Sep 16, 2019

Success in China Is All About Having the Right Formula

, Bloomberg News

(Bloomberg Opinion) -- Selling infant formula to China seems so 2016.

The country abandoned its one-child policy three years ago, spurring expectations of a baby boom. These have been well and truly dashed. Fertility rates remain stuck around the levels they’ve been at for two decades, and the 15 million children born in 2018 was the lowest figure since 1961. Roughly five Indians are born each year for every three Chinese.

So what’s the country’s second-biggest milk producer China Mengniu Dairy Co. doing paying an Amazon.com Inc. valuation for milk-powder producer Bellamy’s Australia Ltd.? The answer tells you a lot about the changing prospects for the Chinese consumer.

Bellamy’s, which makes organic milk and infant foods and first sold shares to the public as recently as 2014. Mengniu’s cash offer, which Bellamy’s board has recommended, is a 59% premium to the last pre-deal closing price and values the company at A$1.5 billion ($1 billion), about 30 times its Ebitda in the last fiscal year (Amazon gets just 27 times).

Formula producers such as Bellamy’s, Nestle SA, and Danone SA have gone through a rough patch in China recently, driven by the slowing birth rate and a general softening in consumer spending.

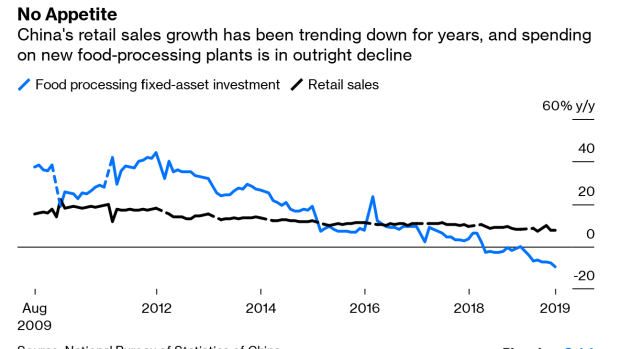

China’s retail sales grew just 7.5% from a year earlier in August, the National Bureau of Statistics reported Monday, the second-slowest pace since the SARS epidemic in 2003. Fixed-asset investment in food processing plants year-to-date slumped 9.4% from a year earlier, suggesting companies see dismal prospects for growth.

So what’s so special about Bellamy’s? For one thing, it still benefits from the long shadow of China’s 2008 tainted-milk scandal, when products including those made by Mengniu, its majority-controlled affiliate Yashili International Holdings Ltd., and arch-rival Inner Mongolia Yili Industrial Group Co. were found to have contained the toxic chemical melamine.

That’s made foreign-branded infant formula such a hot commodity in China that Australian retailers have had to implement maximum-purchase rules to stop the booming buy-overseas, post-back-home trade from clearing their shelves.

That’s not enough on its own, though, given the general headwinds. After all, Mengniu tried to capitalize on this trend back in 2015 when Yashili invested 1 billion yuan ($141 million) in a New Zealand factory. The mid- to high-end image of the Kieember and Kieevagour brands produced there clearly haven’t been a Bellamy’s-level success.

Yashili announced plans to sell a 49% stake in the New Zealand business to Danone for the equivalent of about $201 million last December, but the sale was canceled last month amid unsuccessful attempts to strike a broader agreement between the two companies. While the valuation uplift was clearly a positive, it’s notable that neither side was desperate to gain or retain control of the asset without getting something else in return.

What makes Bellamy’s different is that it eschews the mid-range altogether. Its cans of formula sell on Alibaba Group Holding Ltd.’s Tmall marketplace for 50% more than shoppers pay in Australia, where the organic branding means it’s already a premium line. It’s not so much a bet on China’s baby boom, as on growing wealth disparities and rising affluence in a country that already accounts for a third of the world’s luxury spending

Even in that context, Mengniu will struggle to make a good return on its investment. The company plans to invest to increase capacity and drive sales, Chief Executive Officer Minfang Lu said in a statement. That’s easier said than done, given that it takes three years to convert dairy farms to organic production. Australia is a relatively small organic milk producer, with output of about 50 million liters in 2017 compared with 880 million liters in China, according to KPMG.

Mengniu will need to be confident this brand can hold its own against Yili, Nestle and Danone at the top end of a fiercely competitive Chinese market. Three-quarters of its revenue at present comes from sales in Australia. While Bellamy’s is often treated as a play on Chinese demand, it’s not there yet.

Shareholders in the target would do well to sell into this offer. Those in Mengniu should hope they don’t end up crying over spilled milk.

To contact the author of this story: David Fickling at dfickling@bloomberg.net

To contact the editor responsible for this story: Matthew Brooker at mbrooker1@bloomberg.net

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

David Fickling is a Bloomberg Opinion columnist covering commodities, as well as industrial and consumer companies. He has been a reporter for Bloomberg News, Dow Jones, the Wall Street Journal, the Financial Times and the Guardian.

©2019 Bloomberg L.P.