Oct 4, 2021

Taiwan Says Peace Crucial to Chip Supply as China Pressure Grows

, Bloomberg News

(Bloomberg) -- Peace in the Taiwan Strait is key to the island’s ability to ensure continuous supply of the chips needed to power a wide range of products from cars to smartphones, a senior Taiwanese official said.

Taipei is seeking to rally political support as China ramps up its aggression toward the island that it considers part of its territory. Warplanes sent by Beijing made a record 93 flights close to Taiwan over a three-day period starting Friday, prompting the U.S. State Department to express concern and urge China to cease its “provocative” actions.

“Taiwan has helped foster a great chip manufacturing ecosystem with three decades of efforts against the backdrop of globalization,” Taiwan’s Minister of Economic Affairs Wang Mei-hua told Bloomberg News in an interview on Friday. “The global community should take Taiwan’s security more seriously so Taiwan can continue to provide stable service to everyone and be a very good partner to everyone.”

Wang’s comments highlight the increasingly politicized nature of semiconductors as governments around the world scramble to secure sufficient chips from Taiwan to accelerate a post-Covid economic rebound. Taiwan Semiconductor Manufacturing Co. boasts a 53% share of the contract chipmaking market, fueling concern that any instability in the Taiwan Strait could cut off supply of key silicon used by hundreds of companies including Apple Inc. for its iPhones. Chairman Mark Liu in July also called for peace in the region, in order to prevent disruptions to the supply chain.

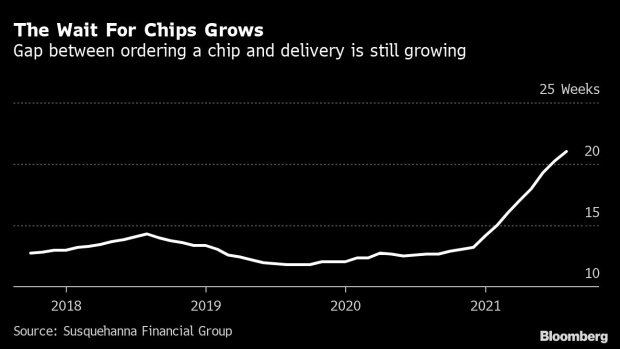

The heavy reliance on TSMC and its local peers has already spurred governments in the U.S., EU, Japan and China to mull bolstering their own domestic chip industries. The Biden administration last month stepped up its pressure on companies to disclose details on their supply-and-demand structures, as the global chip shortage continued to wreak havoc on many industries, including automaking. Intel Corp.’s Chief Executive Officer Pat Gelsinger has exhorted the U.S. government to prioritize support to domestic chipmakers rather than non-American ones, characterizing foreign supply chains as “insecure.”

Wang dismissed concerns that companies around the world are too dependent on Taiwan, saying that the island focuses mostly on chip fabrication within the complex global semiconductor supply chain. It still needs equipment and materials from other countries, such as gear from U.S.-based Applied Materials Inc. and the Netherland’s ASML Holding NV, which has a monopoly on extreme ultraviolet lithography systems required for manufacturing the most cutting-edge chips.

“We can buy EUV machines only from ASML. Are we going to say that it is too risky for us to be so dependent on ASML?” Wang said. “Taiwan has built a professional and reliable ecosystem over a long period of time, so many chip designers end up getting Taiwan to make the chips. It is really because Taiwan has a very efficient production system. Taiwan actually grows and thrives together with global equipment and material suppliers.”

The island’s chipmakers are already doing their part to alleviate shortages plaguing the global automotive industry, she said, with TSMC boosting output of automotive microcontrollers by 60% from 2020. It’s also spending $100 billion to expand manufacturing over three years. But chip packaging and testing services in Malaysia have been affected by lockdowns, and that is what’s causing the current bottleneck in supply, she said.

The chip crunch is now expected to cost global automakers $210 billion in sales this year. They will build 7.7 million fewer vehicles in 2021, according to the latest estimates from AlixPartners issued in September, almost double a previous forecast of 3.9 million. TSMC produces a significant portion of the semiconductors needed by major auto chip suppliers like Infineon Technologies AG, NXP Semiconductors NV and Japan’s Renesas Electronics Corp., companies that carmakers around the world depend on for essential electronic components for their vehicles.

To mitigate U.S. national security concerns, TSMC is building a $12 billion plant in Arizona with the goal of starting to produce chips by 2024. The Taiwanese company is also considering building a fab in Japan and studying the feasibility of a creating plant in Germany. It’s also adding capacity in a fab in the eastern Chinese city of Nanjing.

At home, the Taiwanese government is making efforts to provide TSMC with adequate water and electricity supply in anticipation of the chipmaker’s future needs, Wang said. TSMC has pledged to using 100% renewable energy and producing zero indirect carbon emissions from electricity consumption by 2025.

“The chip industry has propped up Taiwan’s economy. It is a key pillar to Taiwan’s economic security and overall security,” Wang said. “We are working hard to ensure that Taiwan will continue to be a reliable partner for everyone to collaborate with.”

©2021 Bloomberg L.P.