Jan 2, 2023

Tesla delivers record 405,278 cars in quarter but misses target

, The Canadian Press

Musk must start changing Tesla's direction or this situation will get even worse: Dan Ives

Tesla Inc. delivered fewer vehicles than expected last quarter despite offering hefty incentives in its biggest markets, reinforcing demand concerns that contributed to the worst month and year for the electric-car maker’s stock since its 2010 initial public offering.

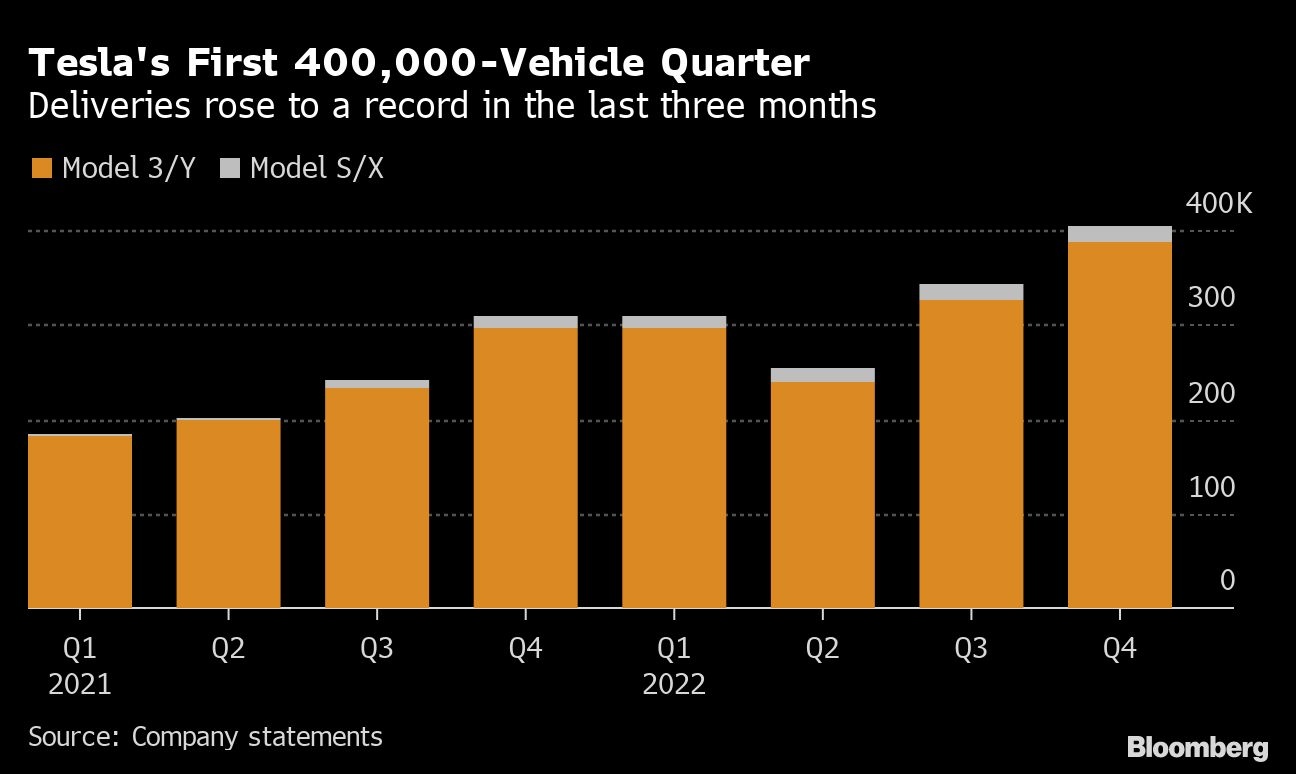

The company handed over 405,278 vehicles to customers in the last three months, short of the 420,760 average estimate compiled by Bloomberg. While the total was a quarterly record for Tesla, the company opened two new assembly plants last year and still came up short of its goal to expand deliveries by 50 per cent.

Tesla shares fell 3.7 per cent as of 4:20 a.m. New York time Tuesday, before the start of regular trading.

After Chief Executive Officer Elon Musk predicted an “epic” end to the year, Tesla cut vehicle prices and production in China, then offered US$7,500 discounts in the U.S. Concerns about rising interest rates, inflation and other economic headwinds — plus alarm over Musk’s antics on Twitter, which he now owns — sent Tesla shares plunging 37 per cent in December and 65 per cent last year.

“We believe that Tesla is facing a significant demand problem,” Toni Sacconaghi, a Bernstein analyst with the equivalent of a sell rating on the stock, wrote in a report Monday. “We believe Tesla will need to either reduce its growth targets (and run its factories below capacity) or sustain and potentially increase recent price cuts globally, pressuring margins.”

