Jan 31, 2023

Taiwan Export Orders Fall in 2022 for First Time in Three Years

, Bloomberg News

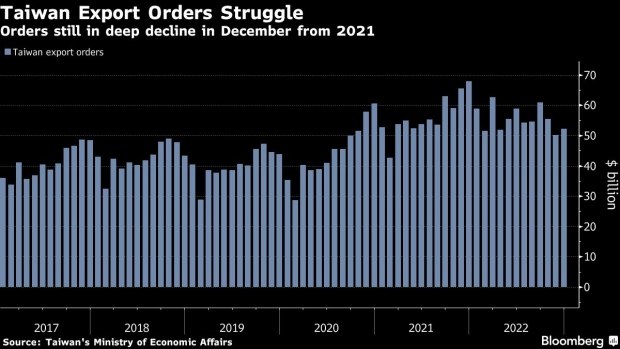

(Bloomberg) -- Taiwan’s export orders fell last year for the first time since 2019, with a steep decline in December that suggests more concern ahead for the trade-dependent economy in 2023.

Overseas orders to Taiwanese firms fell 23.2% in December from a year earlier to $52.2 billion, according to a statement from the Ministry of Economic Affairs on Tuesday. That was slightly better than the median expectation of a 25% drop in a Bloomberg survey of economists, though barely an improvement over November’s 23.4% plunge.

The monthly decline contributed to a 1.1% contraction in export orders for all of 2022 — the first annual fall since 2019 and well below the 26% expansion last year.

Shipments have been falling since late 2022 as pressure on the world economy mounts. Russia’s war on Ukraine, a Covid-fueled slowdown in China and rising global interest rates have all combining to dent demand and cloud the economic outlook.

The December decline in shipments was due to weak demand due to the impact of global inflation and rising interest rates, according to a statement accompanying the data. The statement also cited a high base of comparison with the prior year, when demand was booming.

Challenges are likely to continue this year. Firms have already been signaling additional concerns, with Samsung Electronics Co. on Tuesday warning that it expected a recovery in chips to begin only in the second half of the year. Smartphone demand will likely contract in 2023, it said.

In Taiwan — where chipmaking firms including Taiwan Semiconductor Manufacturing Co. are major contributors to the economy — authorities have been warning about waning global demand for months. The economy unexpectedly shrank in the final three months of the year as the island’s pandemic-fueled trade boom ended, and economists have suggested the slowdown has yet to bottom out.

The China slowdown has been a major factor in Taiwan’s troubled trade figures, with Hong Kong and China recording a nearly 38% drop in orders in December. Orders from the US declined 14.7%, while those from Europe and Asean fell 23.9% and 22.4%, respectively.

China is giving some reason for hope lately, though, as early data show a promising recovery on rising holiday travel and spending on services. That’s key for Taiwan, which counts China as a major export market. The International Monetary Fund this week raised its global economic outlook in part on China’s reopening too. Economics officials cited China’s post-Covid reopening as having helped December’s export orders rise compared to November.

©2023 Bloomberg L.P.