Mar 31, 2023

Sweden’s Builders Fear Protracted Slump as Housing Falters

, Bloomberg News

(Bloomberg) -- Sweden’s construction industry may be facing years of drought as investment in housing plummets in the wake of steep price declines and rising costs of building new homes.

One of the steepest declines in home prices globally, at 15%, is already putting the brakes on development, even as a large majority of municipalities in Sweden report a shortage of dwellings. Housing starts are set to plummet this year, and the slump may stretch out for years, as soaring inflation and deflating asset values squeeze households’ finances.

Combined with rising building costs and more expensive financing, that creates a perfect storm, which is set to have long term effects on construction, according to Lennart Weiss, commercial director at construction company Veidekke ASA.

“When you add all this up, you find that so much purchasing power has been lost that it will take at least until 2026 before you will see any real recovery, and we still see risks on the downside,” Weiss said. “It may get even worse.”

The construction industry represents about 11% of Sweden’s gross domestic product and employs about 350,000 people, so a slowdown in building will also have severe consequences for the economy as a whole. The country’s NIER research institute estimates that economic output will contract by 0.6% this year, largely in line with a forecast by the European Union executive last month that saw Sweden as the only economy in the trading bloc with a full-year contraction in 2023.

The Swedish government, meanwhile, has made fighting inflation its top priority, which means it has limited appetite for subsidy schemes to prop up construction. It has decided to end aid for building affordable rentals, and is focusing its efforts on buttressing households that are worst hit by soaring costs.

“The budget cannot fuel inflation, because a high inflation rate and high interest rates are the main reason why households’ purchasing power is dramatically decreasing,” Housing Minister Andreas Carlson said in an interview earlier this month. “Easing the burden on households is important in itself, but it can also contribute to increasing purchasing power.”

Veidekke’s best estimate is that no more than 25,000 to 30,000 homes will be started this year and that the volume will drop as low as 20,000 in 2024. That equals less than a third of the level deemed necessary to keep up with population growth, and could exacerbate the problems of a dysfunctional housing market, where a shortage of homes is fueling black-market deals and hampering businesses recruitment plans.

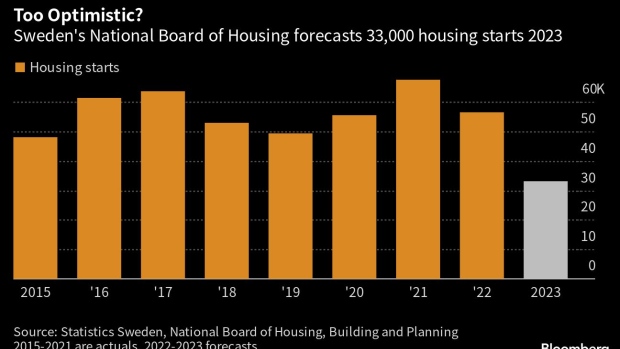

Its forecasts are lower than an earlier estimate from the Swedish National Board of Housing, which said in December that housing starts are likely to fall to 33,000 this year from an estimated 59,000 in 2022. Yet Weiss’ predictions are backed up by others in the industry.

K2A Knaust & Andersson Fastigheter AB’s chief executive, Johan Knaust, said the agency’s forecast is “way too optimistic” and believes the number of construction starts this year will be “much lower.”

Knaust said his company may restart production of rental apartments in the capital of Stockholm at the end of this year. “But outside Stockholm, I have a very hard time seeing that we would start new projects this year given the situation in the market,” he said.

That is particularly concerning as a major industrial transformation underway in northern Sweden will require a large addition of homes to house tens of thousands of workers needed for production of car batteries, hydrogen-based steel and sponge iron.

The massive drop in construction highlights how sensitive the Swedish construction sector is to economic swings, and Veidekke’s Weiss warns that the current slump may drain the industry of competence and capital that will be needed when the market eventually recovers.

“This sector could do with some stability, and solid conditions that would ensure that some 40,000 to 55,000 units are built annually,” Weiss said. “But we don’t have that. We have these terrible swings, and they come at a cost.”

--With assistance from Anton Wilen.

©2023 Bloomberg L.P.