Feb 4, 2021

T-Mobile tops profit estimates, but auction costs muddy outlook

, Bloomberg News

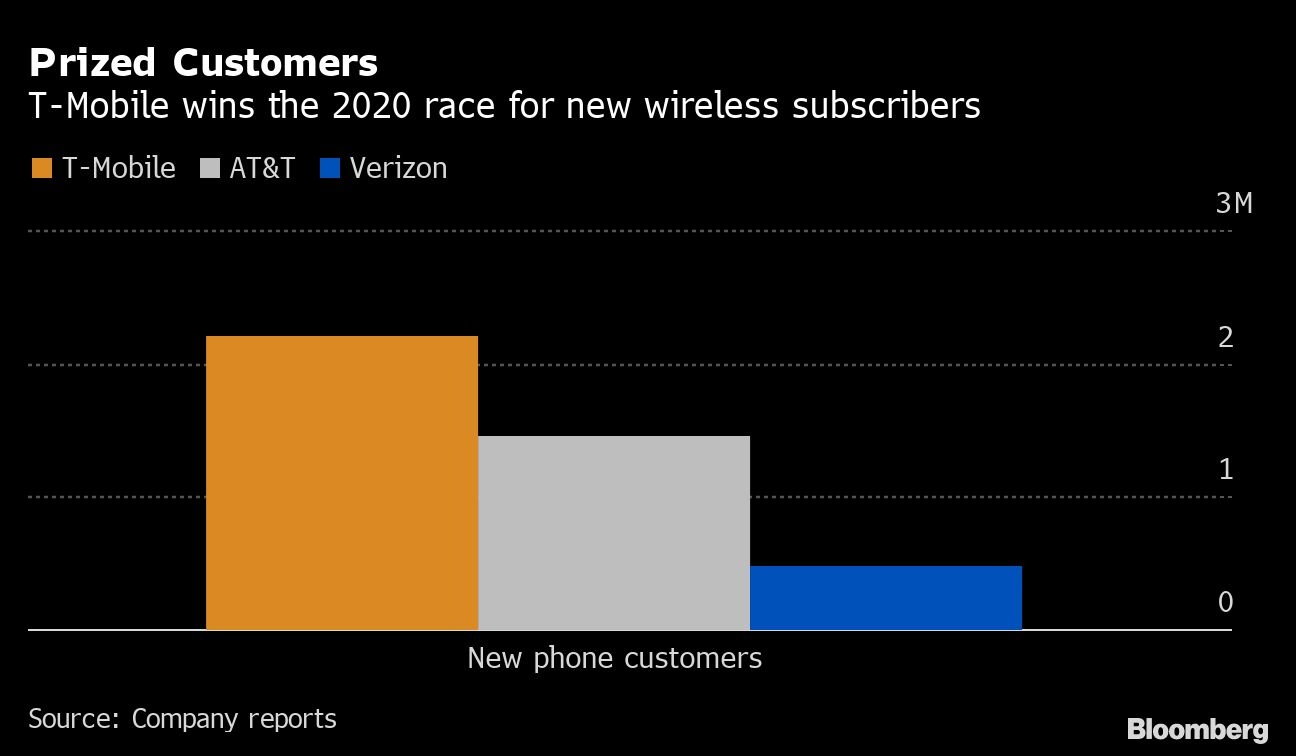

T-Mobile US Inc. exceeded Wall Street’s quarterly estimates but offered a full-year earnings forecast that may be light amid a costly federal auction of airwaves for new 5G spectrum. The No. 2 wireless carrier continues to generate faster customer growth than rivals Verizon Communications Inc. and AT&T Inc.

- Fourth-quarter earnings totaled 60 cents a share, the wireless company said Thursday, exceeding the average 52 cents that analysts were forecasting. Revenue grew to US$20.3 billion, exceeding projections of US$19.7 billion. Adjusted earnings before certain items this year will range from US$26.5 billion to US$27 billion, slightly below some estimates.

- T-Mobile is constrained by federal auction rules from issuing comments about its bidding, and doesn’t expect to say more until a March investor meeting. New subscribers this year are forecast to total 4 million to 4.7 million after the company signed up a record 5.5 million in 2020, including 2.2 million phone customers. The latter tend to be more loyal and lucrative than hotspot and tablet users.

Key Insights

- The company achieved savings of US$1.3 billion from its takeover of Sprint Corp. in the form of revenue gains and reduced costs from combining the companies. T-Mobile also plans to say more about its integration efforts next month.

- The second-largest U.S. wireless carrier borrowed US$3 billion to help cover bids in a record US$80.9 billion federal airwaves auction. T-Mobile already has a wide lead in ownership of midband 5G spectrum and is hoping to maximize that advantage against its phone and cable rivals that are also bidding.

- T-Mobile says it now offers “ultra” 5G midband service -- which can deliver wireless speeds comparable to home broadband -- in 1,000 cities and expects to double coverage by the end of 2021.

Market Reaction

- T-Mobile fell as much as 3.2 per cent to US$126.44 in extended trading Thursday. The stock gained 72 per cent last year, compared with a 16 per cent advance for the S&P 500 index.