Sep 21, 2021

Stocks gain, treasuries curve flattens after Fed

, Bloomberg News

BNN Bloomberg's mid-morning market update: Sept. 22, 2021

Stocks closed higher and the Treasury yield curve flattened after Federal Reserve officials signaled they would probably begin tapering their bond-buying program soon. The dollar strengthened versus its major peers, while oil gained.

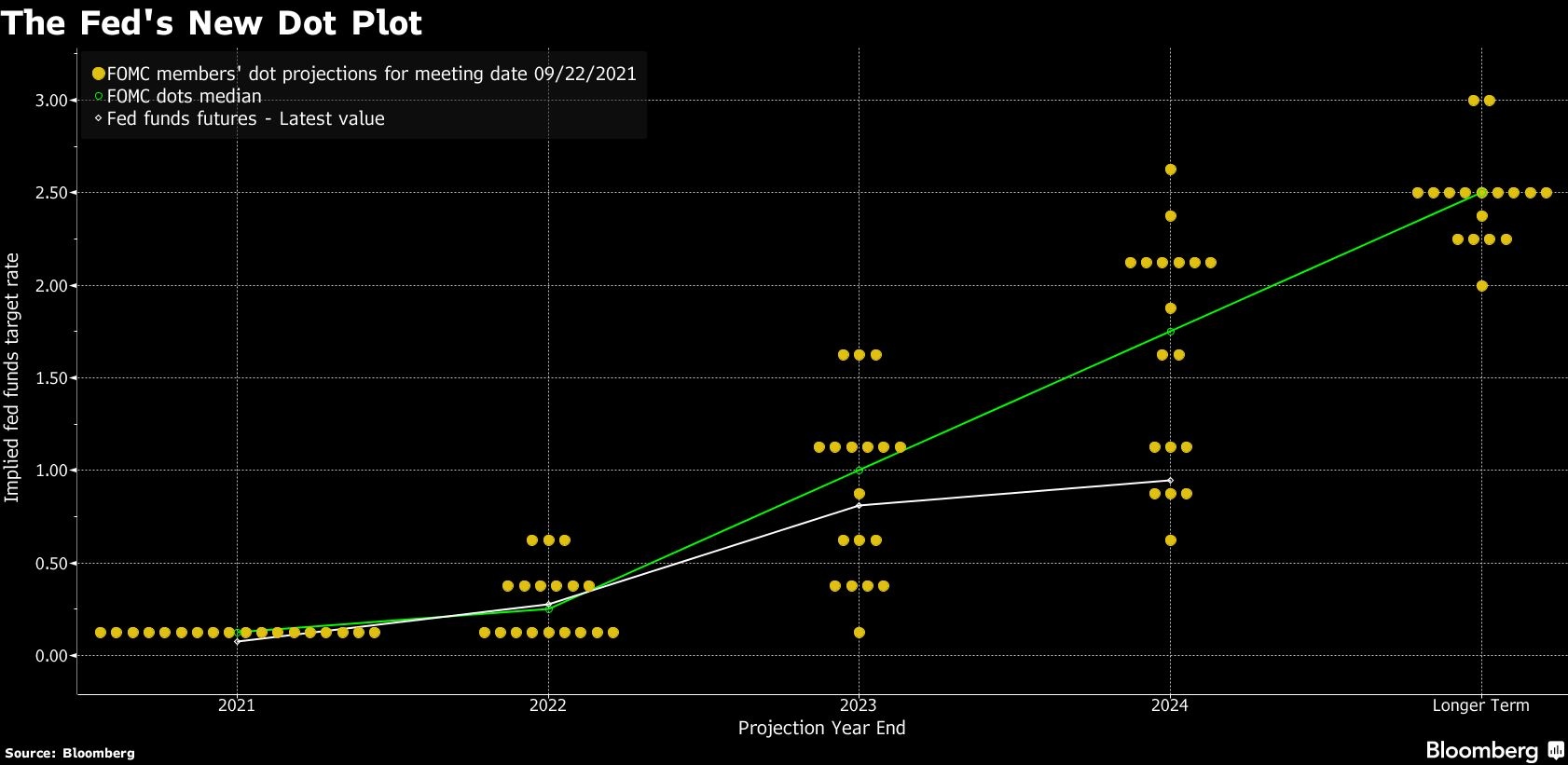

The S&P 500 had jumped earlier, rising for the for the first time in five trading sessions, as concerns about China Evergrande Group’s debt woes eased. The benchmark index rose 1 per cent, the biggest-one day increase since July. Shorter-maturity Treasury notes fell while longer-maturity debt edged higher, flattening the yield curve, after revisions to Fed’s dot-plot forecasts for fed funds target showed a 2022 median of 0.25 per cent, up from 0.125 per cent prior, while 2023 rate forecasts were also dragged higher.

“If you take a step back, the Fed’s stance is still accommodative and it’s reasonable for the Fed to want to return to a state of normalcy if the economy is as robust as the data suggests,” said Mike Loewengart, managing director of investment strategy at E*Trade Financial. “And given the recent volatility, it’s likely that investors are viewing the taper projection and potential 2022 rate hikes as a vote of confidence that the recovery is on track.”

If progress toward the Fed’s employment and inflation goals “continues broadly as expected, the committee judges that a moderation in the pace of asset purchases may soon be warranted,” the U.S. central bank’s policy-setting Federal Open Market Committee said Wednesday in a statement following a two-day meeting.

Fed Chair Jerome Powell said during a press conference that tapering could end around mid-2022 and that most on the committee favor a gradual pace. That could mean the Fed makes an announcement in November, potentially creating an eight-month taper process.

Earlier, basic resources and energy were among the leading gainers in the Stoxx Europe 600 index as commodity prices steadied after Beijing moved to contain fears of a spiraling debt crisis at Evergrande that could ravage demand from the property sector. China avoided a major selloff as trading resumed following a holiday, after the country’s central bank boosted its injection of short-term cash into the financial system.

