(Bloomberg) -- A $131 billion deluge of Treasury notes is about to hit with yields at their lowest in more than a year. But bond traders can take heart: This week is also expected to bring confirmation that inflation remains tame, which could bolster demand.

The trade impasse enveloping the U.S. and China has put global economic growth in question and is driving investors to the safety of Treasuries. The yields on maturities that the Treasury Department will offer -- 2-, 5- and 7-year notes -- are the lowest since at least early 2018.

Arguing against a big jump in yields amid the auctions: The latest reading of the Federal Reserve’s preferred inflation gauge, set for release May 31, is forecast to remain well below officials’ 2% target. That backdrop is fostering skepticism about the central bank’s view that the forces depressing price pressures will prove “transitory,” and is fueling bets on rate cuts by year-end.

“There is a lot riding on the assumption, and the hope, that the fall in inflation is due to temporary factors and that they’ll reverse,” said Antoine Bouvet, an interest-rate strategist at Mizuho International Plc. “If this fails to be the case, then you can expect the Treasury rally to continue.”

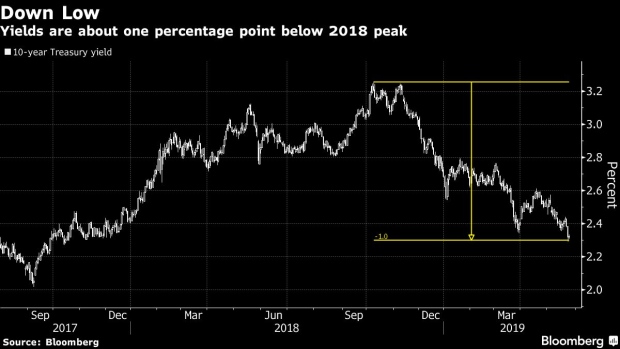

Ten-year Treasuries yield 2.32%, close to the lowest since late 2017, amid escalating trade tensions and signs of slowing global growth. The benchmark for everything from mortgages to auto loans is down from 3.26% in October, leaving it below the rate on three-month bills. An inversion in that gap is historically seen as a precursor to recession.

Fed Bets

Traders are betting the Fed will act in the coming months, even as officials say they can be patient on rates. Derivatives show the market is pricing in more than a full quarter-point Fed cut this year, with some wagers emerging that the first step will be a half-point reduction.

Minutes from the Fed’s April 30-May 1 meeting confirmed many officials agreed with Chairman Jerome Powell’s description of low U.S. inflation as resulting from transitory forces. Since introducing its 2% target in 2012, the central bank has failed to lift inflation to that level on a sustained basis.

The personal consumption expenditures price index, the Fed’s favored inflation gauge, rose 1.5% in March from a year earlier, and is seen climbing 1.6% in April, according to the median forecast in a Bloomberg survey.

And with U.S. President Donald Trump and Chinese President Xi Jinping seemingly far from a deal as other geopolitical concerns are percolating, the Treasury may avoid paying up as it offers fixed- and floating-rate coupon debt starting Tuesday.

“The decline we’ve seen in Treasury yields has been more related to safe-haven flows than economic weakness,” said Michael DePalma, a portfolio manager at MacKay Shields, which oversees $91 billion. “You’ll probably will see demand next week for the new Treasury supply given this environment. People are snapping up debt.”

What to Watch

- U.S. markets will close for the Memorial Day holiday Monday. But traders will be monitoring trade dealings between China and the U.S., as well as Trump’s discussions with Japanese Prime Minister Shinzo Abe during meetings this week in Tokyo. There’s also a Bank of Canada decision set for May 29.

- Fed speakers are limited:

- May 29: New York Fed’s Simon Potter speaks in Hong Kong about the transition away from Libor (9:10 p.m. New York time)

- May 30: Vice Chairman Richard Clarida

- May 31: Atlanta Fed’s Raphael Bostic; New York Fed’s John Williams

- Here’s the economic calendar:

- May 28: FHFA and S&P CoreLogic housing price indices; consumer confidence; Dallas Fed manufacturing

- May 29: MBA mortgage applications; Richmond Fed manufacturing

- May 30: First-quarter gross domestic product, personal consumption and quarterly core PCE index; jobless claims; trade balance; wholesale inventories; Bloomberg consumer comfort; pending home sales

- May 31: Personal income/spending; PCE deflator/core; MNI Chicago PMI; University of Michigan sentiment

- Here’s the schedule for Treasury auctions:

- May 28: $36 billion of 3-month bills; $36 billion of 6-month bills; $40 billion 2-year notes; $41 billion 5-year notes

- May 29: $18 billion of 2-year floating-rate notes; $32 billion 7-year notes

- May 30: 4-, 8-week bills

To contact the reporter on this story: Liz Capo McCormick in New York at emccormick7@bloomberg.net

To contact the editors responsible for this story: Benjamin Purvis at bpurvis@bloomberg.net, Mark Tannenbaum, Dave Liedtka

©2019 Bloomberg L.P.