Mar 30, 2023

Swiss Franc Czar Is Sought for Heart of SNB’s Crisis Machine

, Bloomberg News

(Bloomberg) -- With Switzerland’s banking crisis barely subsided, the country’s central bank will soon need to find a successor to one of the key players behind the scenes.

Andrea Maechler, the governing board member in charge of markets, has only one quarterly interest-rate decision left at the Swiss National Bank and is set to deliver what may be one of her final speeches on Thursday. She will depart at the end of June to become deputy chief at the Bank for International Settlements.

Last year, Maechler was in charge of implementing the SNB’s seminal shift to end currency purchases and start selling the franc. Amid Credit Suisse Group AG’s forced takeover this month, her officials ensured a flow of dollar liquidity to lenders, and kept money markets in line.

Finding a successor with the credibility and skills to set rates in a hiking cycle as the remnants of a bank crisis fester is testing enough. Add to that the tasks of enforcing transmission of monetary policy, and concurrently selling billions of foreign-currency reserves as the SNB unwinds its almost $1 trillion balance sheet.

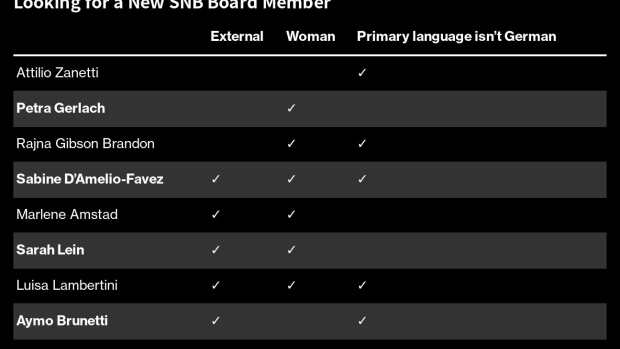

Then there’s the difficulty of ensuring that its three-member board reflects Switzerland’s multilingual regional balance. Another woman would be ideal, and someone from outside the central bank might be preferable too.

Making it even harder for the SNB’s supervisory Bank Council — whose job is to propose candidates — only Swiss citizens are eligible, narrowing the pool to a total population similar to New York City. The government doesn’t have to follow the recommendation in its final decision.

“Finding a successor for Andrea Maechler will not be that easy,” said Karsten Junius, chief economist at Zurich’s Bank J Safra Sarasin Ltd, citing the difficulty of finding a “top-notch” economist and also seeking a linguistic and gender mix for the board.

The language requirement is an unwritten rule that may prove insurmountable. Both SNB President Thomas Jordan and Vice President Martin Schlegel are primarily German speakers.

Jordan could claim his hometown of Biel is on the boundary with French-speaking Switzerland, but appointing someone from a French- or Italian-language canton is optimal.

Maechler ticked the French box, and was also the SNB’s first female policymaker in 117 years: With gender diversity under scrutiny there, another woman would help. Meanwhile an external hire could alleviate criticism of the president’s dominance of the SNB.

“The worst thing would be for Thomas Jordan to further consolidate his power by having a current subordinate appointed,” Geneva political candidate Michael Malquarti wrote on LinkedIn. A group of economists called the SNB Observatory have similar concerns, and in the past week, one local commentator called the central bank a “one-man show.”

With the clock ticking, speculation is building on Maechler’s possible successor. Here’s a look at some potential candidates.

Attilio Zanetti

The 53 year-old Attilio Zanetti has been at the SNB for more than two decades, leading international monetary cooperation before becoming one of four alternate board members last year. He previously spent some months at the International Monetary Fund and the Federal Reserve of San Francisco, and was a lecturer at the University of Basel. Born in Italian-speaking Bellinzona and having graduated in French-speaking Fribourg, Zanetti has the language.

Petra Gerlach

Petra Gerlach, 47, is the only woman in the SNB’s extended top echelon other than Maechler. Before becoming an alternate board member, she was deputy head of economic affairs. She joined the central bank 19 years ago, though she spent five of those at the BIS and in an academic role in Dublin. Gerlach would be the clearest female internal choice, though German being her first language speaks against her.

Other Candidates

The SNB could tap its own supervisory body for a candidate such as Geneva finance professor Rajna Gibson Brandon — a qualified French-speaking woman and former member of the Swiss federal banking commission. She’s on the panel that’s responsible for finding Maechler’s successor, which might prove an obstacle to her selection, though the SNB doesn’t comment on whether that would exclude her as a candidate.

One option from the civil administration might be Sabine D’Amelio-Favez, who runs Switzerland’s budgetary authority. She has both French- and Italian-Swiss heritage, and holds the job Maechler’s predecessor, Fritz Zurbruegg, had when he joined the SNB in 2012.

Marlene Amstad, head of financial regulator Finma and a former SNB official herself, might be another possibility.

Among other names cited by observers are three more academics: Basel macroeconomist Sarah Lein, who already did a six-year stint at the central bank, Luisa Lambertini, a finance professor based in Lausanne who is a dual Swiss-Italian citizen, and has been a consultant with the European Central Bank, and Aymo Brunetti, a former chief economic adviser to the Swiss government who was also among the first experts consulted by parliament in the Credit Suisse crisis.

But the appointment of Maechler herself in 2015 suggests another option. Her selection was a total surprise, offering the possibility that such an outcome could happen again.

©2023 Bloomberg L.P.