Jan 30, 2023

Taiwan Investment in China Dips to Three-Year Low on Covid Zero

, Bloomberg News

(Bloomberg) -- Taiwanese investment into China dropped to the lowest amount since 2019 last year as geopolitical tensions and Covid Zero weighed on the relationship between the two economies.

Foreign direct investment into China was just over $5 billion in 2022, Taiwan’s Ministry of Economic Affairs said in a statement Monday, a 14% decrease from the year before. At no point in the last four years has the total surpassed $6 billion — less than half the amount of new money Taiwanese firms were putting into China about a decade ago.

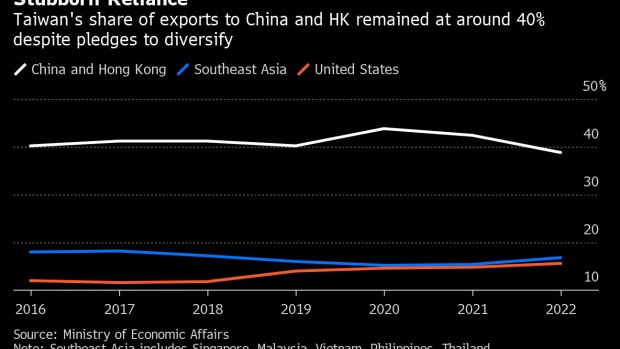

Taiwan has made diversification away from China a goal in the years since President Tsai Ing-wen was first elected in 2016. Late last year, Finance Minister Su Jain-rong told Bloomberg News that the government wanted to “try to diversify our trade partners, our trade market, so that we are not going to put all our eggs in one basket.”

Some firms may have turned wary on China in recent years as geopolitical tensions between Beijing and Washington picked up, peaking last August with a series of provocative People’s Liberation Army drills near Taiwan and import bans on a range of Taiwanese goods.

Covid Zero restrictions through much of 2022 were also a challenge as lockdowns roiled supply chains and created other stresses. Workers at a Foxconn Technology Group plant in China protested against coronavirus curbs in November in one of the most visible symbols of resistance against the rules, creating headaches for the Taiwan-based firm that is one of Apple Inc.’s biggest iPhone makers.

“Due to global geopolitical issues and trade barriers, the era of investing in one country alone is over,” said Ken Li, spokesman at Taiwan-based Giant Manufacturing Co., in an interview with Bloomberg News in November.

Giant, which is one of the world’s largest bicycle manufacturers, has several factories in China — including four near Shanghai that were forced to shut down during last April’s lockdown.

While Giant doesn’t plan to cut its plants in China, Li late last year pointed to the company’s ambitions elsewhere. The firm recently bought a factory in Vietnam where it has started production, he said, adding that the company plans to build another plant there with a goal of producing 300,000 bikes in Vietnam by 2025.

Meanwhile, Taiwan’s Minister of Economic Affairs Wang Mei-hua told reporters in late November that the agency had heard of food service providers leaving China because of the lockdowns.

“Taiwanese businesses are very agile with diversification into other countries,” she said at the time, adding that companies returning to Taiwan would be incentivized to invest. Even so, the world’s second-largest economy remains a major trading partner and destination for investment from the island.

A bid by Taiwan in 2021 to join one of the Asia-Pacific’s biggest trade deals, the Comprehensive and Progressive Agreement for Trans-Pacific Partnership, is still pending, as is China’s application. And China is still a key trading partner for Taiwan overall, with the island’s share of exports to China and Hong Kong sitting at around 40% in 2022.

FDI into China last year was also still sizable compared to other outbound investment. Investment into the US, for example, reached $1 billion, while FDI into Singapore topped $3.3 billion — each notably less than the $5 billion flowing into China. In all, outward investment excluding China reached nearly $10 billion in 2022, the economics ministry said Monday.

Chinese investment into Taiwan has declined too. Chinese firms added roughly $39 million in Taiwan last year, the economics ministry said. That’s the lowest amount since the island opened up for Chinese investment in 2009. While the annual total back then — some $37 million — was smaller than in 2022, the rules restricting Chinese investment weren’t lifted until about midway through the year.

©2023 Bloomberg L.P.