Nov 29, 2021

U.S. stocks rally as Wall Street’s COVID fears ease

, Bloomberg News

Investors should have a stock wish list ready in the event that Omicron expands: Jeff Hull

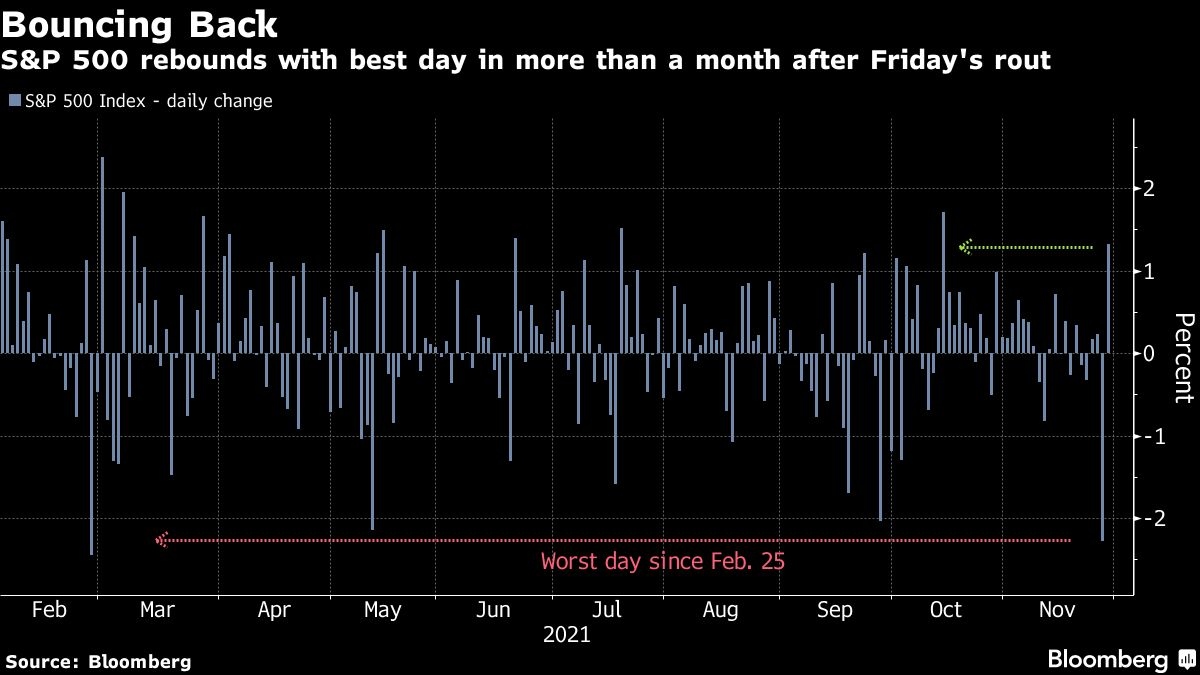

Stocks climbed and bonds fell as a relative sense of calm returned to global markets, with investors reassessing their worst-case scenarios for the omicron coronavirus strain.

In a broad-based rally, the S&P 500 rebounded from Friday’s rout and wiped out its November losses. The Nasdaq 100 jumped more than 2 per cent, led by gains in technology giants such as Apple Inc. and Microsoft Corp. Treasury 10-year yields rose above 1.5 per cent.

President Joe Biden cautioned Americans against panicking over the new variant, saying that vaccines, booster shots and masking are the best steps to keep people safe. Pfizer Inc. will know within two to three weeks how well its COVID-19 vaccine holds up against omicron, according to its top executive, and even in a worst-case scenario he expects the existing formula will retain some efficacy against the heavily mutated strain.

“Investors are evidently making an assumption today that omicron may not be as bad as had been feared on Friday, and that vaccines may still prove effective,” wrote Fawad Razaqzada, an analyst with ThinkMarkets. “It will take some time -- possibly a couple of weeks at least -- to understand this variant better. So, what might happen going forward is that we will see elevated levels of volatility.”

A forward-looking gauge of U.S. home purchases rebounded in October to a 10-month high, signaling steady housing demand. The National Association of Realtors’ index of pending home sales increased 7.5 per cent from a month earlier. The median estimate in a Bloomberg survey of economists called for a 1 per cent advance.

Some other corporate highlights:

- Jack Dorsey the co-founder and chief executive officer of Twitter Inc., is stepping down from the helm of the social network, ceding the position to tech head Parag Agrawal.

- Hertz Global Holdings Inc. plans to repurchase as much as US$2 billion of its common stock, the latest move to realign its finances just months after exiting bankruptcy protection.

- Walmart Inc. said Chief Financial Officer Brett Biggs plans to step down by early 2023, ending a run of more than two decades with the retail giant.

Some of the main moves in markets:

Stocks

- The S&P 500 rose 1.3 per cent as of 4 p.m. New York time

- The Nasdaq 100 rose 2.3 per cent

- The Dow Jones Industrial Average rose 0.7 per cent

- The MSCI World index rose 0.7 per cent

Currencies

- The Bloomberg Dollar Spot Index was little changed

- The euro fell 0.3 per cent to US$1.1280

- The British pound fell 0.3 per cent to US$1.3303

- The Japanese yen fell 0.2 per cent to 113.65 per dollar

Bonds

- The yield on 10-year Treasuries advanced four basis points to 1.52 per cent

- Germany’s 10-year yield advanced two basis points to -0.32 per cent

- Britain’s 10-year yield advanced four basis points to 0.86 per cent

Commodities

- West Texas Intermediate crude rose 2.1 per cent to US$69.59 a barrel

- Gold futures fell 0.2 per cent to US$1,785.30 an ounce