Feb 1, 2023

Tesla Discounts Threaten to Drag Rivals Into EV Price War

, Bloomberg News

(Bloomberg) -- A price war is brewing in the electric vehicle market, but General Motors Co. and Volkswagen AG both said they plan to avoid joining the fray — for now.

Tesla Inc., the largest EV seller in the US, recently slashed prices by as much as 20% on some models. Ford Motor Co. followed suit, reducing the sticker on its Mustang Mach-E by an average of $4,500.

There actions were partly driven by new rules on federal EV subsidies starting this year, which were crafted after passage of President Joe Biden’s signature Inflation Reduction Act. Tesla and Ford both cited the need to cut consumer costs so that buyers could max out on tax credits of as much as $7,500.

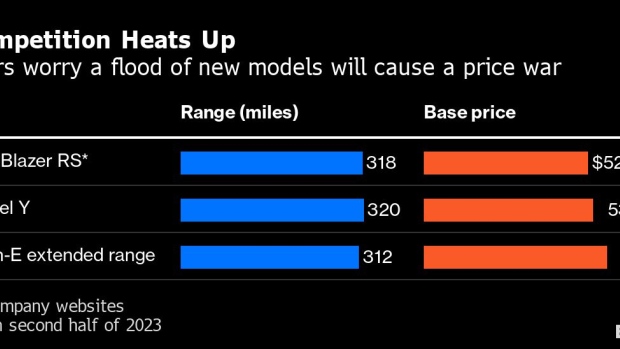

Investors worry that these reductions, coupled with the release of dozens of new EV models later this year, could cause prices to spiral lower and hamper profitability.

However, GM Chief Executive Officer Mary Barra and her counterpart Oliver Blume at Volkswagen both said Tuesday that they can avoid cutting prices.

“Right now, we’re priced where we need to be,” Barra told analysts on a conference call. “With the strength of our product portfolio and what we have coming, we’re positioned well.”

Blume had a similar view, telling the Frankfurter Allgemeine Sonntagszeitung that the company had a clear pricing strategy and is focused on reliability.

“We trust in the strength of our products and brands,” Blume told the newspaper.

GM trailed competitors into the higher end of the EV market, which could forestall the need for discounts if a price war breaks out because it has fewer cars in the pipeline or sitting on dealer lots.

Plus, customers have lined up for both Lyriq and Hummer vehicles, so GM isn’t feeling pressure yet, said Jeff Schuster, senior vice president of forecasting for researcher LMC Automotive.

The automaker is just ramping up battery cell production at its Ultium Cells LLC joint-venture plant in Ohio. In the second half of 2023, it’s increasing production of current EVs and adding three Chevrolet models.

“I get what they said, which is they have a backlog and don’t need to cut prices now,” Schuster said. “But when they don’t have constraints, will they want volume or pricing?”

If the rest of the industry gets sucked into price cutting, GM’s aggressive plans could be one of the main reasons. Barra said 2023 will “be a breakout year for the Ultium platform.” The company will begin building the Chevy Silverado pickup and Blazer and Equinox SUVs. The Blazer will compete directly with Ford’s Mach-E and Tesla Model Y, where the EV maker cut prices the most.

On top of that, automakers will collectively add 50 new EVs this year. Some are small-volume entries from startups and others are electric vans aimed at corporate fleet customers, but most are aimed at retail buyers.

Schuster said Tesla’s Gigafactory in Austin, Texas, which opened in late 2021, has capacity to build 500,000 vehicles annually, but produced only 93,000 last year. As production rises, there may be more pressure to cut prices to meet sales volume expectations, he said. When the Cybertruck goes into production, which could be late this year, that could push Ford to cut F-150 Lightning pickup prices.

Tesla CEO Elon Musk has a goal to increase sales 50% — a target the company missed in 2022 — to 1.8 million units this year. The company has strong margins and could sacrifice them to make life tough on competitors.

There’s one mitigating factor at play, which is that price reductions by Tesla and Ford don’t necessarily mean that the EV market is in trouble. In both cases, the companies rolled back hikes from last year when the chip shortage slowed production and fueled big gains in pricing for new cars.

Still, as competition heats up, EV buyers could benefit with more affordable options. And that would pressure profits, according to John Murphy, an analyst for Bank of America.

“The irrational pricing spiral that appears to be beginning on EVs will hopefully be quickly remedied by criticism by investors — if heeded,” Murphy wrote in a research note. “If not, we believe there is significant risk.”

©2023 Bloomberg L.P.