Nov 20, 2018

Stocks fall as tech darlings slump, U.S. Treasuries rise

, Bloomberg News

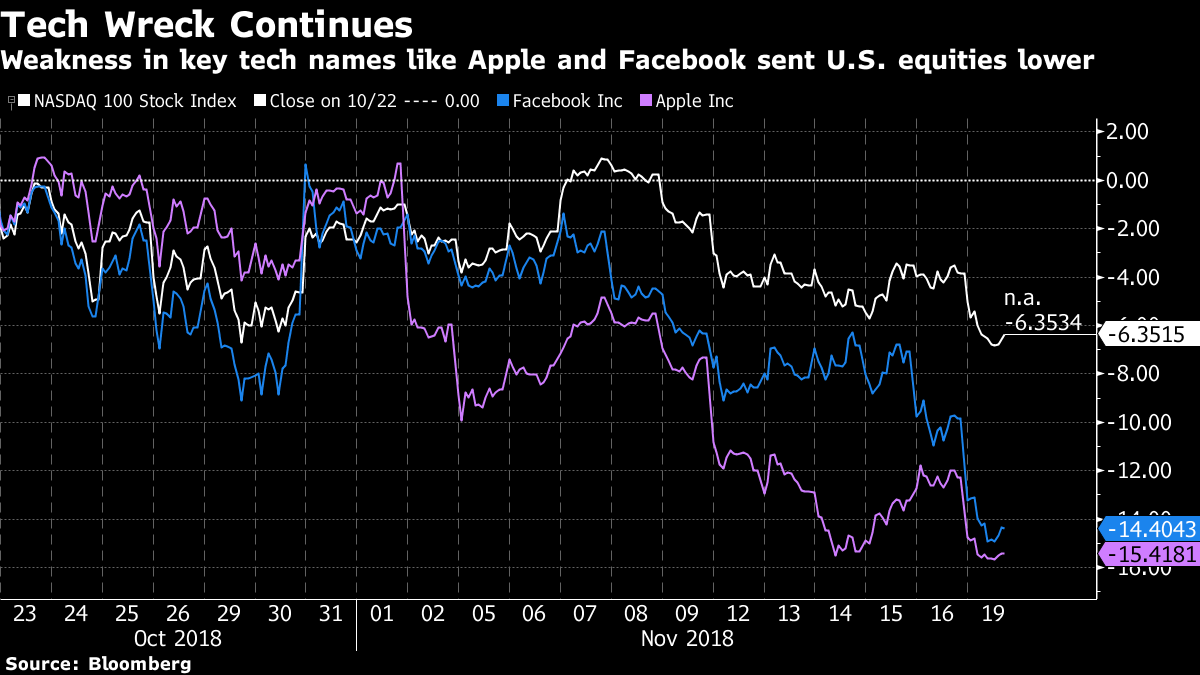

U.S. stocks fell Tuesday as sinking oil prices hit energy companies, tech hardware continued to plunge with Apple Inc. leading the way, and retailers saw little joy from the coming Christmas shopping season. Treasuries advanced with the dollar and gold fell.

All major benchmarks were down more than 1.5 per cent. The S&P 500 Index briefly slid 10 per cent below its September record close before clawing back just above the threshold. The Nasdaq Composite Index was almost 14 per cent below the closing high it reached in August. And the Dow Jones Industrial Average shed more than 500 points, or 2.1 per cent, as angst spread across global equity markets.

Canadian stocks traded lower. The S&P/TSX Composite Index closed down 197.96 points at 14,873.05.

“The fact that we haven’t seen a fast bounce or hard bounce, shows the market is exploring where prices should be,” Brad McMillan, chief investment officer for Commonwealth Financial Network. “But it’s hopefully a sign that we’re starting to find a bottom here.”

Investors pointed to escalating trade tensions, signs of a looming slowdown in retail growth and cracks in the credit market as reasons for the decline. Tech hardware was the worst performing group in the S&P 500, followed by transportation and energy as oil slid to its lowest price in more than a year. The Nasdaq 100 Index fell as much as 3 per cent early in the session but retraced almost half the decline during the afternoon.

“There’s clearly a concern about a global growth slowdown,” said Alec Young, managing director of global markets research at FTSE Russell. “Not so much in the U.S., but internationally driven. Trade has an impact on the tech supply chain, so it’s impacting the technology sector. The market wants more dovish Fed talk. The Fed has been giving guidance based on the U.S. economy, but in recent months the market has become more focused on the global growth slowdown, and we haven’t heard about that from the Fed.”

Apple slumped again, down almost 5 per cent, bringing its plunge from a recent high to around 24 per cent. Target Corp. fell 11 per cent after its sales forecast disappointed; Kohl’s Corp. and L Brands Inc. also sank on weak earnings. Union Pacific Corp. slid 6 per cent, its third consecutive decline, while Norfolk Southern Corp. and CSX Corp. both were lower as well. Devon Energy Corp. sank more than 7 per cent to the lowest since April 2016, and Marathon Oil Corp. lost over 6 per cent.

“There’s a lot of trade fears, a lot of mega-cap tech selling, and it’s one of those things that happens when there’s a correction,” said Dan Miller, director of equities at GW&K Investment. “I’ve seen this too many times before but there’s enough things out there that people are pointing to and it’s created a heavy level of fear.”

WTI crude slipped below US$54 for the first time since October 2017. In bond markets, the yield on 10-year Treasuries fell to the lowest level since September. A credit-default swap index of mostly high-yield issuers in Europe reached the highest in almost two years, signaling renewed nerves about the asset class.

The sell-off in momentum stocks continued a slump that began last month, with the latest blow coming from renewed concern that demand for Apple’s iPhones has slowed. At the same time, the Trump administration is considering tighter curbs on technology exports, a step that Deutsche Bank AG says would have a “profound and long lasting adverse impact” on relations between the U.S. and China.

And calls for dip-buying have turned into notes of caution. Goldman Sachs recommended investors hold more cash. Ray Dalio, head of Bridgewater Associates, the world’s largest hedge fund firm, said that investors should expect low returns for a long time after enjoying years of low interest rates from central-bank stimulus.

These are the main moves in markets:

Stocks

The S&P 500 declined 1.8 per cent to 2,641.89, while the Dow Jones Industrial Average fell 552 points, or 2.2 per cent, to 24,465.64. The Stoxx Europe 600 Index sank 1.1 per cent, hitting the lowest since December 2016. The U.K.’s FTSE 100 Index retreated 1.3 per cent. Germany’s DAX Index lost 1.6 per cent, reaching the lowest in almost two years. The MSCI Emerging Market Index dropped 1.7 per cent. The MSCI Asia Pacific Index slid 1.3 per cent, the biggest decrease in two weeks.Currencies

The Bloomberg Dollar Spot Index gained 0.5 per cent. The euro dropped 0.8 per cent to US$1.1367, the first retreat in more than a week. The British pound declined 0.6 per cent to US$1.2783. The Japanese yen fell 0.1 per cent to 112.70 per dollar.Bonds

The yield on 10-year Treasuries declined one basis point to 3.0537 per cent, the lowest since September Germany’s 10-year yield dipped two basis points to 0.35 per cent. Britain’s 10-year yield advanced one basis point to 1.383 per cent.Commodities

West Texas Intermediate crude slid 6.1 per cent to US$53.32 a barrel, the lowest since October 2017. Gold fell 0.2 per cent to US$1,221.95 an ounce.