Jun 20, 2022

U.S. futures gain with European stocks; Dollar slips

, Bloomberg News

BNN Bloomberg's closing bell update: June 20, 2022

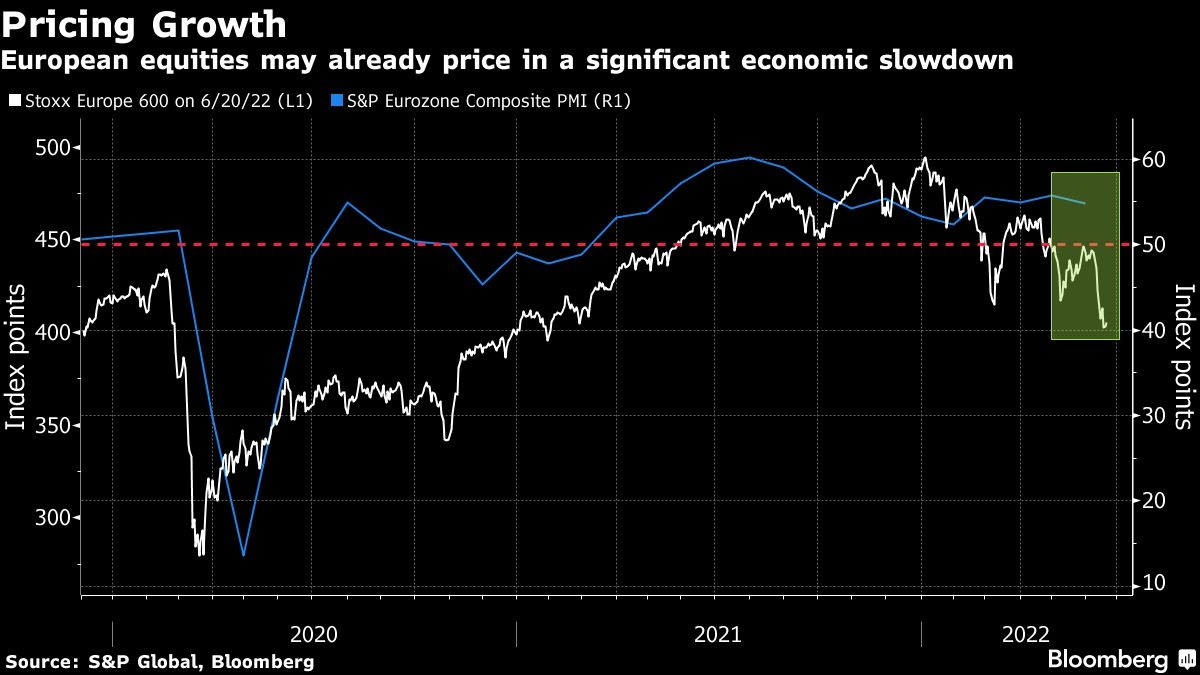

US index futures staged a rebound on Monday along with stocks in Europe as investors weighed whether last week’s selloff had gone far enough to price in concerns about rising rates and slowing growth.

S&P 500 contracts advanced about 1.1 per cent after the worst week for the underlying gauge since the start of the pandemic. Nasdaq 100 futures rose around 1.1 per cent. A dollar gauge edged lower. Treasury futures also slid, with no cash trading due to a US holiday.

Banks, travel & leisure and energy companies led the advance in the Stoxx Europe 600 index. Basic resources underperformed amid a slump in raw-material prices, while construction companies declined. Underscoring the uncertainty pervading markets, Swiss engineering group ABB Ltd. declined after postponing a listing of its electric-car charging business, citing volatile conditions.

France’s equity benchmark lagged after President Emmanuel Macron lost his absolute majority in parliament, putting his reform agenda in peril. UK bonds fell as the country faces up to surging inflation and labor strikes as well as a rising risk of recession in a series of setbacks that have echoes of the 1970s.

Volatility measures remain elevated as investors look for an entry point into equity markets roiled by soaring price pressures and worries that aggressive monetary tightening will tip major economies into recession. JPMorgan strategists said pressure on stocks should ease in the second quarter as inflation moderates, but others -- including Morgan Stanley -- cautioned that more losses may be in store.

“Both prolonged inflation and/or a sharp increase in rates from central banks will have a deep impact on growth perspectives,” Jean-François Paren, global head of market research at Credit Agricole CIB, wrote in a note. “If anything, current valuations are more the ‘exit point’ than the ‘entry point’.”

European bonds were mostly lower after European Central Bank policy maker Martins Kazaks said the central bank is ready to combat unwarranted financial-market moves, but must also be prepared to look through turbulence as it exits negative interest rates.

Commodities reflected the concerns around global growth. Crude oil held Friday’s near-7 per cent plunge, iron ore erased all of this year’s gains and copper extended losses for an eighth session after base metals capped the worst weekly losses in a year.

Bitcoin gyrated above US$20,000 after plunging below US$18,000 over the weekend. A volatile crypto slump has become emblematic of the pressure on a range of assets from sharp Federal Reserve interest-rate hikes to tame high inflation.

MSCI Inc.’s index of Asian shares dropped for an eighth day, the longest stretch since February 2020. China managed to buck the wider trend, continuing a recent spell of outperformance in part on Beijing’s vows of economic support.

What to watch this week:

- RBA minutes, Governor Philip Lowe due to speak, Tuesday

- Fed Chair Jerome Powell semi-annual Senate testimony, Wednesday

- Bank of Japan April minutes, Wednesday

- Powell US House testimony, Thursday

- US initial jobless claims, Thursday

- PMIs for Eurozone, France, Germany, UK, Australia, Thursday

- ECB economic bulletin, Thursday

- US University of Michigan consumer sentiment, Friday

- RBA’s Lowe speaks on panel, Friday

Some of the main moves in markets:

Stocks

- Futures on the S&P 500 rose 1.1 per cent as of 4 p.m. New York time

- Futures on the Dow Jones Industrial Average rose 0.9 per cent

- The MSCI World index rose 0.2 per cent

Currencies

- The Bloomberg Dollar Spot Index fell 0.2 per cent

- The euro rose 0.1 per cent to US$1.0511

- The British pound rose 0.1 per cent to US$1.2256

- The Japanese yen was little changed at 135.03 per dollar

Bonds

- Germany’s 10-year yield advanced nine basis points to 1.75 per cent

- Britain’s 10-year yield advanced 11 basis points to the highest in about eight years

Commodities

- West Texas Intermediate crude rose 0.6 per cent to US$110.27 a barrel

- Gold futures were little changed