Feb 25, 2021

Tech leads U.S. stock decline as bond yields soar

, Bloomberg News

BNN Bloomberg's mid-morning market update: Feb. 25, 2021

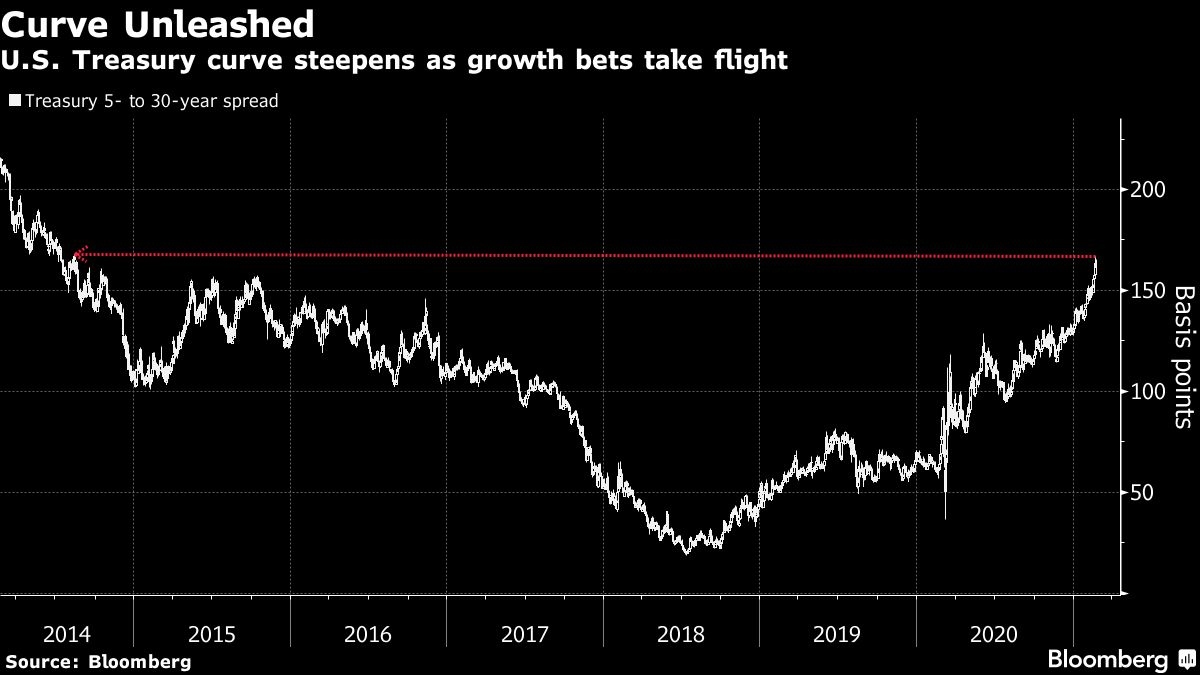

Tech shares led a rout in U.S. stocks while the selloff in global bonds deepened, with the benchmark Treasury yield spiking to a one-year high and debt from the U.K. to Australia coming under pressure.

The Nasdaq 100 tumbled 3.6 per cent, the most since October, as investors rotated away from pandemic-era winners toward companies poised to benefit from an end to lockdowns. About 10 stocks fell for every one that gained on the S&P 500. Cathie Wood’s ARK Innovation ETF extended its decline, leaving it 15 per cent lower for the week. Stocks popular with the day-trader crowd surged once again, with GameStop Corp. doubling at one point before ending 19 per cent higher.

Ten-year Treasury yields spiked after tepid demand at an auction for government bonds, surging as much as 23 basis points to 1.6 per cent, the highest since last February. The increase forced a crucial group of investors such as holders of mortgage securities to sell Treasuries, which in turn led to further increases in yields.

Across markets, investors are betting on a sunnier outlook for the global economy, with U.S. jobless claims data the latest to support that idea. But some traders worry that resurgent growth is already priced into stocks, and they’re staring down the risk that accelerating inflation is just around the corner, a development that would dent the appeal of equities.

“It’s all about interest rates,” said Randy Frederick, vice president of trading and derivatives for Schwab Center for Financial Research. Tech “has been a relative outperformer. As it led on the way up, it will likely lead on the way down too.”

In remarks this week, Federal Reserve Chairman Jerome Powell offered reassurance that policy would continue to be supportive and look beyond a temporary pick-up in inflation, especially from a low base.

That’s given the bond market enough reason to keep driving yields higher. The 10-year U.S. yield adjusted for inflation rose to its highest level since June, a warning sign for riskier assets that have benefited from exceptionally loose financial conditions amid the pandemic.

Elsewhere in markets, Asian bourses closed broadly higher. Bitcoin traded just below US$50,000.

Some key events to watch this week:

- Finance ministers and central bankers from the Group of 20 will meet virtually Friday. U.S. Treasury Secretary Janet Yellen will be among the attendees.

- These are some of the main moves in markets:

Stocks

- The S&P 500 Index fell 2.5 per cent as of 4 p.m. New York time.

- The Stoxx Europe 600 Index fell 0.4 per cent.

- The MSCI Asia Pacific Index surged 0.8 per cent.

- The MSCI Emerging Market Index added 0.2 per cent.

Currencies

- The Bloomberg Dollar Spot Index rose 0.6 per cent.

- The euro climbed 0.1 per cent to $1.2173.

- The British pound fell 0.8 per cent to $1.4024.

- The Japanese yen weakened 0.3 per cent to 106.22 per dollar.

Bonds

- The yield on 10-year Treasuries increased 15 basis points to 1.52 per cent.

- Germany’s 10-year yield jumped seven basis points to -0.23 per cent.

- Britain’s 10-year yield increased five basis points to 0.78 per cent.

Commodities

- West Texas Intermediate crude rose 0.4 per cent to US$63.45 a barrel.

- Gold weakened 1.8 per cent to US$1,773.03 an ounce.

--With assistance from Joanna Ossinger, Lu Wang, Andreea Papuc, Emily Barrett, Cecile Gutscher and Dave Liedtka.