Mar 22, 2023

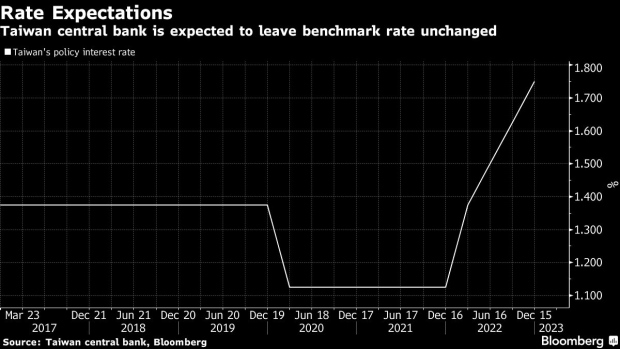

Taiwan’s Central Bank Likely to Hold Key Rate as Economy Slumps

, Bloomberg News

(Bloomberg) -- Taiwan’s central bank unexpectedly raised its key interest rate on Thursday, with Governor Yang Chin-long taking a cautious stance on inflation in his first policy decision since renewing his term in office.

The benchmark rate was increased by 12.5 basis points to 1.875%, the central bank said in a statement. Of the 24 economists surveyed by Bloomberg, 19 had expected the rate to stay unchanged at 1.75%.

The central bank has hiked rates at five of its last policy meetings as it contends with an inflation rate that remains uncomfortably high and a Federal Reserve that continues to tighten monetary policy — most recently with a 25 basis-point hike on Wednesday.

“Today’s decision suggests that the central bank is clearly concerned about inflation risks, given the egg shortage and the coming power tariff hike,” Michelle Lam, an economist at Societe Generale SA, said in a message Thursday. “Given these, inflation will likely remain above 2% for the rest of the year.

Lam, who had forecast the 12.5 basis point increase, called the central bank’s move “brave”. She says this is likely to be the last rate hike of the current cycle.

Most analysts had expected Taiwan to stay on hold after data showed the economy contracted in the fourth quarter and a global banking crisis triggered financial market turmoil.

The central bank downgraded its forecast for economic growth this year to 2.21% from its previous estimate of 2.53% made in December. It sees gross domestic product contracting for a second straight quarter in the first three months of the year before progressively expanding through the rest of 2023.

The monetary authority also sees inflation topping out at 2.51% in the first quarter before easing to 1.76% by the end of the year.

Rising US interest rates have prompted central banks in smaller economies like Taiwan to push up their own rates to help stem currency losses.

--With assistance from Cynthia Li and Argin Chang.

(Adds chart, economist comments in fourth and fifth paragraphs, government forecasts in seventh and eighth paragraphs.)

©2023 Bloomberg L.P.