Mar 29, 2023

Swiss Government Sends Credit Suisse Plan to Parliament

, Bloomberg News

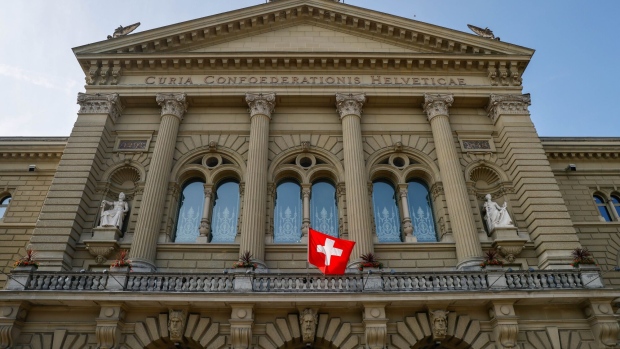

(Bloomberg) -- Switzerland’s government has sent the 109 billion-franc ($118 billion) state guarantees for UBS Group AG’s takeover of Credit Suisse Group AG to the country’s parliament for further debate.

While one parliamentary body has already signed off on the guarantees, lawmakers will discuss the government-brokered takeover of Credit Suisse by UBS Group AG issue in a special session on April 11-13. The debate is expected to be heated given concerns among both politicians and the public about the precedents such a deal will set.

See: Over Half of Swiss Disapprove of UBS’s Credit Suisse Takeover

The government said in Wednesday’s statement that it’s initiating a “comprehensive evaluation” of Switzerland’s so-called ‘too big to fail’ regulation. The set of rules, introduced after the government bailed out UBS in 2008, should have prevented another bank bailout, but were largely ignored as the government together with the Swiss National Bank and banking regulator Finma engineered the UBS takeover instead.

Results of the review should be available within 12 months, the government said.

©2023 Bloomberg L.P.