Feb 7, 2023

Wall Street goes risk-on without Powell's pushback

, Bloomberg News

BNN Bloomberg's closing bell update: Feb. 7, 2023

Stock traders bracing for Jerome Powell to push back against the powerful rally that led to a loosening in financial conditions didn’t really get that, with the market finding encouragement to move higher.

What the Federal Reserve’s chief said Tuesday wasn’t that much different from his remarks last week, noted JPMorgan Chase & Co.’s Michael Feroli. Powell basically highlighted that disinflation has begun, it has a long way to go and further hikes will likely be needed if the jobs market remains strong. When asked if he would have raised rates by 50 basis points in February, instead of the 25 basis points as officials did, Powell demurred.

“The important takeaway is that Powell had a chance to signal a shift to a more aggressive posture and he didn’t take it,” wrote Bill Adams, chief economist for Comerica Bank in Dallas. “In the near-term, the Fed will likely continue to make one (or perhaps two) more hike(s) before going on hold.”

JPMorgan’s Feroli added that markets “shouldn’t expect the same degree of hand holding” from the central bank as it gets closer to the terminal rate as data will dictate its path.

The S&P 500 halted a two-day slide that was driven mostly by overbought conditions. The tech-heavy Nasdaq 100 climbed over 2 per cent, with giants Microsoft Corp. and Google’s parent Alphabet Inc. soaring. The dollar fell alongside Treasury two-year yields, which are more sensitive to imminent Fed moves.

“The bond bullish response in the U.S. rates market indicated that Powell’s decision to set a tone that wasn’t particularly more hawkish than last week’s comments was a disappointment for those anticipating the payrolls print would have changed the messaging,” said Ian Lyngen at BMO Capital Markets. “Staying the course in this context underwhelmed a subset of investors hoping for a more aggressive response.”

Earlier Tuesday, Fed Bank of Minneapolis President Neel Kashkari said January’s strong labor-market report shows the U.S. central bank would need to keep raising rates. “Right now I’m still at around 5.4 per cent,” he told CNBC Tuesday, referring to his forecast for how high rates need to go to bridle inflation. The Fed raised its benchmark to a range of 4.5 per cent to 4.75 per cent last week.

Traders will also keep a close eye on Joe Biden’s speech to a joint session of Congress on Tuesday evening in light of renewed tensions with China and a brewing showdown with House Republicans over raising the federal debt ceiling.

For investors worried that stock prices are going to be pummeled by shrinking corporate profits, here’s a little bit of good news: the drop so far seems largely priced in.

With fourth-quarter results from more than half of the S&P 500 companies already in, earnings per share have fallen 2.8 per cent from a year earlier, according to data compiled by Bloomberg Intelligence. That’s less than the 3.3 per cent drop expected before earnings season began. The smaller-than-anticipated drop suggests that the profit contraction isn’t beginning as badly as once feared, lending support to share-price valuations.

“We continue to see broadening breadth and constructive price action to support further upside in equities,” said Craig Johnson at Piper Sandler. “Our short-term indicators suggest some areas may have rallied too much, too fast. However, we do not expect a significant reversal of the current YTD uptrend and view pullbacks and consolidations as buying opportunities.”

