Feb 21, 2023

Suncor Names Kruger CEO Amid Elliott Pressure, Safety Overhaul

, Bloomberg News

(Bloomberg) -- Suncor Energy Inc. named Rich Kruger as its new chief executive officer, ending a seven-month search that started after a string of worker deaths and pressure from activist investor Elliott Investment Management LP drove out the previous leader.

The appointment of Kruger, a former CEO of Exxon Mobil Corp.’s Canadian unit Imperial Oil Ltd., is effective April 3, Suncor said Tuesday in a statement.

Kruger, who spent nearly four decades at Exxon Mobil, takes over one of Canada’s largest oil producers as it works to improve its safety record and grapples with pressure from Elliott. Under Kruger, Imperial started up the Kearl oil sands expansion project in Alberta and divested hundreds of fuel stations to focus on production and refining. He retired as CEO at the end of 2019.

“Kruger brings with him fully integrated oil sands expertise and was held in high regard amongst the investment community during his time at Imperial,” Phil Skolnick, an analyst at Eight Capital, said in a note. “Imperial’s Kearl oil sands mining project had problems in its early days, albeit not to the same extent as Fort Hills, which became rear view under Kruger’s leadership.”

Kruger also worked in the former Soviet Union, Africa, Asia and the Middle East before taking the top job at Imperial Oil in 2013.

Kris Smith, previously Suncor’s executive vice president for downstream, has served as interim CEO since Mark Little stepped down in July after a worker died at its Base Plant mine in northern Alberta, its second worker death that year. Smith will become chief financial officer at the end of Suncor’s annual meeting on May 9 as Alister Cowan retires. Smith’s move to the CFO role “sets in place a visible CEO succession plan,” Skolnick said.

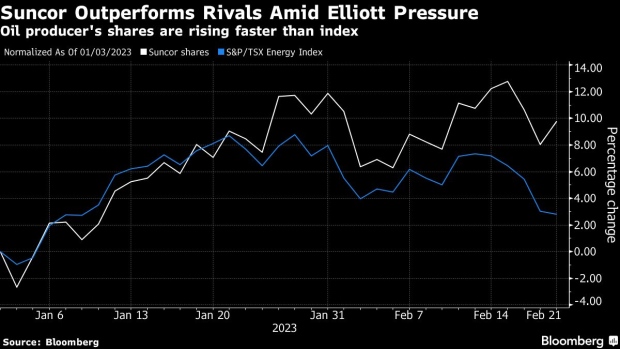

Suncor rose 1.7% to C$45.36 at 10:01 a.m. in Toronto. The shares are up 5.3% this year, compared with a 0.7% decline for the S&P/TSX Energy Index.

Elliott, the activist investment firm founded by Paul Singer, went public with its campaign against the oil-sands giant in April and struck a deal just days after Little’s resignation to add three directors to its board and review a possible sale of Suncor’s downstream assets. Two of those directors were appointed to serve on the committee to select the new CEO.

Elliott has been particularly critical of Suncor’s safety record, which also included deaths in the two years prior to the launch of its campaign.

The repeated accidents prompted Alberta’s Occupational Health & Safety division to put the company under a special safety-monitoring program late last year. The probe has resulted in Suncor receiving 32 safety violations from November through January, far more than its peers have been given.

- Read More: Elliott Target Suncor Draws Regulatory Safety Probe After Deaths

Under Smith, Suncor has taken steps to address safety, including implementing plans to cut its contractor workforce by 20% at mining and upgrading sites.

The company also has agreed to sell oil and gas assets in the UK and Norway and divest its renewable-energy portfolio. But Suncor decided to hold on to its retail filling stations in Canada after a review concluded that the company wouldn’t have fetched the premium it wanted for them.

“Suncor has great people and assets,” Kruger said in a statement. “Combined with strong leadership and the right culture, we can leverage the company’s competitive advantages to excel.”

(Updates with analyst’s comment in fourth paragraph)

©2023 Bloomberg L.P.