Nov 8, 2021

U.S. stocks continue streak of gains; treasuries fall

, Bloomberg News

Investors coming into the market on the back of strong earnings is a sign of strength: Colin Cieszynski

U.S. stocks edged higher, with the S&P 500 notching its longest winning streak since 2017, after corporate earnings, strong hiring data and a COVID treatment breakthrough bolstered optimism in the world’s largest economy. The dollar and Treasuries fell.

The S&P 500 gained 0.1 per cent for an eighth session, led energy producers and materials as investors piled into companies that benefit most from a strong economy. Meanwhile, the Nasdaq 100 fell, weighed down by Tesla Inc.’s 4.9 per cent slump after Elon Musk asked his Twitter followers if he should sell 10 per cent of his stake, to which they said yes.

The news flow last week, which also included passage of a US$550 billion infrastructure bill, washed away worries that high inflation and the Federal Reserve’s plan to curb bond purchases would upend growth. Results of Pfizer Inc.’s virus treatment and the lifting of U.S. travel restrictions also boosted speculation companies will continue to have strong earnings. However, the pace of the latest gains may make it difficult for stocks to push much higher without an additional catalyst.

“Fear over inflation and supply chain headwinds have been replaced by fear of missing out in the record-high rally,” said Craig Johnson, Piper Sandler chief market technician, in a note. “Robust demand and economic momentum continue to drive earnings growth. Coronavirus concerns have also dissipated amid vaccine developments and widespread inoculation rates.”

Markets will closely watch a measure of U.S. consumer prices on Wednesday after gains in U.S. payrolls last week also showed a jump in average hourly earnings. The reading is expected to show price pressures running at the hottest pace in three decades amid supply-chain bottlenecks and higher energy costs, according to Bloomberg Intelligence. Still, some expect the S&P 500 to continue rising into the year end.

“The support for the rise in the S&P is pretty solid,” said Joanne Feeney, partner at Advisors Capital Management LLC, on Bloomberg TV’s “The Close”. “Earnings through the third quarter look like they’ve gone up 40 per cent year over year, and the S&P has gone up about 40 per cent year over year. That doesn’t mean you don’t have to pick and choose carefully.”

Oil pared back gains to US$82 a barrel in New York after the U.S. said it may announce measures to ease oil and gasoline prices as soon as this week. Meanwhile, European gas and power prices surged on signs Russia won’t deliver the boost in supplies President Vladimir Putin promised.

In Europe, the Stoxx 600 was little changed. Chemicals company Henkel and retailer H&M declined on inflation-related earnings concerns, while Siemens Gamesa surged after being nominated as the preferred supplier for Norfolk offshore wind power projects in the U.K.

In China, stocks rose after the Communist Party begun a meeting this week for the first time in more than a year. The gathering is expected to lay the ground for extending the term of President Xi Jinping, who has rattled markets with his “common prosperity” campaign to redistribute the nation’s wealth. Shares in Japan and Hong Kong fell.

Some of the main moves in markets:

Stocks

- The S&P 500 was little changed as of 4 p.m. New York time

- The Nasdaq 100 fell 0.1 per cent

- The Dow Jones Industrial Average rose 0.3 per cent

- The MSCI World index rose 0.2 per cent

Currencies

- The Bloomberg Dollar Spot Index fell 0.2 per cent

- The euro rose 0.2 per cent to US$1.1590

- The British pound rose 0.5 per cent to US$1.3563

- The Japanese yen rose 0.2 per cent to 113.22 per dollar

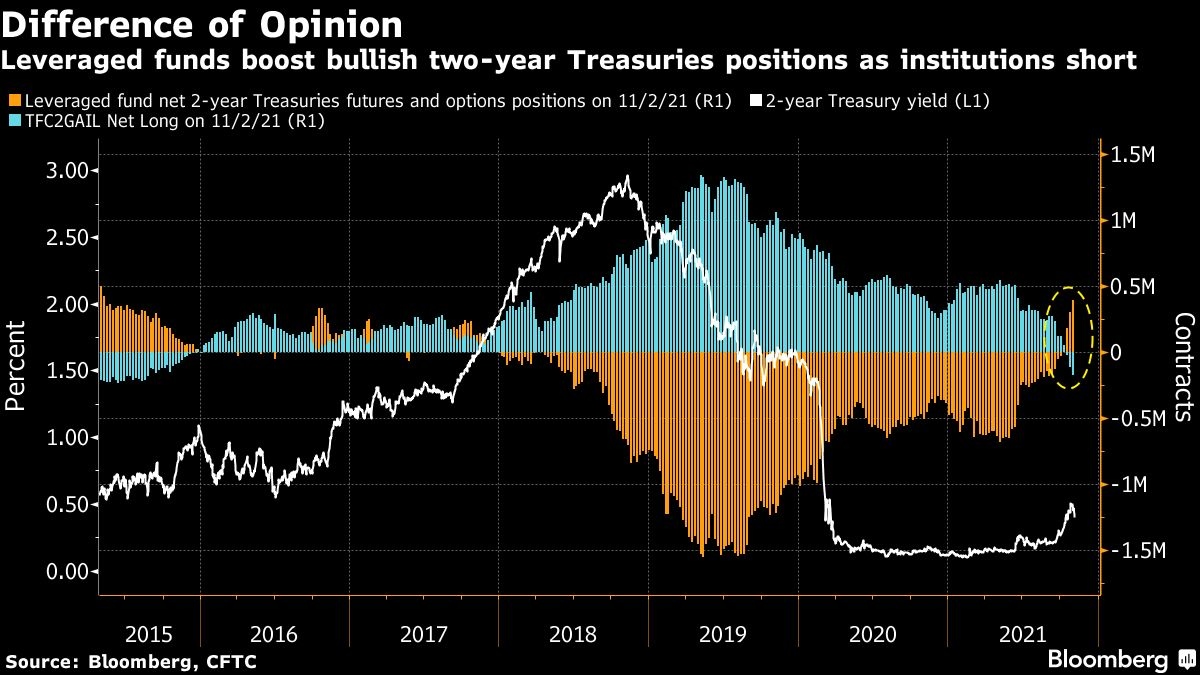

Bonds

- The yield on 10-year Treasuries advanced four basis points to 1.49 per cent

- Germany’s 10-year yield advanced four basis points to -0.24 per cent

- Britain’s 10-year yield advanced one basis point to 0.86 per cent

Commodities

- West Texas Intermediate crude rose 1.2 per cent to US$82.25 a barrel

- Gold futures rose 0.5 per cent to US$1,825.80 an ounce