Aug 10, 2022

Surging Inflation Puts Asia’s Deal-Hunting Bond Buyers on Hold

, Bloomberg News

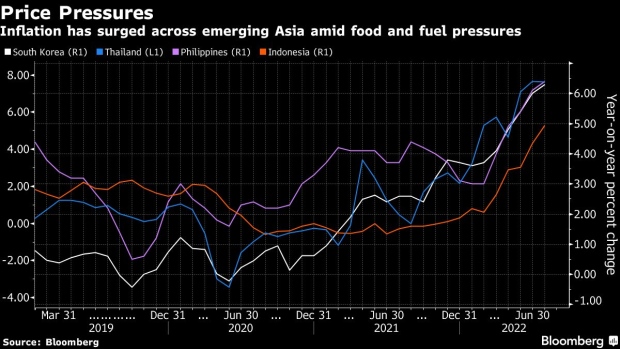

(Bloomberg) -- Investors looking to call the bottom in emerging Asian bonds may have to wait a little longer as inflation in the region shows few signs of peaking.

The latest consumer-price gains data from the Philippines, Indonesia, and Thailand surprised on the upside, signaling that cost pressures continue to outrun market forecasts. Shorter-dated yields, which are more sensitive to hawkish rate expectations, remain elevated as investors appear unconvinced that inflation has topped out for now.

The stronger-than-expected inflation prints run counter to a prediction by Morgan Stanley’s analysts that cost pressures will peak this quarter as supply imbalances reverse. Last week’s robust American jobs report and continued hawkish signals from policy makers are likely to underpin bets for more US policy tightening, which would weigh on emerging Asian debt.

“With the geopolitical situation remaining fluid, it is difficult to call for peak inflation with high confidence,” said Jin Yang Lee, an investment manager for sovereign debt at abrdn Plc in Singapore. “Nevertheless, we are seeing higher recessionary probabilities being reflected in lower commodity prices, which should start to feed into inflation prints eventually.”

But for now, there are few signs that price pressures are about to slow.

Headline inflation in the Philippines quickened to 6.4% on year in July, outstripping estimates for a 6.1% gain. The same measure in Indonesia also exceeded economists’ expectations while a gauge of Thailand’s core consumer-price gains topped forecasts last month. The Bank of Thailand signaled gradual policy normalization on Wednesday as it lifted rates by 25 basis points from record lows.

“A more sustained EM rates rally also needs a green light from domestic inflation,” according to a note from Goldman Sachs Group Inc. analysts last week. “A green light for rate receivers beyond any temporary relief will need a moderation in local inflation and related premia.”

(Updates with the Bank of Thailand rate decision in penultimate paragraph)

©2022 Bloomberg L.P.