Apr 21, 2019

Stock Investors Reluctant to Return to Japan Despite Rally

, Bloomberg News

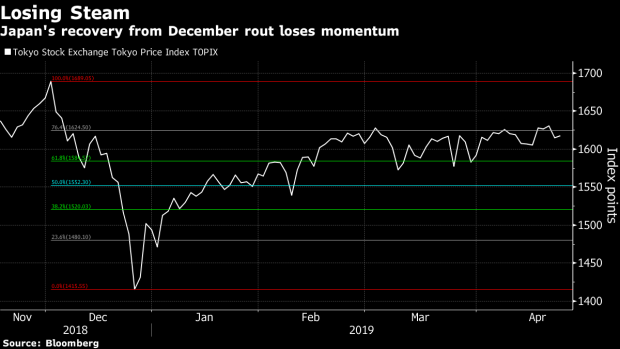

(Bloomberg) -- Japan’s stock market has rallied this year after crawling out of the worst quarterly performance in 11 years. But the bounce isn’t enough to get everyone back.

A gauge of fund manager demand for Japanese equities slid this month to the lowest since November 2016, Bank of America Merrill Lynch said in a April 17 report, citing concerns about the outlook for earnings. The Topix index’s 8.2 percent rebound this year lags the performances of other developed markets.

While only one in 10 of the gauge’s companies have reported so far, earnings have surprised on the downside for a majority of those firms. Profits fell 17 percent in aggregate last quarter versus a year ago and it looks like this season might be more of the same with bellwethers Fast Retailing Co. and Yaskawa Electric Corp. cutting outlooks.

“There aren’t a lot of investors holding Japanese equities,” said Shusuke Yamada, the chief foreign-exchange and equity strategist in Tokyo at BofAML. “In terms of global money flow, it won’t be strange for funds to head to Japan, but the fundamentals aren’t good.”

A survey in the BofAML report showed investor demand for Japanese equities is at the weakest in more than two years. The poll’s gauge -- calculated by subtracting the percentage of fund managers who responded they’re underweight in Japan from those who said they’re overweight -- stood at minus 4 percentage points, down from 3 percentage points in March.

Global investors don’t intend to overweight Japan over the next 12 months, as they remain cautious about Japan’s profit outlook, according to the survey, which was conducted from April 5 to 11 with 239 investors participating.

Stay Positive

Still, Yamada isn’t entirely pessimistic. Given the lack of investors holding Japanese equities, a lot of buying could kick in with the right trigger, he said. A bounce in U.S. long-term yields, for example, will be interpreted as a sign the global economic outlook has brightened. This could boost appetite for Japanese financial stocks and cyclical sectors including steel and autos, he said.

There may also be help from China. The nation’s economy unexpectedly held up in the first three months of the year as policy makers boosted stimulus. Gross domestic product exceeded economist estimates, while factory output jumped more than expected. Both the Topix and the Nikkei 225 Stock Average advanced last week to their highest since December.

“It’s not as if the China numbers are starting to get extremely good but it’s better than what people had thought,” Yamada said. “There’s room for buying positions to be filled” in Japanese equities.

Adding to signs that Japanese stocks can sustain their rebound, foreigners have turned net buyers, purchasing 744 billion yen of shares during the first two weeks of this month. That’s after offloading a net 2.5 trillion yen in equities during the first three months of the year.

But, Tomochika Kitaoka, chief equity strategist at Citigroup Global Markets Japan Inc., is skeptical that this month’s rebound can last.

“When equities climb despite a lack of growth in trading value and fund inflows in what we dub a ‘flowless rally,’ Japanese equities have tended to be firm for the next four weeks and then peak,” Kitaoka wrote in a note. “So we advise caution on chasing the current rally too far.”

--With assistance from Kurt Schussler.

To contact the reporter on this story: Min Jeong Lee in Tokyo at mlee754@bloomberg.net

To contact the editors responsible for this story: Divya Balji at dbalji1@bloomberg.net, Naoto Hosoda, Teo Chian Wei

©2019 Bloomberg L.P.