Jan 26, 2023

Sweden’s Housing Rout Persists as Riksbank Keeps Raising Rates

, Bloomberg News

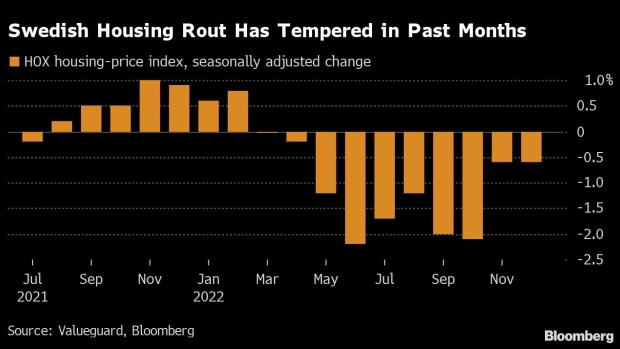

(Bloomberg) -- The drop in Swedish housing prices continued for a ninth straight month in December, with signs of stabilization in Stockholm home values not yet enough to lift the gloom in the biggest Nordic economy’s residential property market.

In December, the HOX housing index fell by 1.4%, according to Valueguard, which compiles the data. Seasonally adjusted, the decline is smaller than previous drops and in the first half of January, prices of apartments in the capital, Stockholm, rose by 2%.

The rapid slide in prices, driven by higher borrowing costs and soaring inflation, has made Sweden emblematic of a wider trend as real-estate markets retreat globally, and analysts expect scarce near-term improvement. Most regional forecasters that updated their economic projections this week, including Nordea Bank Abp, reiterated they expect Swedish home prices to fall somewhat further for a peak-to-trough drop of 20%.

Prices have now slid 16% since a peak in March last year. The Valueguard index, watched by the central bank as it sets monetary policy, uses data from realtor organization Svensk Maklarstatistik.

“After months of soaring energy prices, sky-high inflation and interest-rate shocks, there are a few bright spots,” Nordea chief economist Annika Winsth said in a comment on the Valueguard data. “Unfortunately it is too soon to say we are out of the woods. The Riksbank is not done raising rates and households are still facing high costs of living.”

Brokers said price increases in both Stockholm and Gothenburg, the country’s second-largest town, in the first half of January suggest an improving outlook for the rest of the market.

“We see more and more signs of increased optimism and expect the price drop to stall during spring,” Marcus Svanberg, chief executive officer of broker Lansforsakringar Fastighetsformedling, said in a statement.

Erik Wikander, chief executive officer of broker Svensk Fastighetsformedling, cited a jump in customer activity regarding apartment viewings at the start of January. “If it continues, you can really talk about a trend break,” he said in a statement.

The central bank took its key interest rate from zero to 2.5% in seven months last year, and is widely expected to increase borrowing costs by half a percentage point at a meeting in early February.

“It’s hard to foresee the timing, but we can’t expect the housing market to turn around until it is clear that the Riksbank won’t raise its policy rate further,” Winsth said. “According to Nordea’s view, that will not be until this summer, at the earliest.”

--With assistance from Joel Rinneby.

(Updates with brokers’ comments from sixth paragraph.)

©2023 Bloomberg L.P.