Nov 17, 2021

Target drops on rising cost pressures in supply chain

, Bloomberg News

Target Corp. tumbled after warning that cost pressures are creeping up, stoking concerns that inflation will dent profits at big retailers.

The company isn’t foisting all its cost increases onto customers, said Chief Financial Officer Michael Fiddelke, echoing recent comments by Walmart Inc. Gross margin, a measure of pricing power, fell in the third quarter on higher merchandise and freight costs, Target said in an earnings statement Wednesday. Another drag came from labor expenses at distribution centers.

“We’re definitely protecting price,” Fiddelke said in a briefing. “We’re seeing cost increases that are higher than our retail increases.”

Target’s warning, which took the shine off an otherwise strong quarter, fueled anxiety among investors that retailers will absorb part of the pain from rising inflation -- and sacrifice potential profits -- to avoid ceding ground to rivals. Retailers sometimes opt to raise prices at a slower pace to preserve market share and avoid brusque jumps that would risk sending shoppers elsewhere.

Target shares fell 4.9 per cent to US$253.16 at 9:44 a.m. in New York after sliding as much as 5.3 per cent for the biggest intraday decline in eight months. The stock climbed 51 per cent this year through Tuesday, more than doubling the advance of an S&P retail index.

The company’s gross margin fell 2.6 percentage points to 28 per cent in the third quarter. Analysts had been expecting 29.9 per cent, based on the average of analyst estimates compiled by Bloomberg.

“The problem with the print was in the gross margin,” said Edward Kelly, an analyst at Wells Fargo & Co. Following Walmart’s report on Tuesday, “there was room for some margin disappointment, but this miss was larger than anticipated.”

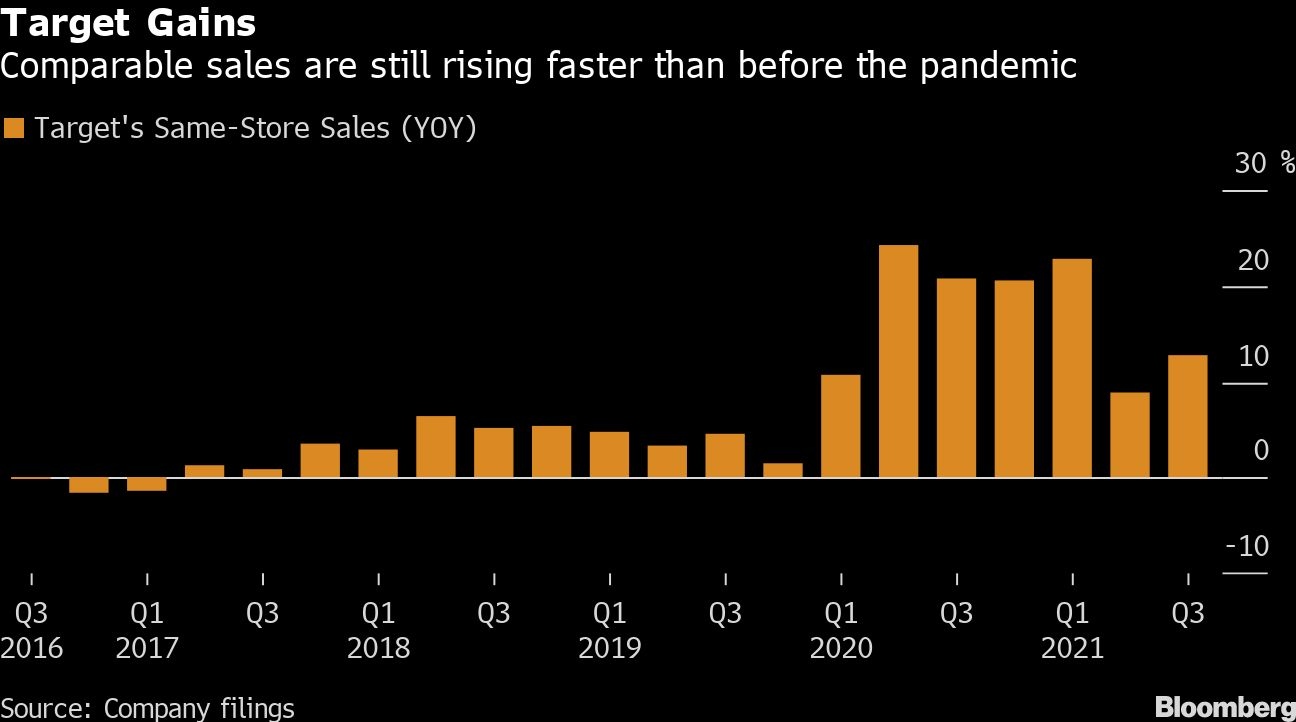

Consumer demand remains strong, Target Chief Executive Officer Brian Cornell said. In the third-quarter, comparable sales rose 12.7 per cent, exceeding the 8.3 per cent average of analyst estimates compiled by Bloomberg.

The growth “reflects continued strength” in Target’s in-store sales and same-day fulfillment services, Cornell said in the statement, adding that the company posted double-digit increases in all five of its core merchandise categories.

Comparable sales may post growth as high as the low-double digits during the fourth quarter, Target said. The company previously forecast expansion in the high-single digits for the second half of the year.

The Minneapolis-based retailer reported adjusted earnings of US$3.04 a share in the third quarter, surpassing the US$2.84 expected by analysts. Revenue rose 13 per cent to US$25.7 billion, topping Wall Street’s prediction by more than US$1 billion.

Inventory climbed 18 per cent during the third quarter. Target said it’s well positioned to satisfy holiday demand.