall Street ill, from blindly ramping up share prices and fueling volatility to undermining governance across corporate America.

Now new academic research claims that equity exchange-traded funds are even creating distortions in the world’s largest debt market.

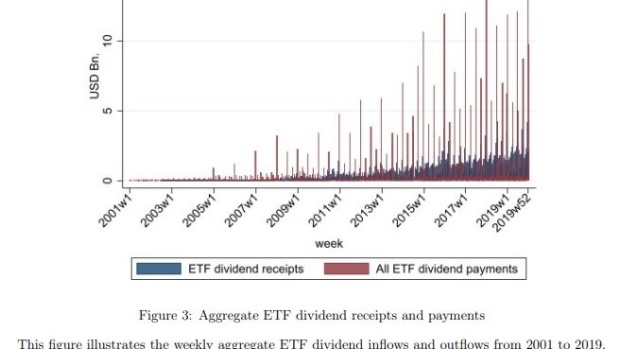

By gradually funneling their dividend income into money-market funds — which typically hold short-term Treasuries — equity ETFs are then seen adding upward pressure to US yields when they divest these holdings in one swoop to make their own distributions to shareholders.

The paper penned by a trio of academics suggests that a slew of stock products are indirectly hitting prices in the short-term Treasury market, thanks to their big liquidations in the world of mutual funds.

It’s a grand claim considering the sheer size of the US bond market and the many fundamental drivers for debt prices from economic data to monetary policy. But the paper adds to the weight of evidence that the explosive growth of ETFs is creating unexpected side effects across markets of all stripes.

“This cycle creates periodic liquidity shocks to MMFs and, consequently, to the Treasury markets,” the study says. “As a result, ETF dividend cycles can explain flows to MMFs and fluctuations in Treasury yields.”

As the ETF industry continues to expand, the scale of the problem identified by the new study could also grow. ETFs now control about $6.8 trillion in the US alone, according to data compiled by Bloomberg, with about $5.3 trillion in equity-focused funds. The paper estimates that they collected about 7% of all American share dividends as of 2021.

In the research, titled ETF Dividend Cycles, Pekka Honkanen at the University of Georgia and Yapei Zhang and Tong Zhou at ShanghaiTech University use data from multiple sources on share dividends paid by US firms, assets and flows of MMFs, and the details of stock ETF holdings and their payouts.

They found prices of Treasuries tend to drop on ETF dividend dates as MMFs sell underlying holdings to meet the ETFs’ withdrawals. US government bonds held by MMFs that are used by dividend-paying ETFs dropped more than similar-maturity securities not held by affected MMFs.

Overall, the paper estimates that for every $100 of ETF dividend disbursement, MMFs reduced their holdings in one-, three-, and six-month Treasuries by approximately $53, $17, and $6, respectively.

“Back-of-the-envelope calculations suggest that when daily ETF dividends increase from the sample median to the 75th percentile, the total loss of market value in short-term Treasuries is approximately $400-700 million,” the authors write.

The findings may be a surprise to some on Wall Street. There have long been worries about how the explosive growth of fixed-income ETFs might make waves in the underlying bond market, but little consideration has been given to whether funds in another asset class might be having an impact.

While the researchers don’t provide full details of their fund sample, checking a handful of well-known products shows some anecdotal evidence in support of the findings.

The $22.5 billion iShares Select Dividend ETF (ticker DVY), the $28 billion iShares Russell 1000 ETF (IWB) and the $264 million iShares Core Dividend ETF (DIVB) all use the same BlackRock fund to store at least some of their cash. Recent payable dates for dividends from all three ETFs were June 15, September 30 and December 19.

The BlackRock fund saw outflows on each of those days averaging $4.4 billion, calculations show. The yield on one-month Treasury bills also rose on each date by an average of more than 7 basis points.

It’s important to note that the total assets of a money-market fund can fluctuate a lot for many reasons. Meanwhile, the daily traded value for Treasuries averages about $600 billion — meaning other forces could theoretically easily overwhelm any dividend-based selling.

But the authors point out the longer the interval between a fund’s dividend payment, the more cash builds up — and the bigger the impact on the Treasury market could be. They estimate that a 100% increase in ETF dividend payments can add 2 to 3 basis points to the rate on affected securities.

For that reason, the academics conclude that ETFs could be made to pay dividends more frequently.

“Given ETFs’ discretion to set their dividend distribution schedules, one policy implication that could smooth money market fluctuations would be mandating funds to disburse dividends at a higher frequency,” they write.

--With assistance from Liz Capo McCormick.

©2023 Bloomberg L.P.