The Fed’s timeline for tapering stimulus and any shifts in expectations for interest-rate increases are key for investors, who have grown used to central-bank stimulus supporting asset prices. The revision follows a period of market volatility stoked by Evergrande’s woes. China’s wider property-sector curbs are also feeding into concerns about a slowdown in the economic recovery from the pandemic.

“What markets are relieved by was that given the events of this week in terms of China, Evergrande, the debt ceiling dysfunction, some of the growth slowdown,” said Michael Arone, chief investment strategist at State Street Global Advisors’ U.S. SPDR business. “Some of what we’ve been seeing in markets, I think the risk was that the Fed would announce tapering and a timeline today. I think that would have been an unexpected surprise that would have created some volatility and some negative reaction by investors, and that didn’t happen, and so investors are happy.”

Elsewhere, Governing Council member Madis Muller said the European Central Bank may boost its regular asset purchases once the pandemic-era emergency stimulus comes to an end.

In Japan, the central bank left its main monetary policy settings unchanged. Markets in South Korea and Hong Kong were closed for a holiday.

Here are key events to watch this week:

- Bank of England rate decision, Thursday

- Fed Chair Jerome Powell, Fed Governor Michelle Bowman and Vice Chairman Richard Clarida discuss pandemic recovery, Friday

Some of the main moves in markets:

Stocks

- The S&P 500 rose 1 per cent as of 4:01 p.m. New York time

- The Nasdaq 100 rose 1 per cent

- The Dow Jones Industrial Average rose 1 per cent

- The MSCI World index rose 0.6 per cent

Currencies

- The Bloomberg Dollar Spot Index rose 0.2 per cent

- The euro fell 0.3 per cent to US$1.1694

- The British pound fell 0.3 per cent to US$1.3620

- The Japanese yen fell 0.5 per cent to 109.79 per dollar

Bonds

- The yield on 10-year Treasuries declined two basis points to 1.30 per cent

- Germany’s 10-year yield was little changed at -0.32 per cent

- Britain’s 10-year yield was little changed at 0.80 per cent

Commodities

- West Texas Intermediate crude rose 2.1 per cent to US$71.97 a barrel

- Gold futures fell 0.6 per cent to US$1,767.60 an ounce