Nov 8, 2018

Tame Chinese Inflation Frees PBOC's Hand as Economy Loses Steam

, Bloomberg News

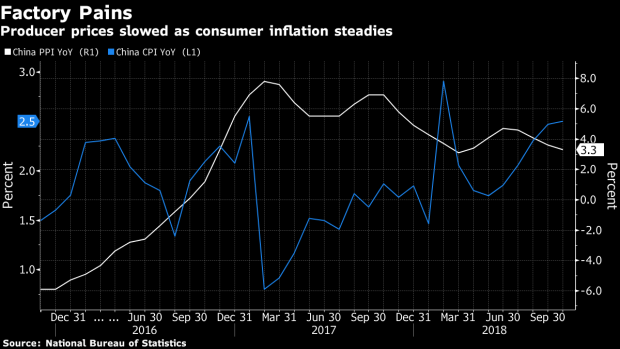

(Bloomberg) -- China’s factory inflation slowed for a fourth month while consumer prices steadied amid sluggish demand, making life easier for the central bank as it works to ease funding conditions to the real economy.

- The producer price index climbed 3.3 percent in October from a year earlier, matching the forecast in a Bloomberg survey of economists and slower than the previous month

- The consumer price index rose 2.5 percent, the same pace as in September

Key Insights

- Slowing factory price gains add to evidence domestic demand remains sluggish despite easing policies. The manufacturing PPI was at the slowest since October 2016.

- Gains of consumer prices steadied, signaling earlier inflation pressure stemming from swine disease and flooding has eased

- The PBOC will be able to keep interest rates on hold for an extended period and decouple from the U.S. Fed. The central bank will focus on liquidity management and its stance is neutral, said Raymond Yeung, chief greater China economist for Australia & New Zealand Banking Group Ltd. in Hong Kong

Get More

- The central bank has shifted to looser monetary settings this year as the combined effects of Beijing’s financial clean up and the trade conflict with the U.S. threatened the economic expansion.

- An outbreak of African swine fever earlier in the year and flooding in Shandong province had raised concerns of higher food prices. That seems to have abated -- Growth in food prices slowed for the first time since May.

--With assistance from Miao Han and Kevin Hamlin.

To contact Bloomberg News staff for this story: Yinan Zhao in Beijing at yzhao300@bloomberg.net

To contact the editors responsible for this story: Jeffrey Black at jblack25@bloomberg.net;Malcolm Scott at mscott23@bloomberg.net

©2018 Bloomberg L.P.