Oct 26, 2021

U.S. stocks rise amid positive early earnings results

, Bloomberg News

Central banks run the risk of choking off demand if they move sooner than communicated: BlackRock strategist

U.S. stocks rose to all-time highs as corporate earnings helped boost sentiment amid lingering concerns about inflation and growth.

The S&P 500 and Dow Jones Industrial Average set records as Tuesday’s round of earnings kicked off, with United Parcel Service Inc. and General Electric Co. gaining after strong results. Facebook Inc. dropped as a pledge to buy back more shares and increase spending on digital offerings was offset by a revenue miss. Big-tech peers Twitter Inc., Alphabet Inc. and Microsoft Inc. are reporting after close of regular trading.

“I don’t think anybody’s too worried about the big tech names,” said Ross Mayfield, investment strategy analyst at Baird. “Their performances are all incredibly strong in absolute standards that the bar is just so high for them at this point that it can be harder to meet expectations.”

The Stoxx Europe 600 index also rose 0.8 per cent to close at a record high. Reckitt Benckiser Group Plc gained after the maker of Strepsils throat lozenges raised its sales forecast and Novartis AG advanced on news it may spin off its generic-drug unit.

c

The 10-year U.S. Treasury yield fell and the dollar gained. The debate over price pressures continues: former Treasury Secretary Lawrence Summers said officials are unlikely to deal with “inflation reality” successfully until it’s fully recognized.

“We’re coming off a 40-plus-year bond-bull market,” said Megan Horneman, portfolio strategy director, Verdence Capital Advisors, on Bloomberg TV and Radio’s “Surveillance.” “And right now we’re looking at interest rates that should be a lot higher from here. So with duration, as high as it is in the fixed income market, you have to be very cautious around fixed income.”

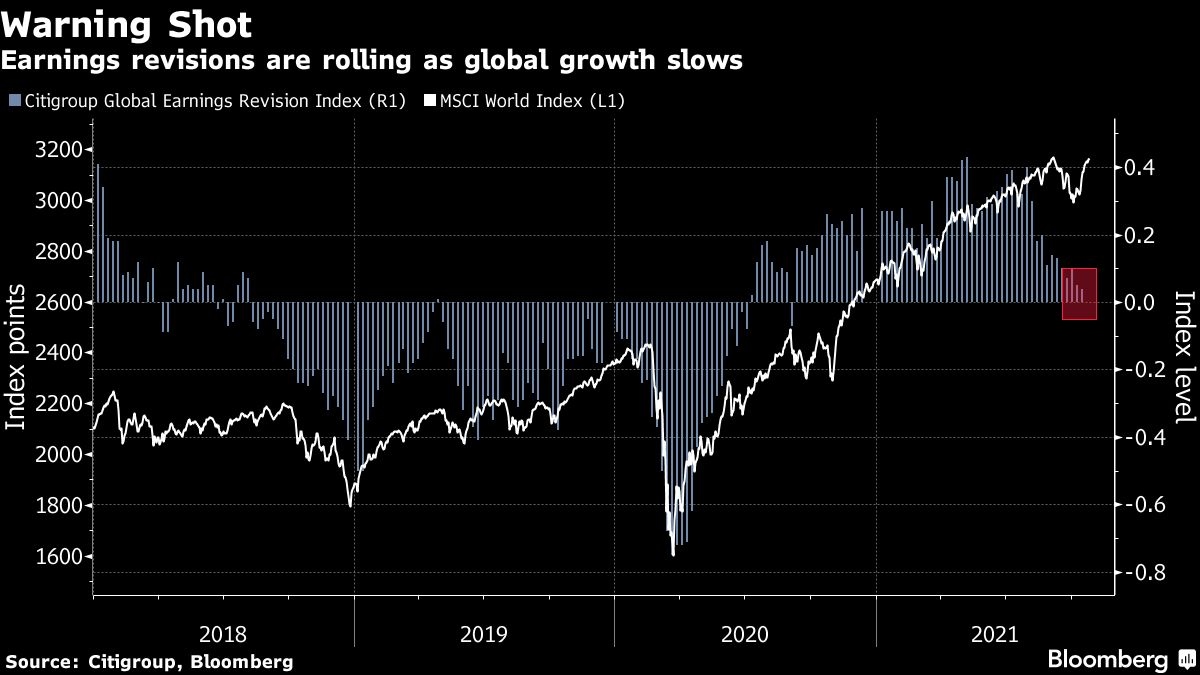

Earnings season is helping to counter concerns that elevated inflation and tightening monetary policy will slow the recovery from the pandemic. Some 81 per cent of S&P 500 members have reported better-than-expected results so far, though Citigroup Inc. warned that profit growth may be close to peaking.

WTI crude oil traded above US$84 a barrel as investors weighed the outlook for U.S. stockpiles and prospects for talks that may eventually help to revive an Iranian nuclear accord, allowing a pickup in crude exports.

Some of the main moves in markets:

Stocks

- The S&P 500 rose 0.2 per cent as of 4:02 p.m. New York time

- The Nasdaq 100 rose 0.3 per cent

- The Dow Jones Industrial Average was little changed

- The MSCI World index rose 0.2 per cent

Currencies

- The Bloomberg Dollar Spot Index was little changed

- The euro was little changed at US$1.1599

- The British pound was little changed at US$1.3763

- The Japanese yen fell 0.4 per cent to 114.13 per dollar

Bonds

- The yield on 10-year Treasuries declined two basis points to 1.61 per cent

- Germany’s 10-year yield was little changed at -0.12 per cent

- Britain’s 10-year yield declined three basis points to 1.11 per cent

Commodities

- West Texas Intermediate crude rose 1 per cent to US$84.58 a barrel

- Gold futures fell 0.7 per cent to US$1,794.90 an ounce