Nov 12, 2020

Tencent’s Sales Top Estimates in Sign the Gaming Boom Persists

, Bloomberg News

(Bloomberg) -- Tencent Holdings Ltd.’s revenue rose a better-than-expected 29%, riding a pandemic-era gaming boom that’s persisted in defiance of an economic downturn.

Sales rose to 125.45 billion yuan ($18.9 billion) in the three months ended September, versus the 123.8 billion yuan average forecast. The world’s largest gaming company reported net income of 38.5 billion yuan, easily surpassing the average analysts’ projection of 30.3 billion yuan after it recorded a one-time gain of 11.6 billion yuan from rising valuations of investees. Shares in top shareholder Naspers Ltd. and its unit Prosus NV climbed roughly 4%.The strong results should help reassure investors scrambling to assess the fallout from Beijing’s broadest attempt yet to rein in the country’s giant internet sector. Chinese regulators on Tuesday unveiled detailed guidelines to curtail monopolistic practices among digital platforms, just a week after new restrictions on digital lending triggered the shock suspension of Ant Group Co.’s $35 billion initial public offering.

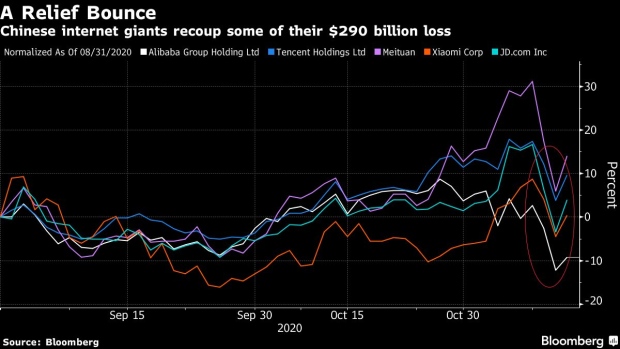

Tencent’s own stock on Thursday climbed 4.7%, recovering partially from a $290 billion selloff among Chinese tech titans led by Alibaba Group Holding Ltd. The WeChat-operator’s main business of video games is perceived as less vulnerable in any potential crackdown versus its e-commerce and fintech peers.

Click here for a liveblog on Tencent’s earnings.

Executives will hold a conference call to discuss earnings Thursday and seek to reinforce perceptions Tencent isn’t in the same boat as fintech giant Ant, the Alibaba-affiliate forced to call off what would’ve been the world’s largest market debut. Its fintech business -- valued at anywhere from $200 billion to $300 billion before Ant’s IPO derailment -- has become one of its fastest-growing divisions. Together with cloud computing, the fintech and business services segment generated almost $15 billion or a quarter of total revenue in 2019. The bulk of that is from commercial payments facilitated by the WeChat super-app, where a billion Chinese schmooze, shop, and share cabs.

Revenue from Tencent’s core gaming and entertainment business also surpassed expectations, suggesting the internet resurgence during Covid-19 still has legs. The Value-Added Services Business -- which includes gaming -- posted a better-than-anticipated 38% surge in revenue to 69.8 billion yuan. Online game revenues grew 45%, the fastest pace since 2017.

That’s despite in-game spending globally showing signs of peaking. Tencent is also fending off stiffening competition from the likes of TikTok-owner ByteDance Ltd. and grappling with global macroeconomic uncertainty that continues to depress advertising.

What Bloomberg Intelligence Says

Mobile game growth may continue to slow further through 4Q and into 2021, in our view, as the boost to engagement and spending from social distancing that peaked in 2Q and faded modestly in 3Q keeps waning. U.S. expansion may lead the global market while China lags amid high market saturation and difficult year-ago comparables.

- Matthew Kanterman and Vey-Sern Ling, analysts

Click here for the research.

Read more: Tencent Ready to Make Case It Can Ride Out China Storm

It’s charted a line-up of new titles for the next year to shore up a slate that now revolves around ageing franchises Peacekeeper Elite and Honor of Kings. In October, its Riot Games unit started testing League of Legends’s highly anticipated mobile version in Asia. Yet another potential hit, Mobile Dungeon&Fighter, has been delayed since August while developers implement an anti-addiction system required under Chinese law.

“The launch time of the flagship game ‘DnF’ has yet to be determined, but we believe the new games in 4Q20 should boost revenue,” Bocom analysts led by Connie Gu wrote before the earnings. “Offline payment and cloud are gradually recovering to normal, while Fintech product expansion is set to drive segment valuation growth in the long term.”

©2020 Bloomberg L.P.