Jun 17, 2021

Stretch Jeep Rolls From Detroit’s First New Factory in 30 Years

, Bloomberg News

(Bloomberg) -- Jeep, the automotive brand known mostly for its rock-crawling Wranglers, is now upgrading the lineup with a more urbane bent: a three-row makeover of the Grand Cherokee sport-utility vehicle that is larger and more luxurious than its predecessors.

This is no mere model refresh. The new Jeep is part of a yearslong effort under successive owners to expand the coveted, profitable marque. To produce the elongated Grand Cherokee L, Stellantis NV invested $1.6 billion to build a gleaming new assembly plant at an existing site in east Detroit. More than half the factory’s nearly 5,000 workers live in the city, which hasn’t had a new auto assembly plant in more than 30 years.

Long-running capital constraints had forced Fiat Chrysler Automobiles NV, which became Stellantis after its merger with PSA Group, to miss out on revenue that rivals gobbled up with three-row SUVs such as the Chevy Traverse and Ford Explorer. Adding the long-absent third row should help Jeep’s best-selling model appeal to millennials with growing families, while two higher-end versions and a top price over $65,000 stake a bigger claim in the luxury realm.

“We’ve had customers that have had to leave the Jeep brand because their lifestyle has dictated that they need either a larger vehicle, more utility, more seating capacity, just more,” said Scott Tallon, director of Jeep product marketing in North America. “Now we have something that is going to be the absolute best tool in the toolbox to retain them.”

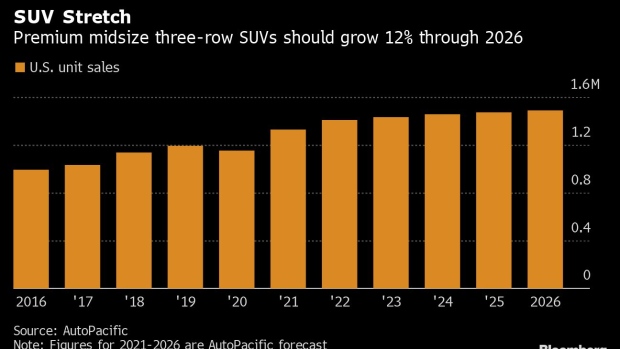

U.S. sales of premium midsize-SUVs with three rows grew 16% over the past five years to 1.1 million units in 2020, according to AutoPacific. Ed Kim, vice president of industry analysis at auto consultancy AutoPacific, forecasts the segment will expand another 12% over the next five years, with a bump this year thanks to the new Jeep models.

“The importance of this model can’t be overstated, because in terms of size and positioning it’s right in that sweet spot for three-row midsize SUVs,” Kim said.

Shares of Stellantis slipped less than 1% to $20.32 at 10:48 a.m. in New York. They’ve climbed about 40% since Jan. 16, the day the merger was completed.

Two-Row Shrinkage

The two-row SUV segment that the current generation Jeep Grand Cherokee leads has shrunk since 2016 as millennials upgrade to bigger vehicles and empty nesters on fixed incomes hang on to their rides longer, he said. A redesigned two-row Grand Cherokee is due later this year.

The roomier Grand Cherokee L is one of three new larger SUVs helping Jeep make up for lost time. A revived Jeep Wagoneer and Grand Wagoneer also add an upscale luster to the brand. The trio are all gasoline-powered, and Stellantis has signaled hybrid versions are coming as its crosstown competitors General Motors Co. and Ford Motor Co. go all-in on electric vehicles.

Jeep Targets Cadillac Escalade with $111,000 Grand Wagoneer

The newest Jeep can tow up to 7,200 pounds. It offers 357 horsepower, all-wheel drive with rear electronic slip differential to scramble over rocks and air suspension that helps it ford a muddy stream without dirtying its outfit. That rugged capability is packaged in a steel- and leather-bound seven-seater that aspires to be more refined than wild.

One advantage of the Jeep brand is its appeal to both mainstream and premium buyers, Kim said, aspects the automaker has tried to marry in the new Grand Cherokee. The entry-level Laredo trim starts at just under $37,000, while the Summit Reserve tops out at $65,290.

The Summit trim offers seats with built-in massage functionality and an oak-and-leather trimmed steering wheel. Safety features like lane-keep assist and forward collision warning are standard, though automated lane centering is an upgrade.

“This new Grand Cherokee arguably shouldn’t even be able to go where it goes, because it looks so good and it’s got so much luxury and technology,” Jim Morrison, vice president of Jeep for North America, said while bouncing up a rocky hill on Stellantis’s proving grounds in Chelsea, Michigan. “Jeep has always had a meaningful connection to luxury and capability, going all the way back to the first Grand Wagoneer.”

New Detroit Factory

To build the elongated Grand Cherokee L, Stellantis expanded its manufacturing footprint. The new assembly plant is built on a site that once produced door panels for Packard in the 1920s, and later the Dodge Viper in the 1990s. Construction was completed in under two years.

But that comes at a time when GM and Ford are spending tens of billions of dollars on battery plants and an extensive lineup of EVs. Stellantis, which will host an electrification day on July 8, still has time to shift to electric powertrains, said Stephanie Brinley, an analyst with IHS Markit.

Electrification is “going to take decades to play out -- you don’t have to be first to be successful,” she said. “What’s going to be more important isn’t getting there first but that they execute well when they do arrive.”

The Grand Cherokee L is built on an all-new platform that can accommodate both gas and electric powertrains, a hint that an electrified version is in the offing. Morrison pointed to the hybrid Wrangler 4Xe, which went on sale earlier this year, as an example of where the brand is headed.

“We’re not forcing it for compliance, we’re doing it because it’s the best technology that our customers want,” he said. “It’s the next generation for Jeep for sure.”

©2021 Bloomberg L.P.