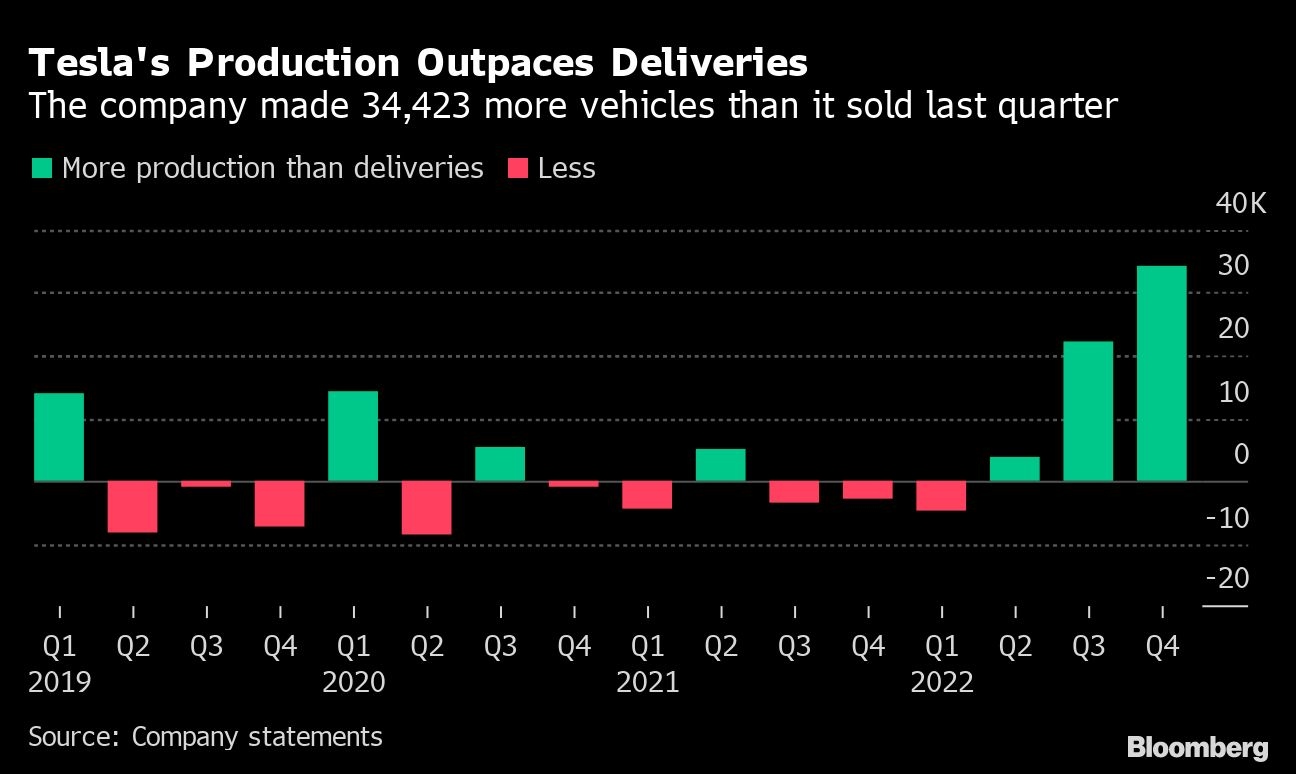

Tesla increased deliveries by 40 per cent to 1.31 million last year, shy of the 50 per cent average annual growth rate the company has said it expects to achieve over multiple years. Production expanded 47 per cent to 1.37 million.

The company produced 439,701 vehicles in the fourth quarter, exceeding deliveries by 34,423 units. Tesla said that it continued to transition to “a more even regional mix of vehicle builds,” which led to another increase in cars in transit at the end of the quarter.

“Tesla sells cars, and the auto industry is slowing down,” Gene Munster, managing partner of Loup Ventures, said by phone. “They are still struggling with logistics, and the gap between production and deliveries grew from the last quarter.”

Musk said during Tesla’s last earnings call that Tesla was trying to “smooth out” deliveries throughout each quarter so that the company no longer has a wave of handovers concentrated at the end of each period. Design chief Franz von Holzhausen nonetheless tweeted that he pitched in at a southern California delivery center on New Year’s Eve.

The discounts Tesla offered in the U.S. toward the end of the quarter matched the maximum tax credit that electric vehicles are eligible for under the Inflation Reduction Act that President Joe Biden signed in August. The carmaker suffered a setback in this regard late last month when the Internal Revenue Service published a list of electric and plug-in hybrid vehicles that are eligible for federal tax credits under the law.

The IRS only deemed seven-seat versions of Tesla’s Model Y to be sport utility vehicles, which means five-seat versions will be subject to a price limit below the cost of the vehicle. Musk took issue with this in several tweets, writing “this is messed up” on Jan. 1 and questioning Monday whether the company was being penalized for making the Model Y too mass-efficient.

Tesla doesn’t break out sales by region, but the U.S. and China are its largest markets, and 95 per cent of sales in 2022 were of the Model 3 sedan and Y crossover.

The company makes the Model S, X, 3 and Y at its factory in Fremont, California. Its Shanghai plant produces the Model 3 and Y, and it started delivering Model Ys from its newest plants in Austin and near Berlin in the first half of last year.

While Musk handed over Tesla’s first Semi trucks to PepsiCo Inc. in December, the company didn’t report any deliveries of the model in its quarterly statement. The carmaker announced separately that it’s scheduled an investor day for March 1, where it will discuss long-term expansion plans, a next-generation vehicle platform, capital allocation and other subjects.