Jan 31, 2020

Swiss National Bank Pulls a Trick Last Used During the Crisis

, Bloomberg News

(Bloomberg) -- Terms of Trade is a daily newsletter that untangles a world embroiled in trade wars. Sign up here.

The Swiss National Bank resorted to a tool to steer short-term interest rates last month that has been virtually abandoned since the European debt crisis.

Data published Friday showed the SNB had 6.5 billion francs ($6.7 billion) worth of franc repo transaction claims on its balance sheet in December. That’s the highest balance since 2012, and helps to explain a rise in sight deposits -- cash held by lenders at the SNB -- that has perplexed central-bank watchers.

In a repo transaction, one party sells securities to another and agrees to buy them back at a set date. Central banks the world over use them to steer liquidity, and the U.S. Federal Reserve has been conducting them in recent months to combat turmoil in the interbank market for short-term loans between lenders.

Read more: Fed’s Repo Support Will Continue, But Uncertainties Remain

The SNB used repos to boost liquidity in the Swiss interbank market, which had tightened in part because the central bank allowed institutions to exempt more reserves from its negative interest rate. That prompted more interbank trading as banks with cash to spare sold it to those wanting to use the extra exemption allowance.

Combined with a rise in demand for banknotes, which typically happens in December, that largely helps to explain the jump in sight deposits, according to Credit Suisse economist Maxime Botteron.

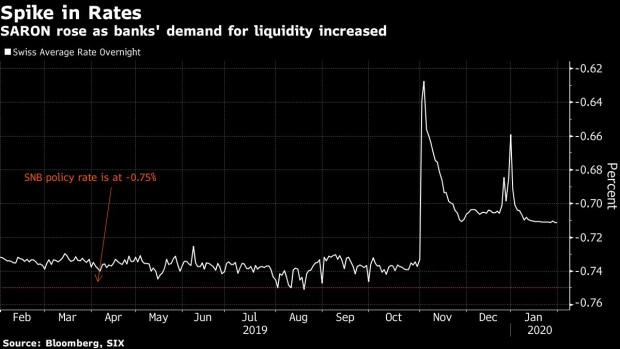

The interbank tightness had pushed the overnight interest rate -- the Swiss Average Rate Overnight (SARON) -- as high as -0.62%. The SNB wants SARON at -0.75%, so took action to steer it back. The rate has lately traded at about -0.71%.

A spokeswoman for the SNB declined to comment on the December repo figure.

--With assistance from Richard Jones.

To contact the reporter on this story: Catherine Bosley in Zurich at cbosley1@bloomberg.net

To contact the editors responsible for this story: Fergal O'Brien at fobrien@bloomberg.net, Jan Dahinten

©2020 Bloomberg L.P.