Nov 8, 2022

Subprime Auto Bonds Hit by Skipped Payments, Falling Used-Car Values

, Bloomberg News

(Bloomberg) -- Subprime auto loan borrowers are increasingly falling behind on payments, and the value of used cars is dropping, two trends that are clobbering bonds tied to the debt.

Yields on some of the riskiest such bonds have jumped to about 6.5 percentage points more than Treasuries as of last week, a risk premium that’s widened up about 2 percentage points from the end of September, according to data compiled by JPMorgan Chase & Co. Excluding a few weeks during the pandemic, current levels are the widest since 2010.

Sellers of subprime auto bonds are bearing the brunt of investors’ increased skepticism. Southern Auto Finance Co. tried to sell an almost $120 million bond offering last month, in what would have been its first such offering, but delayed the deal citing market volatility. Some money managers say they are focusing on companies that have issued the bonds for years and may be safer, and also looking at safer securities within individual transactions.

“It is more prudent right now to play subprime auto from regular and higher quality issuers that have been through different economic cycles,” said David Goodson, head of securitized credit at Voya Investment Management, in an interview. “We remain defensive.”

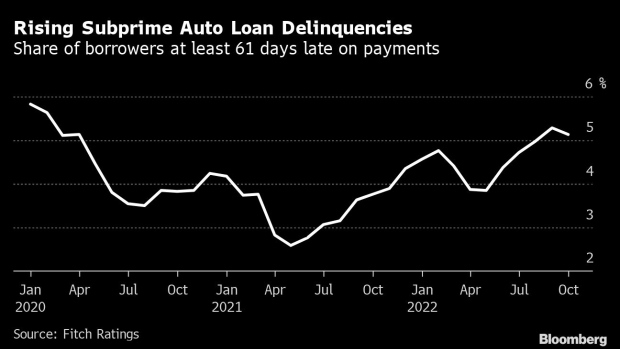

There may be good reason to be defensive now. The current delinquency rate for subprime auto loan bonds has been rising this year, at 5.13% as of October, based on borrowers 61 days or more late, according to data from Fitch Ratings. That’s compared with 3.76% in the same month last year, when households were still flush with cash from pandemic stimulus. And used car prices have dropped about 15% this year according to the Manheim US Used Vehicle Value index, signaling that if times get more difficult and investors have to repossess these cars, the vehicles will be worth less and money managers could lose more.

But subprime auto bonds are built to withstand relatively high losses. For a median AAA portion of subprime auto ABS sold in 2022, the underlying loan pool would need to experience an annualized default rate of 78% over life of the deal before investors would begin taking a loss on their principal investment, according to a recent Morgan Stanley research report citing stress tests performed in May.

“It’s hard for me to fathom a scenario where AAA rated subprime auto asset-backed securities experience a loss,” said Amy Martin, a senior director at S&P Global Ratings focusing on auto asset-backeds.

For the BB rated tranches of 2022 subprime auto ABS, it would take a 19% default rate over the life of the deal for the median bond to take a loss, according to Morgan Stanley’s research. For comparison, on subprime auto bonds during the great financial crisis the peak average default rate was about 15%, according to James Egan, co-head of securitized research at Morgan Stanley.

Loan losses can end up being far worse than expected, as investors learned during the financial crisis. But to some investors, subprime auto bonds can take heavy enough default rates to make the bonds worth looking at.

“We like to think of these structures as bending but not breaking,” said Jordan Chirico, head of Indianapolis-based 352 Capital, a firm backed by money manager Leucadia Asset Management. 352 Capital has been buying subprime auto bonds rated in the BB and BBB tiers.

For now, consumers are still faring well. Unemployment was at 3.7% in October, a report said on Friday, far below the average for the last 10 years of about 5.3%.

“It takes so much to break these bonds or to really find a material loss, that it’s still not in the cards, barring some astronomical recession,” said Vadim Verkhoglyad, a vice president at market data company dv01.

Elsewhere in credit markets:

Americas

Nielsen’s $2 billion secured bond sale is being talked with a yield of 11% to 11.25%, and dealers have drummed up the minimum amount of orders to potentially sell the securities.

- A series of investment-grade issuers, including Ameren Illinois, are selling high-grade bonds

- Heavyweight creditors including Apollo Global Management Inc. and Oak Hill Advisors are making a high-level push to encourage borrowers in the loan market to increase disclosures on everything from carbon emissions to board diversity

- General Electric Co. plans to buy back as much as $7 billion of bonds ahead of the separation of its health unit in January as part of Chief Executive Officer Larry Culp’s plan to rejuvenate the former manufacturing titan.

- For deal updates, click here for the New Issue Monitor

- For more, click here for the Credit Daybook America

EMEA

On Tuesday, 15 issuers sold the equivalent of €19.36 billion ($19.52 billion) of bonds

- Asda and Morrison are facing a combined annual interest bill of over £700 million ($802 million) as a result of their debt-fueled buyouts by private equity last year.

- The developer of Dubai’s artificial palm-shaped islands, Nakheel, secured 17 billion dirhams ($4.6 billion) in financing from a group of local lenders to kick off new projects amid a property boom in the city

Asia

Heungkuk Life Insurance Co., the South Korean insurer that last week triggered a perpetual bond rout in Asia with its convention-defying move to delay early repayment, has reversed its decision and will exercise the call option for its $500 million perpetual note issued in 2017.

- Rakuten Group Inc.’s bonds have fallen to near all-time lows as concerns mount that the Amazon.com competitor in Japan will report more losses

- China Fortune Land says holders with more than 50% of the existing bonds have agreed to the restructuring support agreement

- Vietnam’s central bank is ordering commercial banks to meet capital needs of fuel traders buying fuel domestically and internationally to ensure the nation’s supply requirements are met

--With assistance from Charles Williams.

©2022 Bloomberg L.P.