Apr 12, 2021

Stocks, bonds rise with inflation concern fleeting

, Bloomberg News

BNN Bloomberg's closing bell update: April 13, 2021

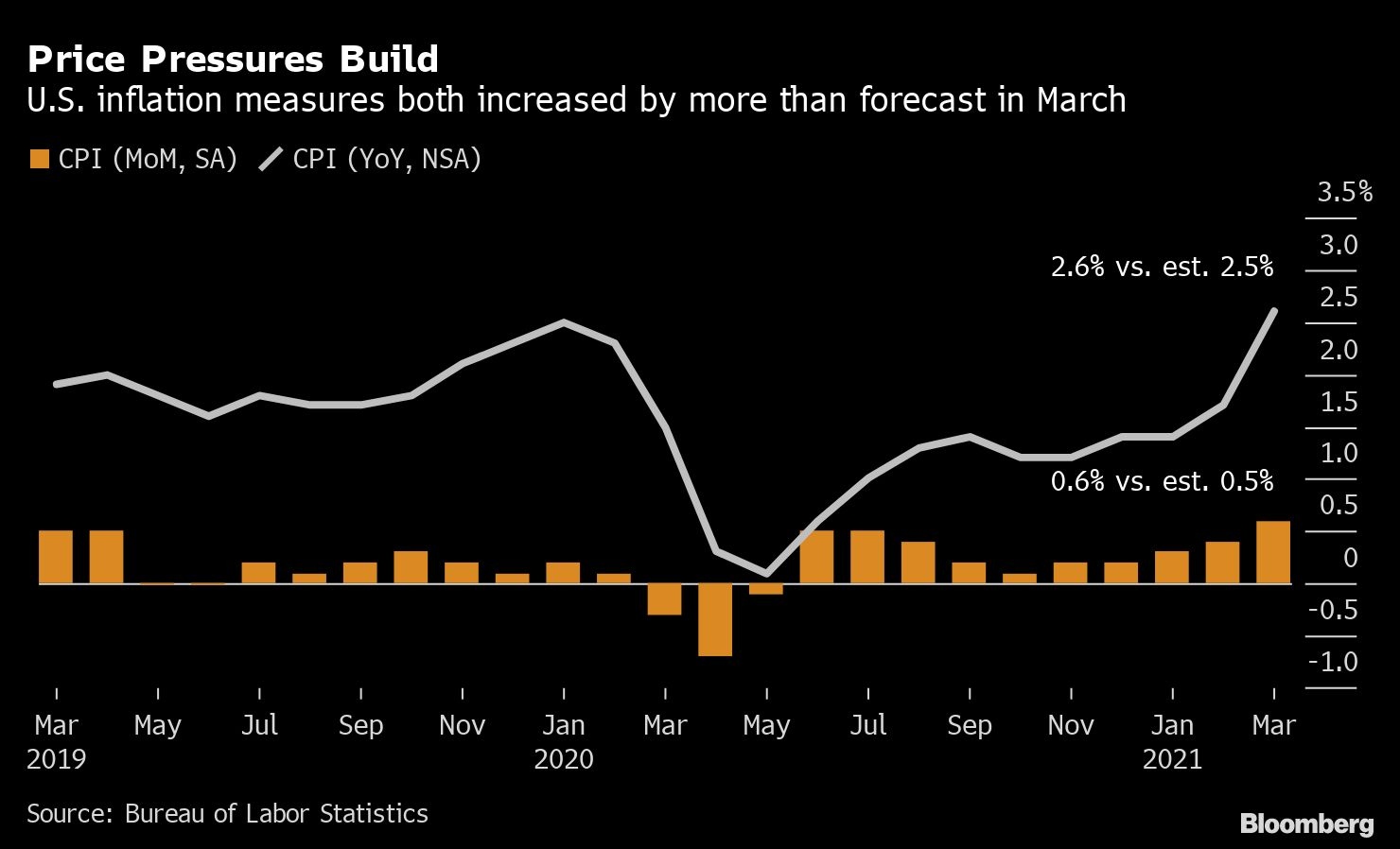

U.S. stocks climbed to record highs and bond yields fell as investors bet that a higher-than-forecast rise in inflation won’t be enough to slow economic stimulus measures.

