Mar 20, 2023

Swiss National Bank’s Quandary Echoes Fed as it Weighs Rate Hike

, Bloomberg News

(Bloomberg) -- The Swiss National Bank has its own version of the Federal Reserve’s quandary this week as it judges whether to deliver a long-awaited interest-rate hike for an economy at the epicenter of global market turmoil.

Hours after US policymakers set borrowing costs on Wednesday in a decision increasingly overshadowed by banking tensions, the focus will quickly shift to officials in Zurich the following day.

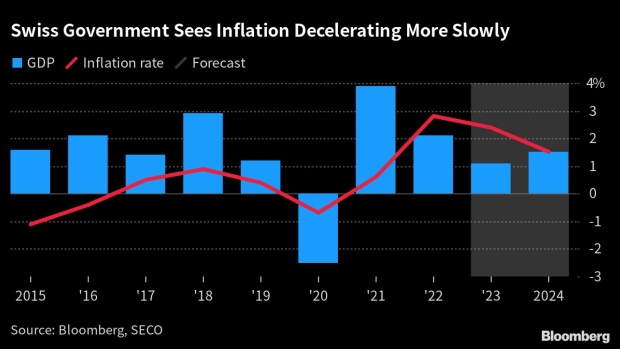

A half-point increase to 1.5% is anticipated by most economists as the SNB plays catchup with the neighboring euro zone in its first decision of 2023. Policymakers have fretted about pressures on inflation, even though the level there is still low compared with much of the advanced world.

Following through with such a move carries risks however at a time of market tensions. The Swiss have just orchestrated a takeover of Credit Suisse Group AG by its bigger rival UBS Group AG, offered liquidity aid to smooth the deal, and introduced daily international swap lines with global counterparts.

“The inflation risk is big enough for the SNB to decide to do a rate hike despite the situation in the banking sector, assuming the situation does not further deteriorate,” said Alessandro Bee, an economist at UBS. “The two things have to be separated: The rate hike, which is supposed to bring inflation back down below 2%, and the risks on the banking side.”

Whether the SNB can keep such considerations distinct will be the overarching question for the central bank in coming days.

In the US, whose own banking turmoil is still festering, the case is building for the Fed to hold off on a rate hike. For the Swiss, money markets are already leaning toward a smaller-than-forecast increase of only a quarter point.

The SNB can argue that their level of borrowing costs remains unnaturally low compared to global peers. That’s because it only meets once per quarter, half as often as counterparts in the euro zone and the US.

So far, Swiss officials has only raised rates by 175 basis points since June, half as much as the European Central Bank.

Aside from domestic inflation pressures driven by the risk of a wage spiral taking hold, there’s the danger that imported price growth might also feed into that equation.

Karsten Junius, chief economist at Bank J Safra Sarasin Ltd, says that the franc is currently being held back from strengthening because SNB rates are so much lower than elsewhere.

But then there’s the question similar to what central banks faced back in 2008: at what point will financial-sector stress become so severe that an impact on the economy becomes inevitable?

“The SNB cannot ignore the risks to the economy and markets arising from the crisis at Credit Suisse,” said GianLuigi Mandruzzato, an economist at EFG Bank in Lugano. “These almost completely balance the cyclical factors such as inflation and growth.”

Junius is more sanguine on that for now. He reckons the SNB can afford to keep tightening, even if it won’t be an easy decision for policymakers.

“The banking system in Switzerland should not have any problems with the interest-rate level,” he said. “Still, with his decision on Thursday Jordan has to face the question of how the SNB sees the relationship between price stability and financial stability.”

--With assistance from James Hirai.

©2023 Bloomberg L.P.