Jul 18, 2019

Stocks to Rise in Asia as Fed-Cut Bets Lift: Markets Wrap

, Bloomberg News

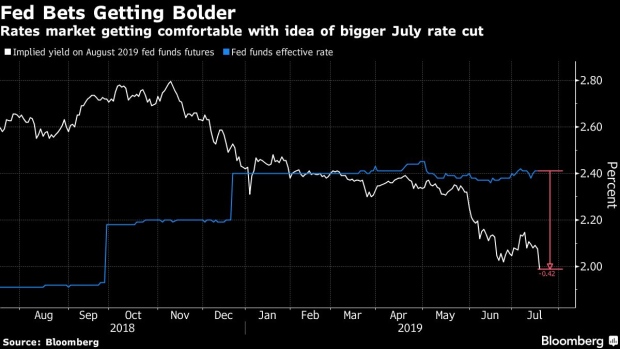

(Bloomberg) -- Stocks in Asia looked set to track gains in U.S. equities as dovish commentary from Federal Reserve officials saw bets on a half-point interest rate cut this month ramp up. Treasury yields and the dollar fell.

Futures on equities in Japan, Hong Kong and Australia rose. Chipmakers will be in focus after a strong outlook from Apple Inc. supplier Taiwan Semiconductor Manufacturing Co. lifted the sector. The S&P 500 climbed and Microsoft Corp. rallied in after-hours trading after sales topped estimates. The MSCI Emerging Markets Index of equities fell even though central banks in South Korea, Indonesia and South Africa all cut interest rates on Thursday.

Fed funds futures are now pricing in about 42 basis points of easing for the July 31 decision. Fed Vice Chairman Richard Clarida told Fox Business Network that policy makers shouldn’t wait for the economy to turn down to act and Fed Bank of New York President John Williams highlighted the need for swift action should policy makers conclude the economy is in trouble.

“We’re in a trade war, you’re seeing the impact on corporate earnings, you’re seeing the central banks forced to scramble to react to that,” Bob Michele, CIO and head of global fixed income at JPMorgan Asset Management, said in a Bloomberg TV interview.

Elsewhere, oil slid to the lowest in almost a month as pessimism about a trade truce between the U.S. and China continued to dog markets, while the resumption of Russian pipeline flows fed worries about a supply glut. The pound climbed as the British Parliament backed measures to prevent the next prime minister suspending the legislature to pursue a no-deal Brexit.

These are the main moves in markets:

Stocks

- The S&P 500 rose 0.4%.

- Futures on Japan’s Nikkei 225 added 0.6%.

- Hang Seng futures earlier climbed 0.3%.

- Futures on Australia’s S&P/ASX 200 Index advanced 0.2%.

Currencies

- The yen was at 107.29 per dollar after slipping 0.6%.

- The offshore yuan was at 6.8739 per dollar.

- The Bloomberg Dollar Spot Index dipped 0.5%.

- The euro bought $1.1278.

- The British pound traded at $1.2552 after climbing 0.9%.

Bonds

- The yield on 10-year Treasuries dipped two basis points to 2.02%.

Commodities

- West Texas Intermediate crude declined 2% to $55.63 a barrel.

- Gold was at $1,446 an ounce.

--With assistance from Rita Nazareth, Benjamin Purvis and Katherine Greifeld.

To contact the reporter on this story: Adam Haigh in Sydney at ahaigh1@bloomberg.net

To contact the editors responsible for this story: Christopher Anstey at canstey@bloomberg.net, Joanna Ossinger

©2019 Bloomberg L.P.