Jul 17, 2022

Sweden Prefers Steel Over Bitcoin Miners as Power Gets Scarce

, Bloomberg News

(Bloomberg) -- Sweden has a choice to make: Provide electricity for job-creating projects such as steel plants or devote more capacity to the Bitcoin miners that are gobbling up growing amounts of power. Energy Minister Khashayar Farmanbar says it’s no contest.

“We need energy for more useful things than Bitcoin, to be honest,” Farmanbar said in an interview. “We are moving from a period of administration to an extreme expansion where our entire manufacturing industry is seeking to electrify.”

His comments suggest Sweden, home to what could be Europe’s largest Bitcoin mining industry, may become less hospitable to the business. The government is so concerned about electricity use that it asked the Swedish Energy Agency late last month to come up with ways of tracking how much power is used for digital infrastructure, with a special focus on crypto mining.

Bitcoin miners operate energy-intensive computers to solve complex mathematical puzzles and unlock rewards in the token. The business relies mainly on access to cheap electricity and land, rather than human labor. Profit margins are to a large extent determined by the swings in Bitcoin’s price.

The government’s review raises the specter that life will get harder for crypto miners that have flocked to Sweden, where vast hydro reservoirs and giant wind parks have delivered some of the cleanest and cheapest electricity in the world.

While Farmanbar declined to say what measures he may take to curb mining, one option mooted may include tweaking the order in which new power users get access to the grid so that those with a tangible benefit the society, including creating lots of jobs, get preference.

Another alternative may be to limit the preferential tax treatment that currently applies to all data centers, regardless of their use. Such incentives were never meant to attract crypto miners, but rather were aimed at multinational corporations such as Microsoft Corp. and Meta Platform Inc.’s Facebook, Erik Thornstrom, a senior adviser at industry group Swedenergy, said in an interview.

“I think the existing tax reliefs should be focused on the activities they were meant to attract in the first place,” he said. “Mining of cryptocurrencies is more questionable.”

Threat to Climate

Hive Blockchain Technologies Ltd. from Canada and Hong Kong-listed Genesis Mining Ltd. are two of the companies active in Sweden. They didn’t respond to requests for comment.

“I think a lot of public officials including the energy minister who have strong opinions about cryptocurrency and blockchain in general need further education and awareness,” Sukesh Kumar Tedla, chairman of the Swedish Blockchain Association, said by email. “Yes, cryptocurrency mining consumes a lot of energy today but so does a lot of other innovative technologies that help run our society.”

Such arguments, however, tend to increasingly fall on deaf ears in an era of persistent global warming and more scarce access to power.

Sweden’s financial regulator has called crypto assets a threat to the climate transition and urged a European Union-wide ban on mining, gaining support from lawmakers in countries from Germany to Spain and Norway. China has outlawed cryptocurrencies altogether.

Rising Power Demand

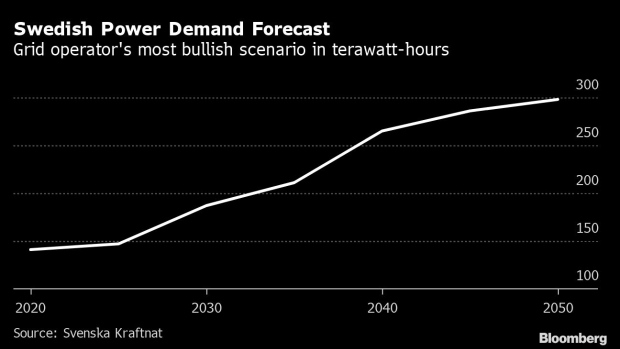

The energy crisis and the electrification of everything from transport to mining as well as new green steel and battery plants means that competition for power and connections to the grid is fiercer than ever. Swedish consumption is poised to double in the next few decades.

Bitcoin mining uses up enough electricity to supply a mid-sized country like Spain or the Netherlands, according to the European Central Bank. The size of the industry in Sweden is hard to estimate, with no public data available on how many miners there are or how much power they use.

Data centers use a few percent of Sweden’s total power today and mining the virtual coins covers a small share of that, according to Thornstrom. But power demand from such facilities may grow eightfold by 2040, according to Sweden’s grid operator.

Sweden’s share of Bitcoin mining is on the rise, amounting to just over 0.8% of the global processing rate in January, according to the latest data from the Cambridge University’s Centre For Alternative Finance. It was next to nothing two years earlier.

While Germany and Ireland have larger shares on paper, their numbers are inflated by the use of virtual private networks or proxy services, according to the institution.

Grid Access

Grid companies supplying electricity to the miners have no obligation to make their usage public. Sweden’s energy agency will report back at the end of January, but getting hold of the information could be a tough job as there is no way to track and quantify the activity at data centers or on individual computers, said Anders Wallinder, head of security of supply at the agency, by email.

SSAB, plans to make fossil-free steel at a plant in the north, said network operators should prioritize industrial projects like its own rather than connecting users on a first-come, first-served basis like they do now.

“You could take into account what projects provide the biggest benefits to the climate and society,” said Tomas Hirsch, head of energy at SSAB. “We could reduce Sweden’s carbon dioxide emissions by 10%.”

That’s a claim any Bitcoin miner would be hard pressed to make -- and one increasingly likely to resonate with politicians under pressure to combat global warming.

“There will be bottlenecks, and that means you have to look into whether we are using energy in the best possible way,” said Farmanbar. “Is Bitcoin mining what we should be using power for, when we can use it for making fossil-free steel, for example? It is not entirely trivial in a free market.”

©2022 Bloomberg L.P.