May 28, 2022

Sun-Starved Sweden Turns to Solar to Fill Power Void

, Bloomberg News

(Bloomberg) -- Sweden, known for its long dark winters with barely any daylight, is seeing a solar power boom.

Harnessing whatever sunshine the country gets is emerging as the quickest solution to fill part of the void left by two closed nuclear reactors in southern Sweden, where the biggest cities and industries are located. With shortages piling up in the region and consumers keen to secure green energy at stable prices, solar is quickly catching up with wind as developers put panels on rooftops and underutilized land in populated areas.

While the lack of sunlight is a hindrance, every bit of new electricity capacity will lower imports from Europe where prices are more than three times higher than in the rest of Sweden. Projects are also getting built quickly because developers are directly getting into power sales deals with consumers and aren’t dependent on government support, said Harald Overholm, chief executive officer of Alight AB, which started Sweden’s biggest solar plant this month.

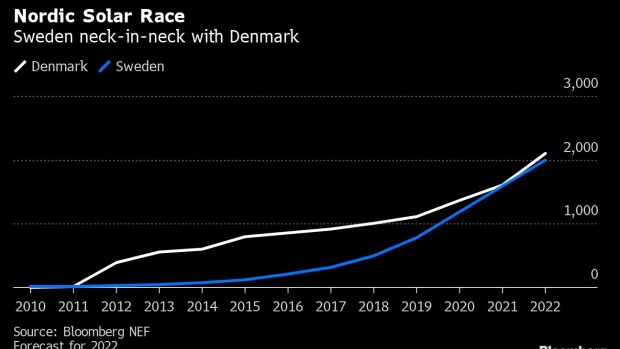

Companies are targeting a quick ramp-up, pushing total capacity in the country to 2 gigawatt this year. That’s more than the two nuclear reactors in Ringhals that were halted in 2020, and will close the gap with Denmark, an early mover in the industry in the region.

“We are very good at creating contracts directly with commercial partners that use power, and that is what drives our development,” said Harald Overholm, chief executive officer of Alight.

Nuclear Hole

The past winter has demonstrated the hole left behind by the two atomic reactors, with the government facing the task of resolving a divergent market. While vast hydro and wind projects have kept the cost of electricity in the sparsely populated north in check, a lack of generating capacity and congested grids have forced the south at times to import power.

The south is home to heavy users such as SSAB AB’s steel plant and Stora Enso Oyj’s paper and pulp mills. But the demand and the higher power prices in the region haven’t been enough to overcome the permitting process for new wind power and expansion of the grid. Municipalities and households remain skeptical of large turbines and very visible energy infrastructure in densely populated areas.

Also read: Clean Power Isn’t Reaching Those Who Need It Most

Solar developers are not faced with the same issue. They use underutilized land or install panels on rooftops, making it a lot easier to blend in. Most of the bigger projects also secures long-term sale deals directly with customers that are enough to break even without government subsides. Buyers are left less exposed to a very volatile market.

“Solar is twice as popular in Sweden as wind in opinion polls,” Overholm said. “It does not disturb, it create more biodiversity, it does not exclude other uses of the land in the long term, no change of the view of the horizon, we don’t create any sounds, there are few thing to oppose.”

Alight started the 18-megawatt project in Skurup this month that will sell its output to a restaurant service company. It followed a similar deal with Swedbank AB for another site in Linkoping. The company plans to build at least another 600 megawatt of capacity in southern Sweden in the next two years.

Others such as Helios Nordic Energy AB, OX2 AB and European Energy A/S are also planning new capacity.

Lack of Sunshine

But companies face a major challenge -- a lack of sunshine. During the darkest month of December, southern Sweden gets only about half of the sun-hours than Munich does or about a quarter compared with Madrid.

It means a megawatt capacity of solar in the country can churn out just about 14% as much electricity as a megawatt of nuclear capacity running around the clock during those long dark winters when electricity demand reaches a peak.

The challenge has meant the Nordic region’s solar industry is still far behind other European heavyweights, with Germany at 55 gigawatts and Spain’s 16 gigawatts, Bloomberg NEF data show.

Even though the added capacity is unable to fully replace the closed reactors, it will push down prices in southern Sweden, according to Christian Holtz, a energy markets consultant with Merlin & Metis AB in Stockholm.

“If we look at Germany that also shut down nuclear plants and built a lot of solar capacity, you can see a clear effect on prices with very low levels in the middle of the days,” he said. “We are starting to add pretty big volumes in Sweden too that will make a difference”

©2022 Bloomberg L.P.