Nov 20, 2018

Target stumbles with sales miss; shares plunge

, Bloomberg News

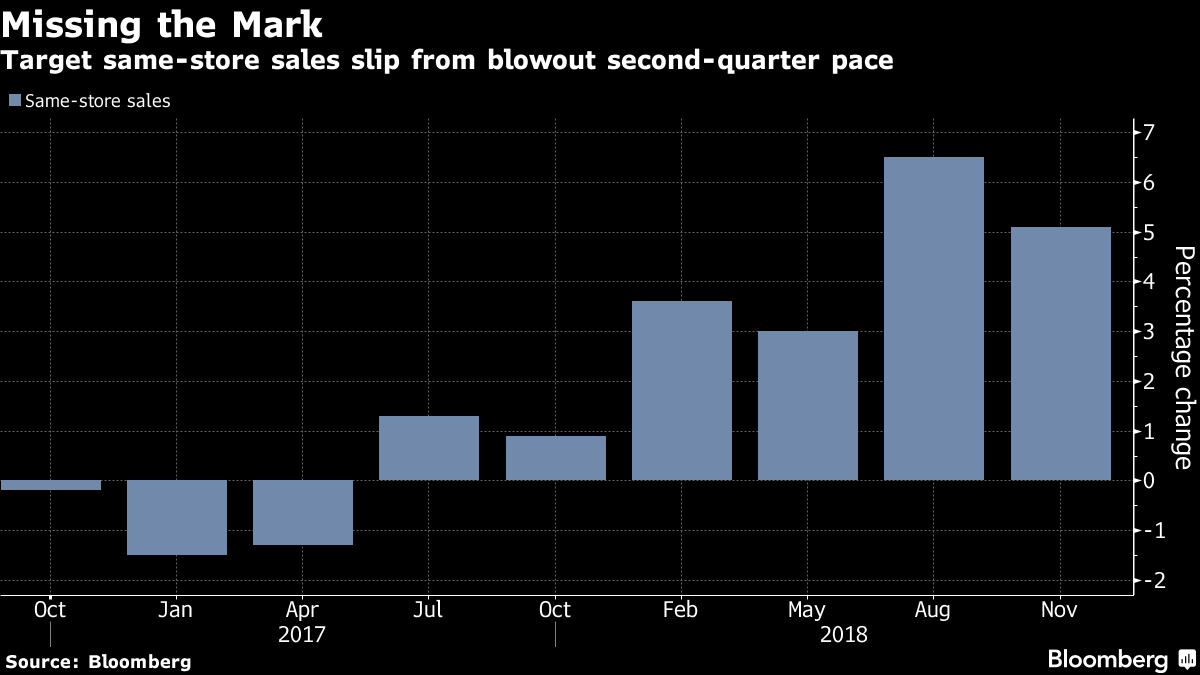

Target Corp. fell in early trading after posting quarterly sales and margins that disappointed Wall Street, adding pressure on the cheap-chic retailer as it heads into the critical holiday season.

Comparable sales, the most-watched barometer of a retailer’s performance, rose 5.1 per cent in the third quarter, just shy of analysts’ 5.2 per cent estimate. The company said it expects that measure to be about 5 per cent in the final quarter, signaling another slight slowdown ahead.

Key Insights

-It’s the next quarter that really matters, and Target is pulling out all the stops to entice holiday shoppers this year. It’s expanding toy departments in more than 500 stores, offering two-day free shipping with no minimum purchase on thousands of items and accelerating the pace of store remodels. The enhancements come at a cost though, and its third-quarter gross margin was weaker than estimates.

-At stake is as much as US$100 billion in sales that are up for grabs in the wake of Sears Holding Corp.’s bankruptcy and the demise of Toys “R” Us and other chains. Target Chief Executive Officer Brian Cornell wants to pick up more than his fair share of those customers. Judging by the 5.3 increase in the third quarter’s foot traffic, he’s succeeding thus far.

-Target needs to win online as well. About one-fifth of holiday spending will happen online this year, according to researcher Forrester, so Target has added a new gift finder on its website and is letting customers personalize ornaments and wrapping paper online. Web sales rose 49 percent in the quarter, but those gains cut into margins.

Market Reaction

-Target shares fell as much as 11 per cent in premarket trading.

-Rival retailer Kohl’s Corp. also reports Tuesday, along with electronics chain Best Buy Co., rounding out the retail earnings season.

--With assistance from Karen Lin