Apr 5, 2023

Terry Smith Builds Billion-Dollar Fortune With Riches Held Offshore

, Bloomberg News

(Bloomberg) -- He’s been dubbed Britain’s Warren Buffett, an old-fashioned and hugely popular stock picker who tells people to invest in companies they understand. But when it comes to understanding Terry Smith’s own business, it’s far from simple.

As his firm Fundsmith shot to fame over the past decade with stellar returns, Smith has moved more of his interests away from Britain through a series of legal entities in tax havens in the Indian Ocean.

Since 2015, he’s shipped a greater proportion of his wealth to Mauritius 6,000 miles away, where he’s now a resident, making payments of hundreds of millions of pounds to a company based on the island. And in 2022, he transferred most of his stake in the asset manager to an entity in the Seychelles.

The arrangements — all legal — can be seen in a series of regulatory filings from the UK, US and Mauritius. They now show the structures through which large amounts of Fundsmith management fees move, and how it ends up in another entity founded by Smith.

Based on these filings, and if the Fundsmith stake now held by the Seychelles entity were included, the Bloomberg Billionaires Index would put Smith’s wealth above $1 billion. That’s about three times more than some other calculations.

Smith, 69, said in an emailed response to questions that the transfer of the stake is part of long-term succession planning, with the ultimate aim of having the firm owned by the people running his funds. He said that he has no plans to retire.

The Seychelles entity is called Eighth Wonder Foundation, and a filing says that it was set up to “provide for the long-term succession of Fundsmith’s business interests.”

Smith himself discussed this in a 2021 shareholders’ meeting. He said he was working on tax structures and making sure “that we don’t cause an event where we give somebody something and they end up with an enormous tax bill accidentally as a result.”

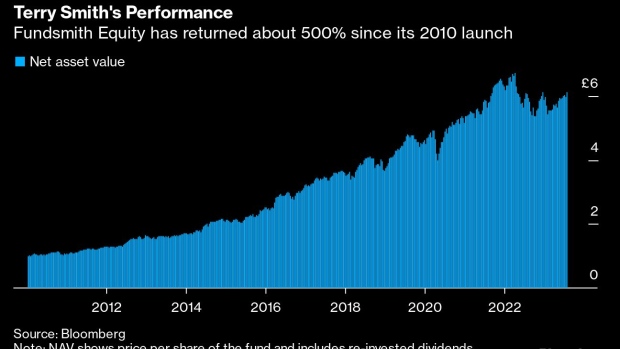

While Smith has become well known for his stock-picking prowess over the past decade — his flagship fund is up about 500% since inception — he rose to fame years earlier as an outspoken finance figure, known to hit out at actions he sees as wrong.

In the 1980s, he famously issued a sell recommendation on Barclays Plc while working for its own investment bank, and was later fired from UBS AG after publishing an exposé of questionable accounting practices used by some of the UK’s biggest companies.

Now, his January letters to Fundsmith investors are anticipated for both their jargon-free analysis and to see which investment or firm he will skewer next.

Mauritius Services

In recent years, Fundsmith’s annual statements include a reference to a Mauritius-based company called Fundsmith Investment Services Ltd. (FISL), which has been charging the UK asset manager ever-larger sums for “services” or “delegated services,” without any additional detail.

Smith’s UK pay, taxed in Britain, is enough to make headlines by itself – some £36 million in 2022 – but the Mauritius transfers are far higher. Since 2010, Smith’s awards through Fundsmith have amounted to about £155 million. FISL, registered in 2014, has charged the UK business almost £900 million in total, according to company statements.

Smith, who was in favour of Brexit, moved to Mauritius about a decade ago and later became a resident of the Indian Ocean island, where he’s known for driving expensive cars and cruising on his yacht.

He was welcomed into the local scene and quickly embedded himself in the community of prominent island residents, for whom he hosts regular bolognese and movie nights, according to people familiar with the matter who asked not to be identified discussing private events.

And it’s here, close to idyllic beaches far away from Fundsmith’s London headquarters, that Smith manages the money of thousands of Britons. Alongside his £23 billion Fundsmith Equity Fund, he also runs other smaller ones in the UK as well as a private mandate for expert investors, which is regulated in Mauritius.

Mauritius residents typically face 15% tax rates on income above 975,000 Mauritius rupees ($21,430), while Britain’s highest rate is three times that. The basic corporate rate is 15%, but there are ways to significantly reduce that, according to the Tax Justice Network, which advocates for a fairer tax system. UK corporation tax is now 25%.

Eighth Wonder

Smith’s financial ties with the UK have weakened further recently. In June 2022, he shifted his indirectly held stake in Fundsmith to Eighth Wonder Foundation, an entity he founded and which is registered in the Seychelles, according to a regulatory filing. It’s listed as the “principal owner” of the asset manager.

Additionally, Eighth Wonder Foundation is the full owner of a second Mauritius-registered firm, Eighth Wonder Limited. This entity in turns owns 78% of FISL, the firm that has charged the UK asset manager hundreds of millions of pounds since 2015.

“I have no plans to retire and intend to be running Fundsmith for a long time to come,” Smith said. “However, one day I will not be able to do so for one reason or another and I want to do all I can now to ensure the long-term success of Fundsmith when that day comes and after it.”

“In other words succession planning, but succession does not just involve naming a successor. Fund management is a people business and works best when the majority of the firm is owned by the people who work in it, and not by me if I am retired or by my heirs. That is what I am seeking to achieve by these measures.”

Seychelles Entities

Seychelles foundations are popular because they typically allow founders to retain more control than in a UK trust structure, according to tax researchers and lawyers. While assets transferred there become property of the foundation, the Seychelles Foundations Act allows the founder to keep wide-ranging powers, including to direct investment and chose beneficiaries.

The Tax Justice Network says the Seychelles has “one of the worst transparency frameworks for private-interest foundations” because it makes it hard to know who is in control and benefiting.

According to a spokeswoman for Smith, he does not control, own or receive income from Eighth Wonder Foundation. She declined to comment on the extent he can direct or manage the assets. According to a person familiar with the matter, Smith is a councillor of the foundation, an administrative position whose role includes managing and administering.

In a filing last year, Fundsmith said the foundation was set up to “ensure employees, partners and investors are sufficiently protected.”

--With assistance from Brian Chappatta, Harry Wilson and Tom Hall.

(Updates to add in fourth paragraph that amounts transferred are management fees, clarifies language in second chart, adds additional comment on Smith not receiving income from foundation in second last.)

©2023 Bloomberg L.P.