Jul 13, 2022

Suncor Investors Await Possible Board Shakeup After CEO’s Exit

, Bloomberg News

(Bloomberg) -- After Suncor Energy Inc.’s top executive resigned on Friday following the death of an oil sands worker, shareholders are wondering if an exodus of board members is close behind.

Mark Little stepped down suddenly as chief executive officer after a 26-year-old contractor at the company’s Base Plant mine was killed, the latest in a series of fatalities at the company. Activist investor Elliott Investment Management LP had already called for five directors to be added to Suncor’s board in April due to the company’s safety record and poor stock performance relative to peers.

“I think there needs to be some new thinking” when it comes to the board, said Norman Levine, a recently-retired managing director of Portfolio Management Corp. who says he’s personally owned Suncor for decades and currently holds thousands of shares. “I am glad there is a change of CEO at the top. Sorry that it took somebody dying for it to happen.”

Laura Lau, chief investment officer of Suncor shareholder Brompton Funds, said she expects some longtime board members, like 18-year veteran Maureen McCaw and 16-year member Eira Thomas, might opt to exit before a new CEO takes the reins. “You might have some people who want to be refreshed out,” she said. “Do you want to be associated with this?”

McCaw didn’t immediately respond to a message sent via LinkedIn, while Thomas declined to comment when reached by phone.

Suncor has installed Kris Smith, executive vice president for downstream, as interim CEO while it searches for a permanent replacement.

“I think the street wants him to be somebody from outside the company to change the culture,” Lau said of the CEO search.

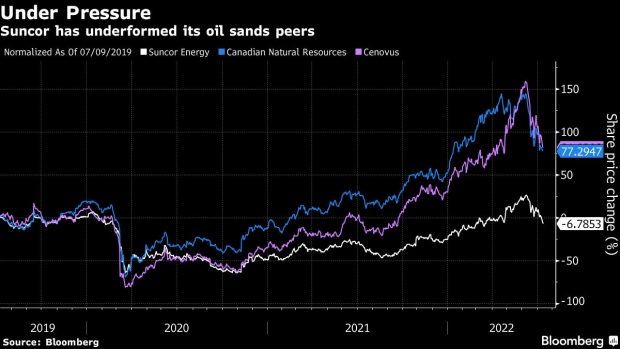

Even before the latest event, Suncor shares have underperformed other Canadian oil sands producers. Suncor shares fell below C$40 ($31) on Tuesday for the first time since April. That same month, Elliott sent a letter demanding a shakeup of the company, including the addition of new directors, a management review and the possible sale or spinout of assets.

Elliott didn’t reply to requests for comment. Suncor declined to comment.

Still, while Elliott had been a vocal critic of Suncor management, the activist investor may now push for quieter action, such as bringing in an outside consultant to address safety, said Joshua Young, chief investment officer at Bison Interests LLC, who invests in other Canadian energy companies but has been avoiding Suncor due to the safety issues.

“To the extent that the board acts on this, which they did, to the extent they hire somebody that is acceptable, I am not sure that we will necessarily see substantial board changes,” he said, noting that Elliott appears to be “having a substantial impact on the company already.”

©2022 Bloomberg L.P.