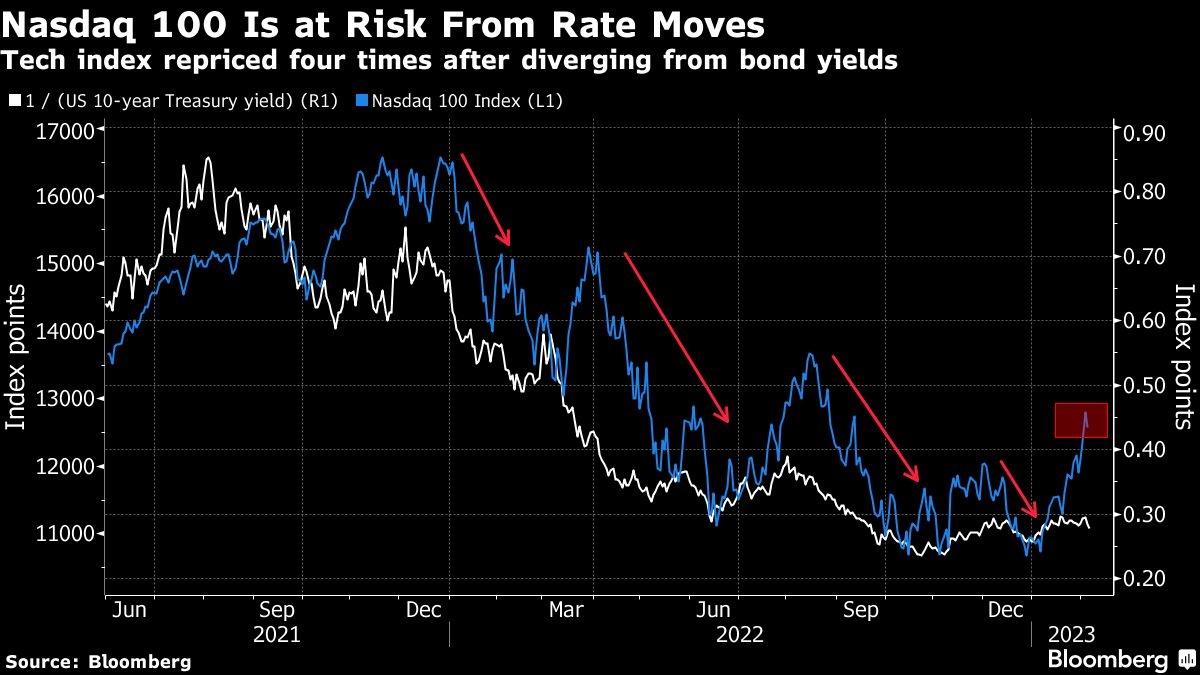

Still, as the Nasdaq 100 approaches a bull market and earnings estimates are trending down, valuations have swelled to expensive levels compared with real bond yields, posing a risk to the rally.

The tech-heavy benchmark’s forward price-to-earnings ratio has jumped to 24, the highest level since April, spurred by bets that inflation has peaked and the Fed will pivot soon. The move is at odds with the inflation-protected 10-year Treasury yield, which remains high on fears that a buoyant job market and stronger-than-expected economic data will keep the pressure on the Fed to stay hawkish.

Key events:

- U.S. wholesale inventories, Wednesday

- New York Fed President John Williams is interviewed at Wall Street Journal live event, Wednesday

- U.S. initial jobless claims, Thursday

- ECB President Christine Lagarde participates in EU leaders summit, Thursday

- Bank of England Governor Andrew Bailey appears before Treasury Committee, Thursday

- U.S. University of Michigan consumer sentiment, Friday

- Fed’s Christopher Waller and Patrick Harker speak, Friday

Some of the main moves in markets:

Stocks

- The S&P 500 rose 1.3 per cent as of 4 p.m. New York time

- The Nasdaq 100 rose 2.1 per cent

- The Dow Jones Industrial Average rose 0.8 per cent

- The MSCI World index rose 0.9 per cent

Currencies

- The Bloomberg Dollar Spot Index fell 0.4 per cent

- The euro was little changed at US$1.0724

- The British pound rose 0.2 per cent to US$1.2040

- The Japanese yen rose 1.2 per cent to 131.10 per dollar

Cryptocurrencies

- Bitcoin rose 1.3 per cent to US$23,203.53

- Ether rose 1.7 per cent to US$1,666.16

Bonds

- The yield on 10-year Treasuries advanced three basis points to 3.67 per cent

- Germany’s 10-year yield advanced five basis points to 2.35 per cent

- Britain’s 10-year yield advanced seven basis points to 3.32 per cent

Commodities

- West Texas Intermediate crude rose 4.3 per cent to US$77.30 a barrel

- Gold futures rose 0.2 per cent to US$1,883.20 an ounce