The S&P 500 touched an all-time high even after the U.S. recommended pausing Johnson & Johnson vaccines amid health concerns. The tech-heavy Nasdaq 100 also hit a record while the Dow Jones Industrial Average erased earlier losses. Consumer prices rose more than expected last month but investors speculated the acceleration was not fast enough to warrant any Federal Reserve policy change. The drop in yields weighed on bank shares.

“The market has been skittish about rates for some time,” said Mike Loewengart, managing director of investment strategy at E*Trade Financial. “While this may cause some short-term volatility, investors have been pretty steadfast in their faith in a full economic recovery.”

J&J shares fell as officials agreed to the pause and started an investigation into a link from its shot to rare and severe blood clots, while rivals Moderna Inc. and Pfizer Inc. advanced. The U.S. anticipates having enough other vaccines during the period. Investors flocked back to stay-at-home companies while selling travel shares such as Carnival Corp. and Royal Caribbean Cruises Ltd. American Airlines Group Inc. also slid.

Fund managers across the world now see inflation, a taper tantrum and higher taxes as bigger risks than COVID-19, according to the latest Bank of America Corp. survey.

“A lot of growth and inflation have already been priced into the market,” said Emily Roland, co-chief investment strategist at John Hancock Investment Management. “It’s almost as if you need to exceed those expectations in order to see a more pronounced reaction from markets.”

Although policymakers at the Federal Reserve expect a bump in consumer prices to be short-lived, many traders disagree, with fears of faster CPI playing out across duration-heavy assets from bonds to tech stocks.

Treasuries extended gains after the government’s auction of 30-year bonds was greeted with strong demand.

Meanwhile, Bitcoin jumped to an all-time high as the mood in cryptocurrencies turned bullish before Coinbase Global Inc. goes public. Oil traded near US$60 a barrel.

Some key events to watch this week:

- Banks and financial firms begin reporting first-quarter earnings, including JPMorgan Chase & Co., Citigroup Inc., Bank of America Corp., Morgan Stanley, Goldman Sachs Group Inc.

- Economic Club of Washington hosts Fed Chair Jerome Powell for a moderated Q&A on Wednesday.

- U.S. Federal Reserve releases Beige Book on Wednesday.

- U.S. data including initial jobless claims, industrial production and retail sales come Thursday.

- China economic growth, industrial production and retail sales figures are on Friday.

These are some of the main moves in financial markets:

Stocks

- The S&P 500 Index increased 0.5 per cent to 4,141.67 as of 4:02 p.m. New York time, the highest on record.

- The Dow Jones Industrial Average was little changed at 33,678.78.

- The Nasdaq 100 Index advanced 1.2 per cent to 13,986.50, the highest on record with the largest gain in a week.

- The Nasdaq Composite Index advanced 1.1 per cent to 13,996.10, the highest in almost eight weeks on the biggest gain in a week.

- The Stoxx Europe 600 Index climbed 0.1 per cent to 435.75.

Currencies

- The Bloomberg Dollar Spot Index dipped 0.2 per cent to 1,139.10, the lowest in three weeks.

- The euro gained 0.3 per cent to $1.1952, the strongest in almost four weeks.

- The British pound advanced 0.1 per cent to $1.3753.

- The Japanese yen appreciated 0.3 per cent to 109.06 per dollar, the strongest in almost three weeks.

Bonds

- The yield on two-year Treasuries decreased one basis point to 0.16 per cent.

- The yield on 10-year Treasuries sank four basis points to 1.62 per cent.

- The yield on 30-year Treasuries declined three basis points to 2.30 per cent.

- Germany’s 10-year yield advanced less than one basis point to -0.29 per cent, the highest in almost two weeks.

- Britain’s 10-year yield dipped one basis point to 0.779 per cent.

Commodities

- West Texas Intermediate crude climbed 1.1 per cent to US$60.40 a barrel, the highest in more than a week.

- Gold strengthened 0.8 per cent to US$1,744.98 an ounce.

--With assistance from Kamaron Leach.