May 7, 2019

TSX, U.S. markets sustain losses amid heightened trade worries

, The Canadian Press

BNN Bloomberg's closing bell update: May 7, 2019

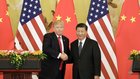

TORONTO — North American stock markets sustained deep losses Tuesday over rising concerns about a looming trade war between the U.S. and China.

Markets mostly recovered Monday from early losses after U.S. President Donald Trump tweeted he's set to impose 25-per-cent tariffs Friday against US$525 billion worth of Chinese imports, including US$200 billion that currently face 10 per cent levies.

A similar bounce-back didn't materialize Tuesday after U.S. Trade Representative Robert Lighthizer reinforced original market anxiety about tariffs by talking about China reneging on prior commitments. The comments came even though China will send a delegation for negotiations on Thursday, a day later than originally planned.

"It's certainly a bad day," said Anish Chopra, managing director with Portfolio Management Corp.

"Given the tight timeline and the details coming out of other senior U.S. government officials, it just seems like it's getting to be more certainty that it could happen."

The S&P/TSX composite index closed down 135.71 points to 16,357.75 after hitting an intraday low of 16,317.94.

In New York, market losses were at least twice as steep. The Dow Jones industrial average had its biggest single day decrease of the year by losing 473.39 points at 25,965.09. It was down more than 648 points or 2.4 per cent earlier in the trading session.

The S&P 500 index was down 48.52 points at 2,884.05, while the Nasdaq composite was down 159.53 points at 7,963.76.

After more than a quarter century moving towards freer global trade, increased tariffs would be seen as a step backward, said Chopra.

"When you move away from freer trade generally you have an impact on global economic growth and the market is adjusting to the potential, assuming that the tariffs do get put in place, that you're looking at just lower GDP growth rates worldwide going forward," he said in an interview.

Investors headed to safety as defensive sectors like consumer staples and utilities which led the TSX. Large sectors that account for the bulk of the market fell as eight of the 11 major sectors were down on the day.

Health care led with a 2.2 per cent drop, following by technology, energy, industrials and financials. Shopify Inc. was down 2.54 per cent, Crescent Point Energy lost 4.4 per cent, SNC-Lavalin was down 4.13 per cent and First Quantum Minerals Ltd. was off 5.9 per cent.

The Canadian dollar traded at an average of 74.21 cents US compared with an average of 74.32 cents US on Monday.

Crude oil prices fell on concerns about weaker global demand and in anticipation of a report Wednesday that is expected to suggest rising U.S. oil production this year and in 2020.

The June crude contract was down 85 cents at US$61.40 per barrel and the June natural gas contract was up 1.2 cents at US$2.54 per mmBTU.

The June gold contract was up US$1.80 at US$1,285.60 an ounce and the July copper contract was down 4.4 cents at US$2.79 a pound.