Oct 3, 2019

Tech leads U.S. stocks higher as stimulus bets increase

, Bloomberg News

BNN Bloomberg's closing bell update: Oct. 3, 2019

U.S. stocks advanced as investors ramped up bets that the Federal Reserve will cut rates this month to shore up an economy showing increasing signs of weakness. Treasuries rallied.

The S&P 500 rose the most in a month after roaring back from a drop of more than 1 per cent sparked by the weakest reading on the services sector in three years. Odds the Federal Reserve cuts at its next meeting spiked as the data came just after the worst factory numbers in a decade. Investors are also finding their footing after the benchmark fell around 3 per cent over the last two sessions, with one of the hardest hit sectors, tech, pacing gains.

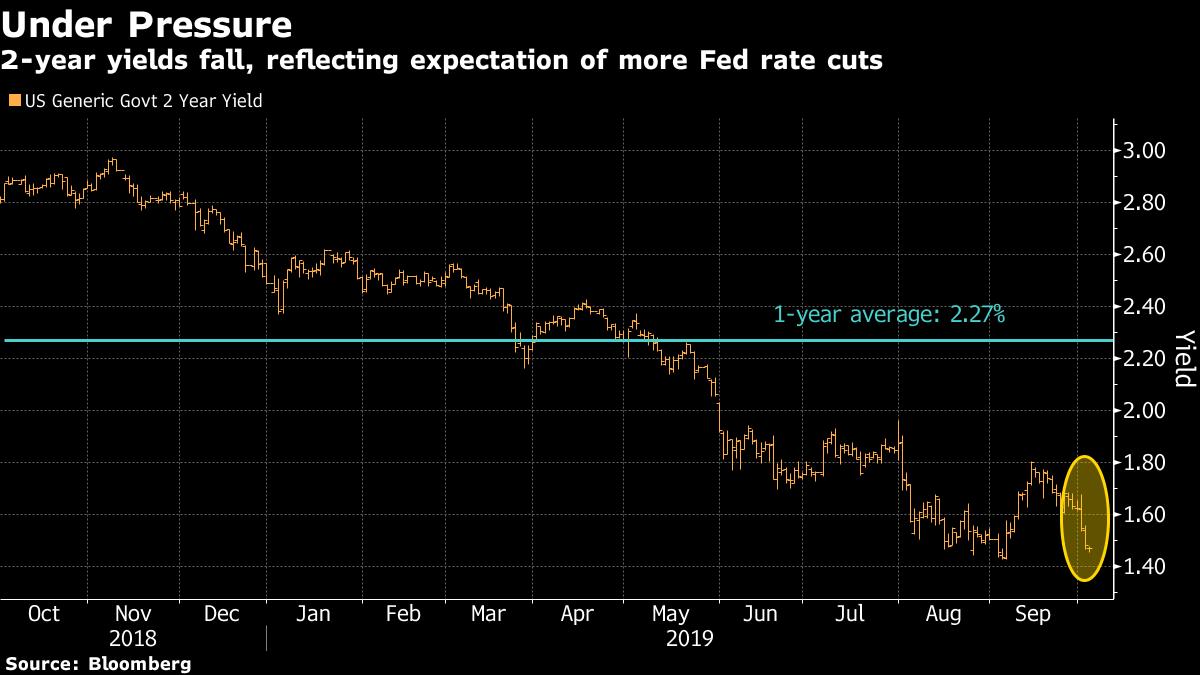

The yield on 10-year Treasuries dropped for the sixth straight day, while the dollar fell for a third time in a row.

“This downturn is starting to spread and that means the tea leaf readers at the Fed are going to be teeing up a third rate cut this year when they next meet again at the end of this month,” said Chris Rupkey, chief financial economist at MUFG Union Bank. “Policymakers are going to need a bigger gun to stop this avalanche of bad news from dragging down business and consumer confidence even further. Rate cuts are coming. Lots of them. Bet on it.”

This week’s march of weak data confirmed investor concerns that the global economy is struggling for traction, and may be seeping from the manufacturing sector into consumer sentiment, as the U.S.-China trade war churns in the background. That’s also driving bets that the Fed will pump more stimulus into the economy this year. Focus now turns to the nonfarm payrolls figure on Friday, when Federal Reserve Chairman Jerome Powell will also speak.

Elsewhere, the yen continued to strengthen along with gold. West Texas crude fell below US$53 a barrel.

HAVE YOUR SAY

What’s the biggest concern for markets right now?

Here are the main moves in markets:

Stocks

The S&P 500 Index rose 0.8 per cent, the most since Sept. 5, at 4 p.m. New York time.

The Nasdaq Composite Index gained 1.1 per cent, while the Dow Jones Industrial Average added 0.5 per cent.

The Stoxx Europe 600 Index was little changed.

FTSE 100 Index dropped 0.6 per cent.

The MSCI Emerging Market Index increased 0.3 per cent.

Currencies

The Bloomberg Dollar Spot Index declined 0.2 per cent.

The euro rose 0.1 per cent at US$1.0970.

The British pound climbed 0.3 per cent to US$1.2343.

The Japanese yen rose 0.3 per cent to 106.88 per dollar.

Bonds

The yield on 10-year Treasuries dipped six basis points to 1.53 per cent.

The yield on two-year Treasuries fell nine basis points to 1.39 per cent.

Germany’s 10-year yield sank five basis points to -0.60 per cent.

Britain’s 10-year yield decreased four basis points to 0.458 per cent.

Commodities

West Texas Intermediate crude fell 0.7 per cent to US$52.26 a barrel.

Gold rose 0.2 per cent to US$1,511.00 an ounce.