Apr 3, 2020

Stock Investors Hungry for Yield Shun Canadian REITs in Downturn

, Bloomberg News

(Bloomberg) -- For the longest time, Canadian real estate investment trusts were a stalwart for income investors. Now, dividend payments hang in the balance as commercial and residential tenants struggle to pay rent during a pandemic that has shut down much of the economy.

Typically seen as a place to get a high, safe payout in a world of low bond yields, REITs are one of the worst performing groups in the nation’s benchmark index since the peak on Feb. 20, plunging 38%.

That has sent yields skyward as share prices fall and investors anticipate dividend cuts or suspensions.

Before the market sell-off, the 19 stocks that make up the S&P/TSX Capped REIT Index gave it a dividend yield of 4.1%. That spiked as high as 7.8% last week as the rout got worse, and is now just above 6.5%.

“Before we were looking at an average yield in that 3 to 5% range and now you’re looking at yields in the 5 to 10% range,” Jenny Ma, an analyst at BMO Capital Markets, said by phone. “It has really widened out as far as the individual names go. And in some cases when you have REITs trading at yields in excess of 10%, and in some cases well in excess of 10%, then clearly the market is suggesting that the expectation is for a distribution cut.”

Two REITs in the index with double-digit yields both have high exposure to retail. SmartCentres Real Estate Investment Trust is the landlord to many Walmart outlets and other big-box stores. H&R Real Estate Investment Trust owns retail, industrial and office properties across Canada; it yields more than 17% after a decline of 62% in the stock this year.

Cash Flow Trouble

In normal times, falling interest rates are good for REIT shares. But the usual rules don’t apply: commercial property markets in major economies have frozen up as buildings that bustled with diners, shoppers and workers just weeks ago have gone quiet.

This isn’t the first time Canadian REITs have hit a wall. Ma believes the global financial crisis in 2008-2009 taught them a valuable lesson that might help them now -- the wisdom of lower payout ratios.

Real estate trusts that had strong growth in cash flow, and resisted the urge to pass all that growth to investors in higher dividends, might be a better position today than they were a decade ago, Ma said.

What’s different this time around is whether tenants can pay their rent, something that wasn’t as much of an issue during the financial crisis.

- RioCan Real Estate Investment Trust will lose as much as one-quarter of its revenue in the next two months as retail tenants close their doors due to the coronavirus spread, Chief Executive Officer Ed Sonshine told Bloomberg News last month.

- Cominar REIT withdrew its 2020 forecast and suggested its retail unit, with heavy exposure to enclosed malls, will be materially affected.

“It stands to reason that it’s hard to manage your cash flow if you’re not earning any more,” Ma said. “A lot of companies have been very good and said that they are going to pay their employees. They still have to pay their overhead costs and they have to pay their rent. So there’s a lot of questions as to what’s going to happen there.”

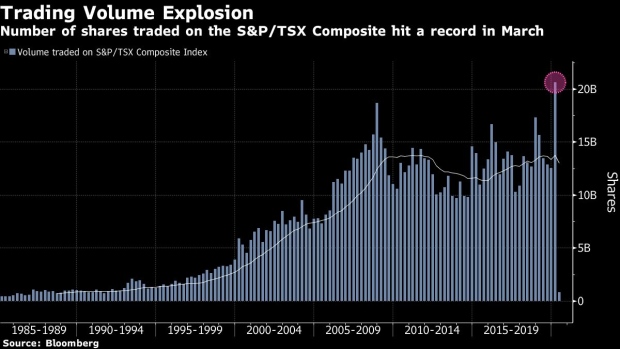

Markets -- Just The Numbers

Chart of The Week

Economy & Politics

Economists will be keeping an eye on March jobs data due April 9 after Bloomberg News reported that more than two million Canadians, making up about 11% of the labor force, applied for jobless claims since the start of nationwide lock downs last month to slow the spread of the coronavirus.

Bank of Canada’s business outlook survey is expected on April 6 and March housing starts data is due on April 8.

The cost of Prime Minister Justin Trudeau’s fiscal package to protect the economy from the impact of Covid-19 has hit about C$250 billion ($176 billion). One of the flagship programs, a plan to temporarily subsidize 75% of wages for Canadian workers, will cost C$71 billion, Finance Minister Bill Morneau said. Along with other measures such as a monthly C$2,000 benefit for affected workers, the government expects to spend C$105 billion on direct support for companies and households.

#TrendingInCanada

Prime Minister Justin Trudeau’s decision to work with Amazon.com Inc.’s Canadian unit to manage distribution of equipment to provinces and territories has faced backlash among Canadians who believe the nation’s postal service should be doing the job.

©2020 Bloomberg L.P.